The cryptocurrency market witnessed a sharp decline in altcoin prices, with XRP experiencing a significant 42% drop. Analysts suggest the move was not entirely organic, raising concerns about possible market manipulation by major liquidity providers.

The price of XRP initially followed a downtrend before rebounding gradually to its current state. According to a market expert, Traderview on X, the order book on Binance perpetual contracts displayed unusual behavior during the plunge.

Large buy orders appeared at a level where few would anticipate XRP to fall, leading to speculation about intentional liquidity withdrawal. A detailed analysis of the order book suggests that major players may have orchestrated a rapid sell-off to force liquidations.

As the price plummeted, liquidity dried up, allowing select market participants to execute their buy orders at discounted prices. The absence of significant buy-side liquidity before these orders appeared raises further suspicion.

Source: traderview2/X

Also Read: Brad Garlinghouse Addresses Concerns Over Crypto Regulation Meeting

Market Patterns Indicate Coordinated Effort

Traderview continued by noting that historical trends suggest that cryptocurrency market makers often exert control over price movements. The abrupt nature of XRP’s decline, combined with the sudden presence of large buy orders, indicates a possible coordinated effort to shake out long positions before accumulating at lower prices.

“I don’t want to resort to conspiracy but if you think that move was “natural”, think again,” he said.

The subsequent 40% rebound from the low further supports this theory, as those who managed to secure positions at the bottom are now in substantial profit.

Market observers emphasize that such strategies are not new in cryptocurrency markets. Instances where liquidity providers simultaneously remove buy-side support can result in cascading liquidations, amplifying downward pressure. This scenario unfolded with XRP, as it suffered a rapid decline before rebounding sharply.

Wider Market Impact

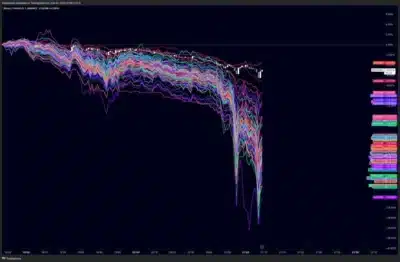

A broader look at the market reveals that altcoins suffered extreme losses within hours. Market data shows that altcoins dropped by 30% in a manner comparable to the FTX collapse and the Covid market crash.

The synchronized nature of these declines suggests a deliberate effort to remove liquidity and trigger mass liquidations. The attached graph illustrates the magnitude of the drop across various cryptocurrencies, reinforcing concerns about systemic manipulation.

The implications of these events raise questions about fair market practices in cryptocurrency trading. The lack of regulatory oversight on perpetual futures contracts enables large players to exploit liquidity gaps.

Traders who were unprepared for the sudden drop saw their positions liquidated, while those who strategically placed bids at lower levels benefited significantly.

Regulatory bodies and exchanges continue to assess the influence of market makers on digital asset pricing. Meanwhile, traders remain cautious, understanding that similar price movements may occur in the future.

The recent XRP price action serves as a reminder of the risks involved in leveraged trading and the potential influence of major liquidity providers in shaping market trends.

Also Read: Here is The Latest Discussion in the XRP Lawsuit You Should Know About