The spot Litecoin exchange-traded fund (ETF) by Canary Capital has been listed on the official website of the Depository Trust and Clearing Corporation (DTCC).

This development, confirmed by the Litecoin Foundation on their X handle, marks a potential step toward mainstream cryptocurrency adoption. The ETF appears under the ticker LTCC, and its presence on the DTCC platform has drawn attention from market participants.

From the Litecoin Foundation, DTCC is central in financial markets as it works to settle trillions of securities daily. Including the Canary Capital Litecoin ETF in this system can signify the increased demand from institutional investors, which could shift Litecoin considerably in terms of price and trading volume.

Also Read: SEC Latest Move Sparks Speculation Over Ripple (XRP) Lawsuit, Here is What Happened

Institutional Interest and Market Response

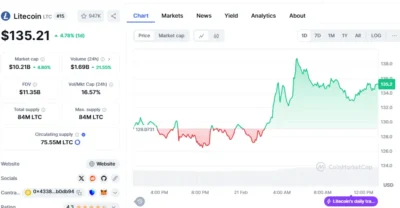

In response to the announcement of the ETF, Litecoin spiked to 4.78% in value within 24 hours. It touched a daily high of approximately $138 before closing at $135.21 at the time of this report.

There is still a key resistance level, $142; if this level is breached by sustained demand, then the climb will continue.

Source: CoinMarketCap

This market response reflects the growing bullish sentiment around Litecoin, specifically as institutional investment in the cryptocurrency continues to grow. The listing on DTCC makes the ETF more accessible to the broader market, which increases the possibility of institutional money entering the cryptocurrency space.

Technical Indicators Point to Continued Bullish Momentum

The technical analysis shows that there is potential for additional gains. The Relative Strength Index (RSI) is 61.26, which indicates bullishness but not an overbought signal yet. This means there is room for the stocks to go up before the selling pressure sets in again.

Source: Tradingview

The MACD indicator also supports this bullish outlook as it shows bullish divergence. The MACD line is still above the signal line of the daily chart, suggesting that this upward trend is continuing. Should this trend persist, one might expect Litecoin to experience additional upticks in prices soon.

However, the trend in the broader cryptocurrency market could influence the future direction of Litecoin in one way or another. If the market conditions do not change and the ETF receives a better status closer to a launch, there could be a significant increase in the LTC price.

Also Read: Litecoin Whale Transactions Surges Exponentially, Accumulating 3 Million Tokens Over the Last Month