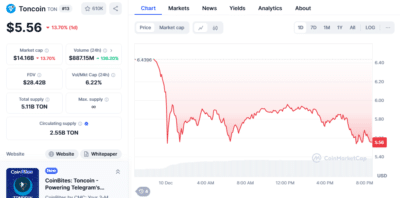

Toncoin (TON) experienced an explosive rally in November, with the altcoin surging by 50%, breaking through the $6.50 resistance level, and establishing it as support. December started on a strong note with a 14% gain in the first week, but a recent retracement has wiped out those gains.

Over the past week, TON has slipped by 1.01%, trading between $6.59 and $6.82. With the price hovering near key support at $6.50, traders are closely watching whether Toncoin will regain its bullish momentum or continue to consolidate.

As of press time, Toncoin was trading at $5.55, experiencing a daily decline of 13.92% within 24 hours. Indicators suggest that the market sentiment is showing signs of weakening. The Alligator indicator shows consolidation, with the fast-moving average flattening near the current price, suggesting a period of indecision.

Source: CoinMarketCap

Also Read: PEPE Price Prediction for December 2024 and 2025: Strong Momentum with Volatility Ahead

Key Resistance and Support Levels to Watch

Toncoin’s price action depends heavily on the direction it takes at critical price levels. For a bullish continuation, TON must break above the $7.20 level, targeting $7.50 as the next resistance zone.

A break above $7.50 would pave the way for a potential revisit of the altcoin’s all-time high at $8.24. On the other hand, if Toncoin fails to hold support at $6.50 and breaks below it, the price could decline toward $6.28, with further support at $5.45.

Momentum indicators reflect some concerns. The 14-day RSI stands at 59.38, indicating weakening bullish momentum, while the Stochastic RSI at 59.02 suggests that downward pressure could be building. These factors point to a slightly bearish outlook for the immediate future.

Source: Trading View

Network Activity Decline Signals Potential Slowdown

In addition to technical indicators, Toncoin’s network activity has been declining, which could further impact the price action. Data reveals a 16.33% drop in new addresses and a 19.69% decrease in active addresses. The number of zero-balance addresses has fallen by 41.90%, indicating reduced blockchain engagement. Historically, network activity correlates with price movements, and the current downturn in engagement aligns with the ongoing price consolidation.

Source: IntoTheBlock

For Toncoin to regain upward momentum, an increase in network activity will be key. If engagement improves, it could provide the necessary support for a rebound in price. The market remains in a cautious state, with the balance between bullish and bearish sentiment hovering around neutral levels.

FAQs:

1. What resistance level does Toncoin need to break for a bullish continuation?

For a bullish continuation, Toncoin needs to break above $7.20, with $7.50 as the next target.

2. How has Toncoin’s network activity impacted its price movement?

Toncoin’s declining network activity, with drops in new and active addresses, has contributed to the ongoing price consolidation.

Also Read: Cardano Price Prediction: ADA Faces Crucial $1.25 Resistance Level and Potential 50% Surge