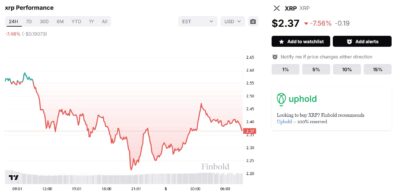

XRP has taken a significant downturn after experiencing one of the most remarkable rallies of 2024, leaving many in the cryptocurrency community questioning the reasons behind its sharp price correction. At $2.37 at the time of writing, XRP has dropped by 7.56% in the past 24 hours. This decline follows a significant plunge from its recent high of $2.82 on December 3, marking a 16% collapse in just two days.

Source: TradingView

While the sudden drop may seem abrupt, it follows a clear pattern often seen after strong rallies. XRP’s Relative Strength Index (RSI) had surged above the 70 mark, signaling an overbought condition and setting the stage for a possible correction. The cryptocurrency market, known for its volatility, often sees such pullbacks after an asset enters overbought territory.

The correction from XRP’s November highs was initially attributed to geopolitical factors, particularly a political crisis in South Korea, where the president declared martial law. This was followed by an attempt to dissolve parliament, triggering massive uncertainty in the market. However, this downturn was short-lived, with XRP stabilizing after the crisis subsided.

Also Read: Ripple CEO and Industry Leaders Back Paul Atkins as New SEC Chair, Expecting Major Regulatory Shift

Impact of Ripple’s Stablecoin RLUSD Announcement

Recently, XRP’s price faced another significant dip, which some analysts believe was triggered by the speculative frenzy surrounding the potential launch of Ripple’s stablecoin, RLUSD. Market rumors, fueled by high-profile figures such as Tron’s Justin Sun, suggested that the stablecoin would launch imminently. These speculations fueled buying pressure, driving XRP prices higher in anticipation of the positive effects the launch could bring to Ripple’s ecosystem.

However, Ripple’s official statement on X deflated the market’s optimism. The company clarified that RLUSD had not yet received approval from the New York State Department of Financial Services (NYDFS), pushing the stablecoin’s launch back and significantly cooling the speculative fervor.

This news was a significant blow to XRP’s momentum, leading to a sharp price drop. Many had hoped that RLUSD’s launch would drive increased utility and adoption of the XRP Ledger (XRPL), ultimately boosting the price of XRP. But with the delay in the stablecoin’s release, market sentiment has soured, leading to a renewed correction.

In conclusion, while XRP’s recent price crash is primarily attributed to the overbought conditions following its rally, the delay of RLUSD’s launch seems to have played a role in exacerbating the downturn. As the market waits for further developments, XRP’s trajectory will likely depend on broader market trends and the eventual approval of Ripple’s stablecoin.

Also Read: XRP Reaches New Market Cap High Amid Concerns of Potential Correction