Bullish pennants formed on the XRP target of $4.40, thanks to positive funding rates and consistent market momentum. Ripple CEO criticizes media coverage and demands correct reports on the crucial legal situation of XRP as part of the SEC case.

Also Read: XRP Price Prediction 2024-2025: Can XRP Sustain the $2 Mark?

XRP Shows Bullish Momentum With $4.40 Target

With the creation of three consecutive bullish pennant patterns, XRP has shown impressive bullish momentum, a classic signal for continuing upward momentum. Analysts believe the $4.40 target; however, a retrace to $2.25 offers an excellent entry point for investors. This pattern represents an abundant buyer and shows investors’ trust in XRP’s long journey in the future. Such formations have often preceded large price increases; thus, XRP is the focus for traders interested in high returns.

Repeats of the same bullish pennants point to persistent momentum; each consolidation phase leads to a breakout. The fact that XRP can maintain and push through these levels gives solidification of the market support for the digital asset and increased interest by institutional and retail investors alike. A dip to $2.25 presents traders with an opportunity to trade long-term with a bullish trend until the bullish leg resumes.

If the current trajectory is sustained by XRP, technical setup, and market sentiment match up with the projected $4.40 target. These patterns facilitate a better understanding of XRP’s strong positioning among the top crypto or why traders and investors are keen to trade using this token due to the way it moves. XRP remains a key player in the current market cycle, and we’re growing optimistic.

Ripple CEO calls for accurate reporting on XRP legal developments.

Ripple CEO Brad Garlinghouse isn’t happy with the recent media coverage of the company’s fight with the SEC. This is all centered around a 60-minute segment that seemingly didn’t mention a key federal court ruling concerning the legal standing of XRP. In some cases, the court said that XRP is not a security (when it is traded on public exchanges), but sales to institutional investors could still be considered a security.

The July 2023 ruling by Judge Analisa Torres of the U.S. District Court for the Southern District of New York comes with far-reaching consequences for the cryptocurrency industry. It sheds light on how digital assets fit into U.S. law, a thorny issue for investors and regulators. Garlinghouse stressed the need for well-balanced news reporting to prevent misleading the public and aid in cryptocurrency regulation debates.

In December 2020, the SEC filed a legal battle, arguing Ripple conducted unregistered securities sales through its XRP offering. Despite the victory granted by some aspects of the court’s decision, the Ripple case is still not over since the SEC is appealing some of those aspects. The outcome of this case will be extremely important if it impacts the regulatory treatment of digital assets in the US.

XRP Funding Rates Signal Bullish Sentiment

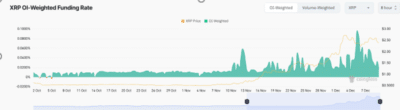

Over the past two months, the XRP OI Weighted Funding Rate has been noting some wild swings, embracing the excitement in the market. The OI-weighted funding rate started sharply increasing in early November as XRP’s price gradually rose from around $1.50 to above $2.50. Higher funding rates reflect a bullish market and signal buying dominance in the market; thus, this upward trajectory shows a growing bullish sentiment among traders.

XRP Funding Rates Source: Coinglass

Considering that the funding rate has been positive, this implies traders are willing to pay premiums to carry long positions, and it supports the expectation that the price will keep moving higher in the future.

You also see spikes in the OI-weighted funding rate, which suggests excess leverage in the market, which can behaviorally lead to volatility in the short term. These metrics are being eyed by investors and analysts alike, who are eager to know if XRP’s rally is sustainable and at what point overleveraging in the derivatives market becomes a serious issue.

FAQs:

1. What is XRP’s price target after the formation of bullish pennants?

XRP’s price target is $4.40 following the formation of three consecutive bullish pennants.

2. Why is Ripple CEO Brad Garlinghouse critical of 60 Minutes’ coverage of the XRP case?

Ripple CEO Brad Garlinghouse criticized 60 Minutes for omitting key details about the court ruling on XRP’s legal status.

3. What do positive funding rates for XRP suggest about market sentiment?

Positive funding rates for XRP indicate strong bullish sentiment and buying dominance in the market.

Also Read: PEPE Price Prediction for December 2024 and 2025: Strong Momentum with Volatility Ahead