DeFi researcher Michael Nadeau predicts fierce rivalry between Coinbase and Robinhood in the coming years. The two fintech behemoths are competing for supremacy in a variety of cryptocurrency industries, including trading, staking, and possible banking services.

Source:Michael Nadeau

Nadeau captures another consequence of the global financial crisis, pointing at significant differences in their trading operations. Coinbase generates revenue based on charges on completed trades, while Robinhood provides free trade in digital assets. Coinbase is now among the world’s biggest centralized crypto trading platforms. However, Robinhood is a relatively unique stock trading application with a completely decentralized structure and does not perform transactions through a central hub.

Also Read: Coinbase Sparks Speculation of New Wrapped Bitcoin Token, cbBTC

Tokenization and Potential Banking Services Could Define Future Competition

Nadeau is also right about Robinhood’s potential benefit of tokenization. Robinhood is a broker-dealer that also has its exchange, and Coinbase has an unused license to have an exchange. Despite this difference, Nadeau sees a potential similarity: it is essential to note that both platforms could have the ability to become a bank in the future. It is also the case that both Coinbase and Robinhood can make revenue from the storage of assets for staking. Robinhood offers staking services in European countries, while Coinbase provides such services to users in the United States.

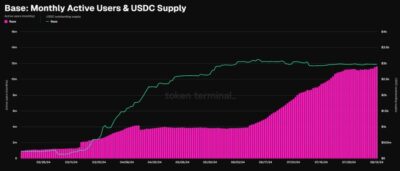

Another area of interest relates to ‘Stablecoin payments’. USDC payments is an area that Robinhood has not claimed dominance in, but Nadeau points out that Coinbase has partnered with Circle to facilitate such payments. Even though Robinhood recently broke the news of adding credit cards, it still has not reached Coinbase standards.

Besides, Robinhood entered futures and options trading only a few months ago. On the other hand, the contenders such as Coinbase have had these offerings in place in the past year. Moreover, Nadeau does not limit the comparison to trading and discusses both exchanges regarding crypto lending, prime brokerage, and infrastructure.

Traditional Financial Institutions Lagging Amid Fintech Advancements

According to Nadeau, while applications such as Coinbase and Robinhood are moving ahead in every way, traditional banks, brokerages, and financial services providers appear stuck in the mud. These institutions seem to be still waiting for regulatory blessings to innovate, putting them on the back foot in Fintech’s already dynamic new world.

As Coinbase and Robinhood push forward in the crypto market, their rivalry is expected to intensify. With both platforms making strategic moves in various sectors, the competition between them could reshape the future of financial services.

Also Read: Coinbase Escalates Legal Battle with SEC, Demands Crucial Documents