- 324B SHIB moves to exchanges, raising fresh concerns over selling pressure

- Rising exchange reserves suggest traders favor exits over long-term holding

- On-chain flows align with weak price action and growing downside risk

Shiba Inu is facing renewed market stress as on-chain data shows a sharp rise in exchange deposits totaling about 324,000,000,000 SHIB. That scale of movement has reinforced sell-side dominance concerns, as traders increasingly favor short-term positioning over long-term holding.

Exchange reserve metrics show steadily rising SHIB balances on trading platforms, suggesting growing readiness among holders to liquidate positions. Netflow data supports this trend, with inflows outweighing withdrawals and signaling selling intent rather than accumulation behavior.

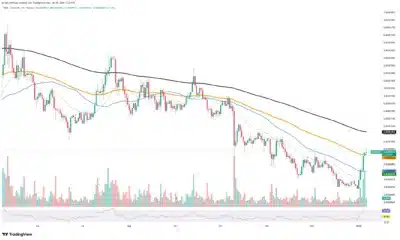

Although transaction counts and active addresses recorded moderate growth, increased activity does not automatically indicate bullish participation. In current conditions, spikes in exchange transfers signal risk reduction, as traders often use minor price rebounds to exit positions.Price action mirrors this pressure, with SHIB failing to sustain moves above key moving averages.

Each recovery attempt met immediate supply, halting momentum and showing limited buyer appetite for absorbing ongoing sell orders.

Also Read: Morgan Stanley advances Bitcoin and Solana ETF plans as regulated crypto demand builds

Exchange Inflows Strengthen Bearish Market Structure

Token velocity across the Shiba Inu network remains elevated, and analysts note that high velocity alongside exchange inflows often reflects speculative turnover. At times, rising velocity aligns with broader adoption trends, but when paired with heavy deposits, it usually signals short holding periods.

In SHIB’s case, rapid token movement suggests traders favor liquidity over storage, and this behavior increases short-term volatility risks. Overhead resistance continues to build as exchange balances rise, meaning any upward price movement faces strong and immediate selling pressure.

Source: Tradingview

Market structure now favors sellers, with rallies struggling to gain traction, while sentiment remains fragile amid persistent inflow activity. Traders closely monitor exchange deposit trends for early reversal signals, as a sustained slowdown in inflows could ease immediate downside risk.

Until that shift occurs, downside exposure remains elevated, and continued inflows may amplify losses during broader market pullbacks. Shiba Inu currently trades under supply-heavy conditions shaped by on-chain behavior, making exchange flow data a key indicator guiding near-term expectations.

Also Read: Legendary Trader John Bollinger Flags Hidden Risk Behind XRP’s Sudden Price Surge