- Ripple’s acquisitions quietly reshape XRP into regulated institutional financial infrastructure.

- Strategic custody and brokerage deals expand XRP’s real-world liquidity and settlement use.

- Infrastructure-focused growth shifts XRP’s narrative away from speculation toward utility.

A detailed post on X by pundit Mason Versluis drew attention to how a series of acquisitions by Ripple quietly reshaped XRP’s institutional positioning. His observation centered on infrastructure developments that have directly strengthened XRP and affected how the token functions within regulated financial markets.

Versluis listed four major acquisitions that serve different but complementary roles within Ripple’s broader financial strategy, with each transaction designed to address a specific institutional requirement tied to XRP adoption. His analysis framed the moves as operational upgrades designed to remove long-standing barriers to institutional XRP adoption.

Fortress Trust Brings Regulatory Access to XRP Operations

Versluis first highlighted Ripple’s acquisition of Fortress Trust in September 2023, noting that it addressed regulatory access rather than market liquidity or payments. The deal delivered a Nevada trust charter, embedding licensed compliance capabilities into Ripple’s ecosystem.

This regulatory structure allows XRP-related services to operate within frameworks that many banks and financial institutions require before engaging with digital assets at scale. As a result, XRP gained improved eligibility for institutional settlement use cases where compliance oversight is mandatory.

Also Read: Egrag Crypto: XRP Could Make Major Moves Within the Next 2–4 Weeks – Here’s What Could Happen

4 powerful Ripple acquisitions explained simply and how they strengthen $XRP pic.twitter.com/ORe7mGEEZc

— MASON VERSLUIS (@MasonVersluis) January 3, 2026

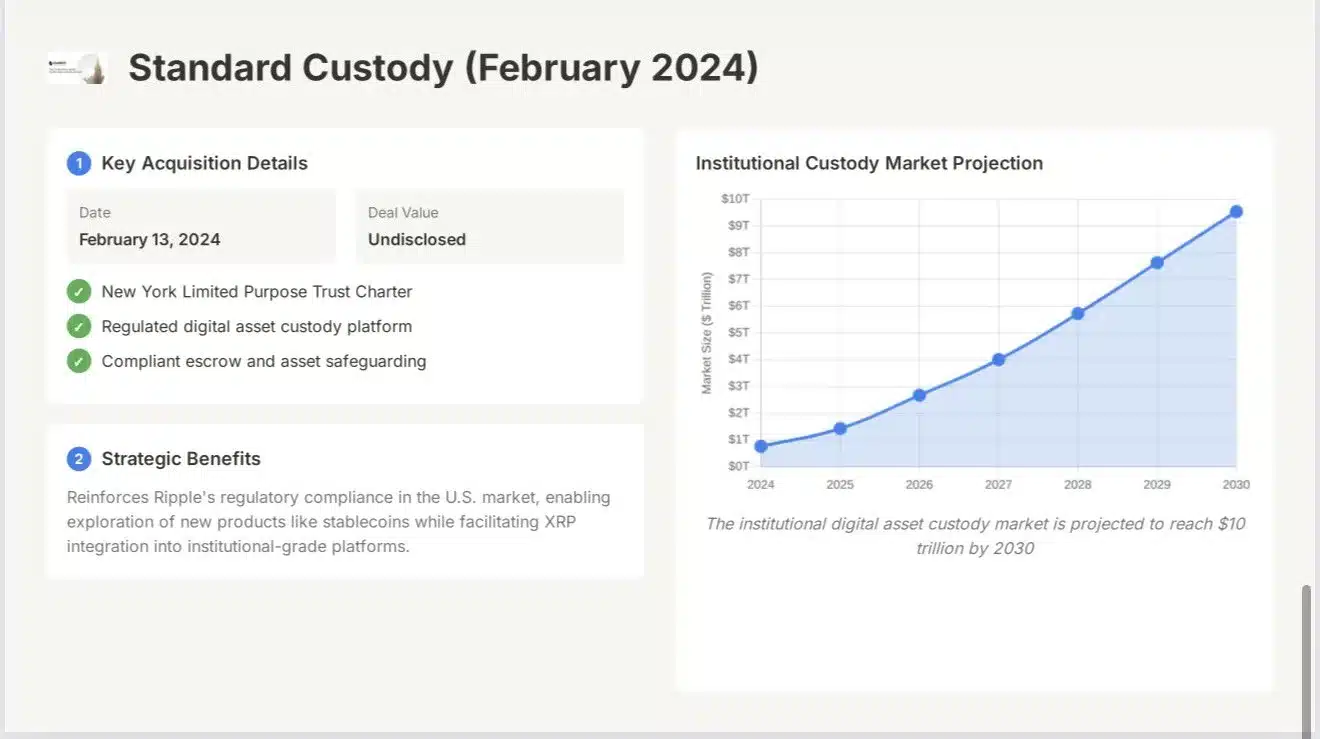

Standard Custody Solves Institutional Storage and Risk Concerns

Standard Custody expanded Ripple’s capabilities in a separate but equally critical area in February 2024. The New York trust framework introduced regulated digital asset custody designed for institutional standards.

This structure enabled financial firms to hold XRP under established legal supervision while reducing operational and counterparty risk exposure. Custody and escrow services provided by this framework made longer-term institutional participation more practical and operationally sound.

Hidden Road Integrates XRP Into Institutional Trading Infrastructure

Ripple’s acquisition of Hidden Road shifted the strategy toward market infrastructure. The $1.25B transaction brought prime brokerage services, including clearing, financing, and execution, under Ripple’s control.

This integration allowed XRP to function within institutional trading environments where collateral efficiency and settlement speed directly impact capital deployment decisions. By connecting crypto markets with traditional trading systems, XRP gained expanded utility beyond payment-focused applications.

Rail Strengthens Payment Execution and Stablecoin Interaction

Ripple’s Rail acquisition focused on enterprise-grade payment execution. The $200 million deal enhanced on and off ramps, liquidity access, and stablecoin payment rails.

This infrastructure improved how XRP interacts with stablecoins during cross-border transactions, supporting faster settlement without bypassing compliance requirements. Payment efficiency improved while maintaining alignment with regulated financial standards.

How these Acquisitions Strengthen XRP

Versluis noted that each acquisition supports a distinct layer of financial infrastructure rather than duplicating functionality. Regulatory access, custody, trading, and payment execution now operate within a single integrated framework.

This structure reduces dependence on third-party providers that often introduce friction and operational delays. For XRP, this means clearer settlement pathways and fewer institutional adoption hurdles. The acquisitions also reflect a shift in how XRP is positioned within financial markets, with its role increasingly aligning with infrastructure usage rather than speculative trading cycles.

Market participants continue tracking institutional deployment trends as Ripple’s strategy unfolds. The four acquisitions collectively redefine how XRP fits into regulated global finance without relying on market hype or short-term narratives.

Also Read: The Next Major XRP Catalyst Could Come From Japan – Here’s Why