- Upbit drives XRP plunge with 75 million tokens sold rapidly.

- Analysts monitored $3 level key support zone weakens fast.

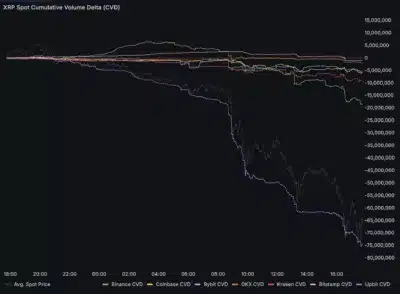

- CVD charts confirm Korean market’s dominant role in the XRP drop.

A wave of selling pressure from South Korea’s Upbit exchange has rattled the XRP market, sparking concern among traders and analysts. According to Dom (@traderview2), over the last 24 hours, more than 75 million XRP tokens were sold through market orders on Upbit, contributing to a rapid decline in price across major exchanges.

The move was met with responses in Binance and other exchanges globally, with Coinbase being relatively dormant throughout the sell-offs.

Orderbook data and heatmap charts indicate that excessively aggressive sell orders on Upbit exceeded buyer demand, especially when little liquidity was present in the books.

Binance, Coinbase, and Kraken orderbook profiles indicate that the price reduced rapidly due to the increasing pressure from the sales. The orderbook skew implies the domination of a bearish mood related to the inadequate ratio of buying to selling volumes.

Korean market Upbit choose violence today on $XRP

Over 75 million $XRP sold at market over the last 24 hours

The pump AND dump was brought to you by Upbit…

The orderbooks have been pretty empty, thus the quick move down today

We have reached some bids around $3, which I… https://t.co/xxCVcN899s pic.twitter.com/WSyjwOFW0d

— Dom (@traderview2) July 23, 2025

Also Read: Ripple CEO Releases Important Message to XRP Holders Amid Price Hike

Such an insufficient support of the bids triggered XRP to drop rapidly, with technical analysis showing that sellers control the short-term outlook.

CVD Metrics Point to Upbit as the Leading Force

Cumulative Volume Delta (CVD) charts have provided clear evidence of Upbit’s dominant influence on this market event. Although Binance, Coinbase, and other large exchanges registered fairly sluggish activity, Upbit’s CVD plummeted to record sales of more than 75 million XRP in a short period of time.

Source: @traderview2

Such a sharp decline in CVD ascertains that the greater pressure came primarily through Korea. When XRP reached $3, a few bids began to develop, which indicated a possible demand area.

Nevertheless, based on the data, the resistance is low on platforms such as Coinbase, with the lack of activity at the higher price areas. Binance also continues to be skewed on the selling side, which also weighs on the potential of a speedy recovery.

Source: @traderview2

Analysts remain focused on whether the $3 level can hold, as a breakdown at this point could trigger significant downward pressure with limited support available.

The XRP market was characterized by aggressive selling on Upbit and other Crypto exchanges, with more than 75 million tokens been sold over the last day. The primary question is whether important support areas can prevent further losses.

Also Read: Reasons Why XRP Price is Crashing Today