In the world of cryptocurrencies, stability and liquidity are the basis for efficient trading. Traders and market makers are constantly looking for ways to minimize risks and maximize profits.

However, in addition to the trading instruments, it is very important to provide conditions that will help ensure liquidity. This is where market-making comes in, as it plays a critical role in maintaining these conditions.

Understanding how market-making programs work on cryptocurrency exchanges, which platforms are leaders in this area, and what they have to offer traders are important aspects of successful trading in the cryptocurrency market.

Market Making in Crypto: How Liquidity and Market Stability Are Ensured

Market making is the process of providing liquidity to the market through the active buying and selling of digital assets. In other words, market makers help to maintain market stability so that traders can efficiently execute transactions even when liquidity is limited.

They act as intermediaries by constantly quoting prices for buying and selling assets, facilitating the trading process.

Who can participate in the programs?

- Market makers – companies or legal entities that provide liquidity and stability in the market;

- HFT traders (high-frequency traders) – use powerful computers and algorithms to make quick trades, making money on short-term price fluctuations.

- Algorithmic traders – rely on technical, fundamental, or statistical analysis; their goal is to increase the efficiency of trading processes.

- Arbitrage traders are traders who seek to profit from the difference in prices of the same asset or related assets in different markets. There are the following types of arbitrage:

- Spatial – the difference in prices in one market;

- Temporal – price differences in different periods;

- Statistical – the use of statistical models to identify undervalued or overvalued assets.

Most Common Crypto Market-Making Strategies

Market makers use various strategies to perform their roles effectively. In particular, the most common ones are passive and statistical market making.

- Passive – market makers place limit orders at certain price levels and wait for other traders to execute them. They make money on the spread between buying and selling, minimizing risks.

- Statistical – based on the analysis of historical data and market trends. Using algorithms and statistical models, they adjust their quotes in real-time, adjusting them to the current market situation.

- High-frequency trading (HFT) market making – using advanced algorithms and computer systems, market makers execute numerous transactions in a matter of seconds, making a profit on short-term price differences.

- Inter-exchange arbitrage – traders use the difference in prices for the same cryptocurrency on different exchanges. In other words, they buy coins on an exchange with a lower price and sell them on another exchange with a higher price, thus making a profit from the difference.

Market Making on Exchanges: Which Programs Are More Profitable?

Choosing the best market-making program can be a daunting task, as there are several key factors to consider. Let’s have a look at what the largest cryptocurrency exchanges offer and compare their programs.

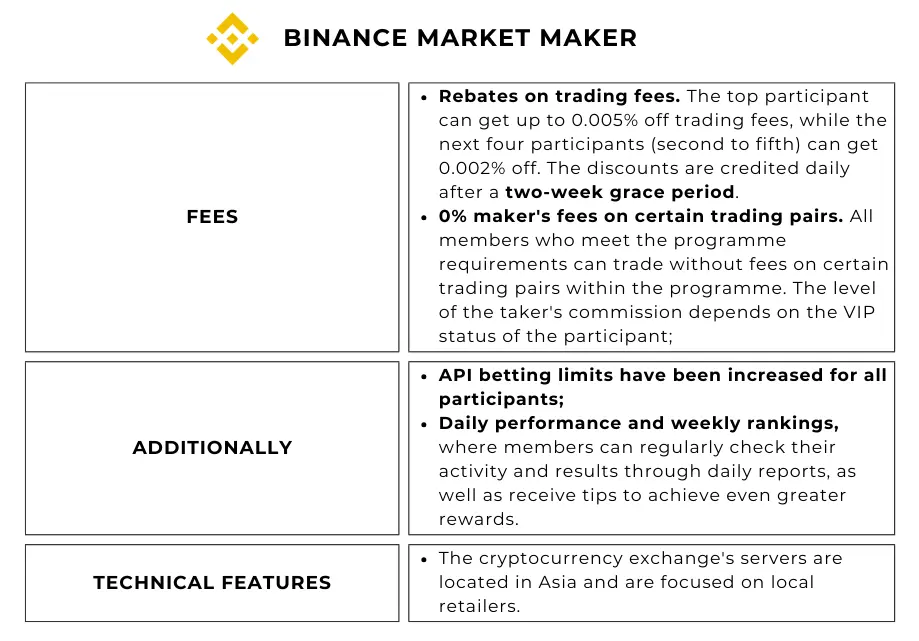

Binance Market Maker

Binance offers the following rewards to its members:

