As the cryptocurrency market continues to evolve, some projects stand out for their potential to deliver massive returns in the coming years.

XRP, Hedera Hashgraph (HBAR), SUI, Render (RNDR), and MakerDAO (MKR) have positioned themselves as industry leaders in their respective domains, offering innovative technology, strong real-world applications, and growing adoption.

With blockchain adoption increasing across finance, artificial intelligence, enterprise solutions, and decentralized finance, these five cryptocurrencies are poised for 10x growth by 2025.

Also Read: Alchemy Pay (ACH) Price Prediction (2025-2029): Can ACH Hit $2 Soon?

Top 5 Cryptos That Could 10x in 2025

- XRP

- Hedera Hashgraph (HBAR)

- SUI

- Render (RNDR)

- MakerDAO (MKR)

1. XRP

XRP, developed by Ripple, is one of the most recognized cryptocurrencies in the financial sector, and it is known for its ability to facilitate instant, low-cost cross-border payments. Unlike Bitcoin, XRP does not rely on mining but uses a consensus protocol, allowing transactions to be settled in seconds while maintaining security and efficiency.

This has made XRP an attractive solution for banks and financial institutions looking for an alternative to the slow and expensive SWIFT network. Ripple’s ongoing partnerships with financial entities and its work on Central Bank Digital Currencies (CBDCs) strengthen XRP’s long-term value proposition.

Regarding price action, XRP has consolidated after a strong rally, showing resilience around the $3.10 level. The MACD indicator suggests that a bullish crossover is forming, indicating that momentum is shifting in favor of buyers.

If XRP breaks through resistance at $3.48, it could initiate another leg up in its bullish cycle. With increased regulatory clarity and adoption by institutions, XRP has the potential to reach new all-time highs in the next few years.

2. Hedera Hashgraph (HBAR)

Hedera Hashgraph is an enterprise-grade blockchain platform that implements Hashgraph consensus technology instead of the standard Proof-of-Work or Proof-of-Stake protocols.

The system enables rapid processing of transactions alongside enhanced efficiency and unlimited scaling capabilities for which businesses and large-scale applications prioritize. The governance structure of Hedera operates under the supervision of major corporations, including Google, IBM, and Boeing, to ensure stability and attract corporate stakeholders.

Integration efforts between corporations indicate increased enterprise trust in Hedera’s potential as an advanced blockchain solution. Recent market lows for HBAR have shown signs of recovery following an upward trend in bullish momentum in its price chart.

Price has reached resistance levels within the Bollinger Bands, yet breaking past $0.32 could spark an intense upward price revaluation. Hedera Hashgraph stands strong in gaining more enterprise adoption because businesses require fast, secure enterprise solutions that drive significant long-term growth.

The demand for HBAR will increase as companies adopt decentralized applications and blockchain services, and it will mature into one of the top choices for exponential growth by 2025.

Also Read: Top 5 Must-Have Crypto in February: Do Not Miss Out

3. Sui (SUI)

SUI is a high-speed Layer-1 blockchain built to excel in scalability, with low fees and parallel execution capabilities, and to become a dominant competitor against Solana and similar fast blockchain networks.

SUI’s groundbreaking architecture design creates barrier-free outstanding transaction processing that tackles blockchain adoption challenges with congestion and high costs.

Failings in decentralized finance (DeFi) alongside gaming and large-scale applications demand fast and economical blockchain solutions; thus, SUI is their best option.

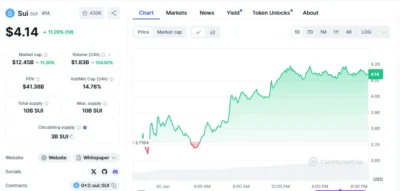

SUI has received significant investor confidence through its daily trading activity exceeding $1.8 billion, indicating growing market support. The token continues to hold a position above $4.00 while breaking past vital resistance thresholds to continue advancing toward $4.50–$5.00 price levels.

The expansion of blockchain implementations in gaming and financial operations creates the potential for SUI to become one of the leading performers in future market cycles because of its efficient scalability.

Source: CoinMarketCap

4. Render (RNDR)

Render Network is a decentralized GPU rendering system, enabling GPU owners to connect with users needing high-performance computing capabilities. The platform provides economical solutions and scalable infrastructure to businesses in artificial intelligence, gaming, the metaverse sector, and 3D rendering.

The rising demand for decentralized GPU computing power within the growing AI and metaverse markets makes Render a fundamental infrastructure supplier for this developing sector.

The AI and gaming market advancements have resulted in growing demand for Render services, which further increases RNDR token adoption rates. The technical data reveals that RNDR rebounds from vital support after its MACD histogram generated positive indications, suggesting weakening bearish pressure.

The upcoming breakout potential manifests from Bollinger Bands, while a bullish momentum could drive prices to reach $6.88. The fast growth of metaverse and AI projects positions Render ideally to leverage market expansion, thus qualifying it as a strong long-term investment option.

5. MakerDAO (MKR)

Through its essential management functions, MakerDAO is the crucial foundation of DeFi which operates DAI stablecoin—one of the most popular decentralized stable currencies. DAI operates by algorithmic management through over-collateralization, which protects its stability despite market volatility.

The governance system of MakerDAO implements the MKR token to let decentralized users decide about protocol development and setting interest rates along with risk protocol changes.

MakerDAO now extends its real-world asset (RWA) integration features to incorporate bonds with real estate as available collateral assets. The connection between decentralized finance and traditional banking gets stronger through this development, which increases the Maker ecosystem’s stability and market attraction.

The MKR token has shown a price decline since it started going down, yet its price movement attempts to reach $1,100 in support levels. The Bollinger Bands display overbought signs, while the MACD indicates possible market trend reversal signals.

The price surpassing $1,294 would signal a fresh bullish trend while the expanding DeFi market leads to rising demand for MakerDAO’s decentralized products, which supports MKR as a long-term investment opportunity.

Conclusion

A new adoption phase in the cryptocurrency market develops as institutions alongside businesses while developers search for blockchain solutions that provide practical applications and scalable performance.

XRP, HBAR, SUI, RNDR, and MKR lead innovation through their commitment to resolving distinct problems in blockchain technology.

XRP advances worldwide payment methods while Hedera guides corporate blockchain adoption, and SUI reinvents transaction scalability as Render delivers decentralized computation services alongside MakerDAO’s expansion into standard financial markets through DeFi.

Technical data shows that these five cryptocurrencies hold optimistic potential for price pattern changes, which point to developing upward market trends. The assets will receive major price growth during the coming years due to growing adoption and institutional participation.

Long-term investors seeking growth opportunities will find suitable prospects in these five cryptocurrencies, which present a variety of innovative technologies alongside real-world implementations and rising consumer interests.

Open market conditions have the potential to position these projects among the top cryptocurrency performers during the next cycle, which will increase their investment appeal for a 10x return by 2025.

Also Read: Spell Token (SPELL) Price Prediction (2025-2029): Can SPELL Hit $0.03?