Aave, a prominent decentralized finance platform initially launched as ETHLend in 2017 and rebranded in 2018, continues to captivate market attention. Its native token, AAVE, offers governance privileges and discounted platform fees, making it highly appealing to users and investors. Recent trends and predictions point to significant price fluctuations for AAVE in the coming years.

Also Read: Solana Price Prediction: Short-Term and Long-Term Outlook for 2024-2028

Aave’s Market Performance and Indicators

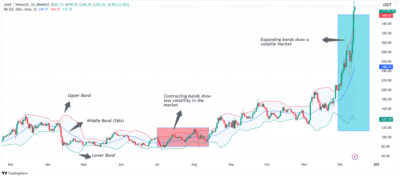

The Bollinger Bands for Aave reveal high market volatility, significantly expanding to signal increased trading activity. Aave’s price has frequently touched the upper band, often preceding a market correction. Such corrections typically bring prices closer to the middle or lower band levels.

Source: Trading View

The Relative Strength Index (RSI) shows Aave in an overbought zone with values above 70. This indicates substantial buying pressure, potentially leading to a short-term price pullback as traders secure profits. However, the Moving Average Convergence and Divergence (MACD) indicator suggests optimism.

Aave demonstrates strong bullish momentum with a positive MACD value of 42.19 and consistent growth reflected in green histogram bars. Traders should still monitor its convergence with the signal line, as this interaction could signal a shift in market dynamics.

Source: TradingView

Price Predictions for Aave (2025–2028)

Based on market analysis, Aave is expected to experience significant growth, particularly during the anticipated bullish market conditions in 2025. Key support and resistance levels will be critical in shaping its price movements. The following table outlines the projected price ranges for Aave between 2025 and 2028:

| Year | Minimum Price | Average Price | Maximum Price |

| 2025 | $500 | $650 | $800 |

| 2026 | $450 | $550 | $650 |

| 2027 | $650 | $690 | $850 |

| 2028 | $700 | $750 | $1,000 |

In 2025, Aave is expected to break resistance at $430, reaching an average price of $650 in a bullish market. Conversely, a retracement to support levels around $255 could disrupt this trend if bearish pressures intensify. By 2028, Aave is projected to achieve a maximum price of $1,000, underscoring its growth and market strength.

FAQs:

What is Aave, and why is it popular among cryptocurrency enthusiasts?

Aave is a decentralized finance platform launched in 2017 as ETHLend and rebranded in 2018. It allows users to borrow and lend cryptocurrencies with its native token, AAVE, offering governance rights and discounted platform fees. Its unique features make it a popular choice among DeFi users.

Why is the Relative Strength Index (RSI) necessary for analyzing Aave’s price movements?

The RSI helps determine if a cryptocurrency is overbought or oversold. For Aave, RSI values above 70 indicate overbought conditions, suggesting the token may experience a price pullback as traders take profits.

How does the MACD indicator reflect Aave’s market performance?

The MACD measures the difference between two exponential moving averages to assess momentum. A positive MACD value for Aave and green histogram bars indicate strong bullish momentum, suggesting continued price growth.

What factors could impact Aave’s price predictions for 2025–2028?

Key factors include market dynamics, Bitcoin halvings that historically boost cryptocurrency markets, and Aave’s ability to maintain strong support and resistance levels. Additionally, investor sentiment and DeFi adoption will significantly determine price movements.

Conclusion

Aave’s recent market performance highlights its potential for both volatility and growth. While short-term corrections may occur, the token’s long-term trajectory appears promising. Investors should remain vigilant about support and resistance levels and leverage technical indicators to navigate the evolving market landscape as Aave targets its ambitious price projections through 2028.

Also Read: Just a Chill Guy Price Prediction: Strong Short-Term Momentum, Promising Long-Term Outlook