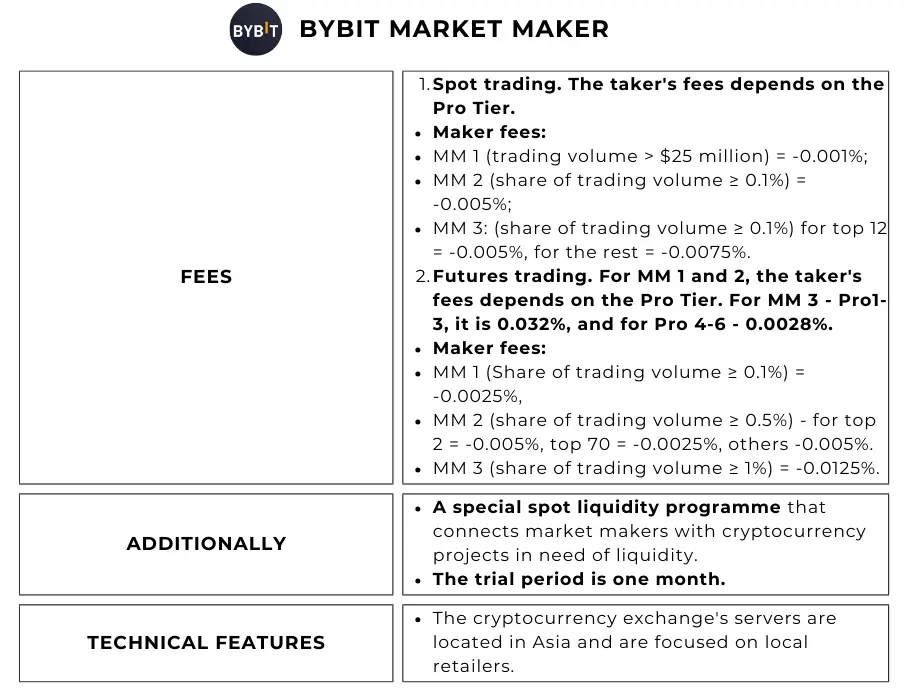

Bybit Market Maker

Bibyt crypto exchange offers the following conditions for market makers who wish to participate in their program:

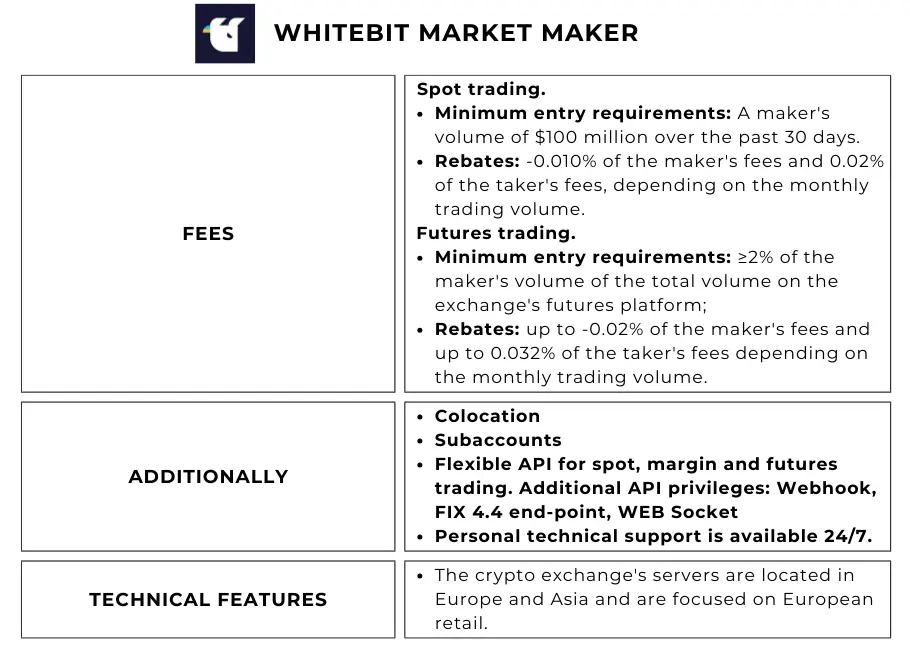

WhiteBIT Market Maker

WhiteBIT crypto exchange offers the following requirements and personal rewards for its members:

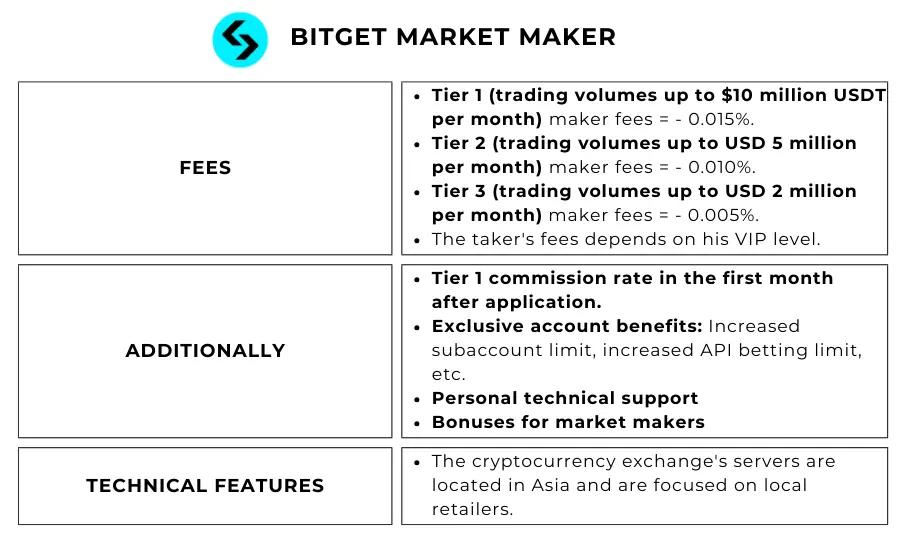

Bitget Market Maker

Bitget offers the following terms and conditions for market makers wishing to participate in their program:

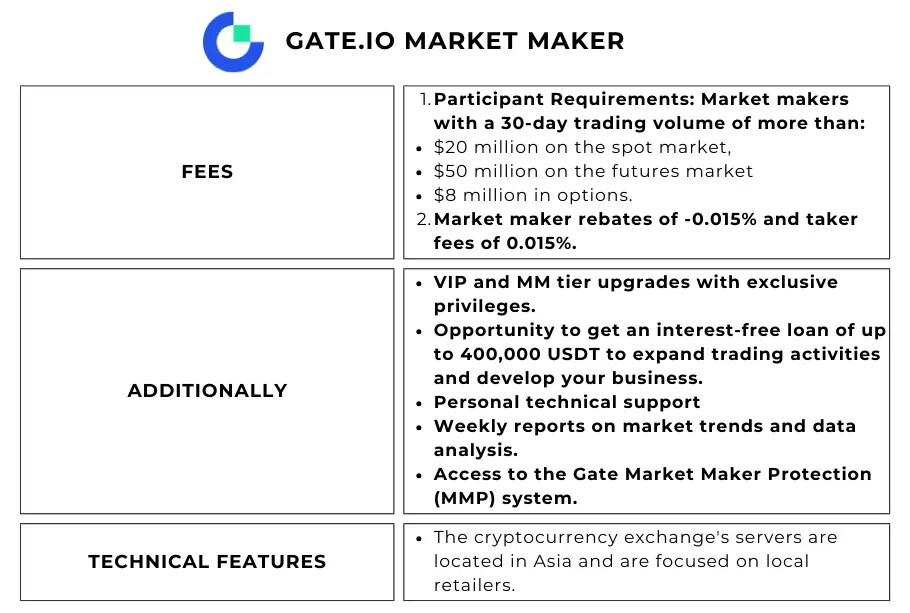

Gate.io Market Maker

Gate.io crypto exchange offers the following conditions for market makers wishing to participate in their program:

Tip: For successful trading on the cryptocurrency market, it is important to choose cryptocurrency exchanges with proper market-making programs that provide high liquidity and minimal trading fees. Carefully research the conditions and benefits of the programs to find the most favorable option for your trading strategy.