The XRP community is excited as the U.S. Securities and Exchange Commission (SEC) prepares for a closed-door meeting on February 27, 2025. Speculation is mounting after official documents revealed that XRP is explicitly referenced in the meeting agenda.

Given the SEC’s history of enforcement actions against digital assets, industry observers question whether major regulatory developments are on the horizon.

This meeting follows the recent closure of high-profile cases involving Coinbase, Robinhood, and Uniswap Labs. With these legal battles now resolved, attention has turned to XRP, fueling discussions about its regulatory status and the SEC’s next course of action.

Source: X

Also Read: New Shocking Twist Uncovered in The Ripple-SEC Lawsuit, Could Impact Outcome

XRP-Related Enforcement Matters and ETF Proposal Under Review

The agenda for the meeting includes deliberations on the institution and settlement of injunctive actions, administrative proceedings, and enforcement-related matters. Given XRP’s mention in the documents, analysts and market participants closely monitor the situation for any regulatory developments.

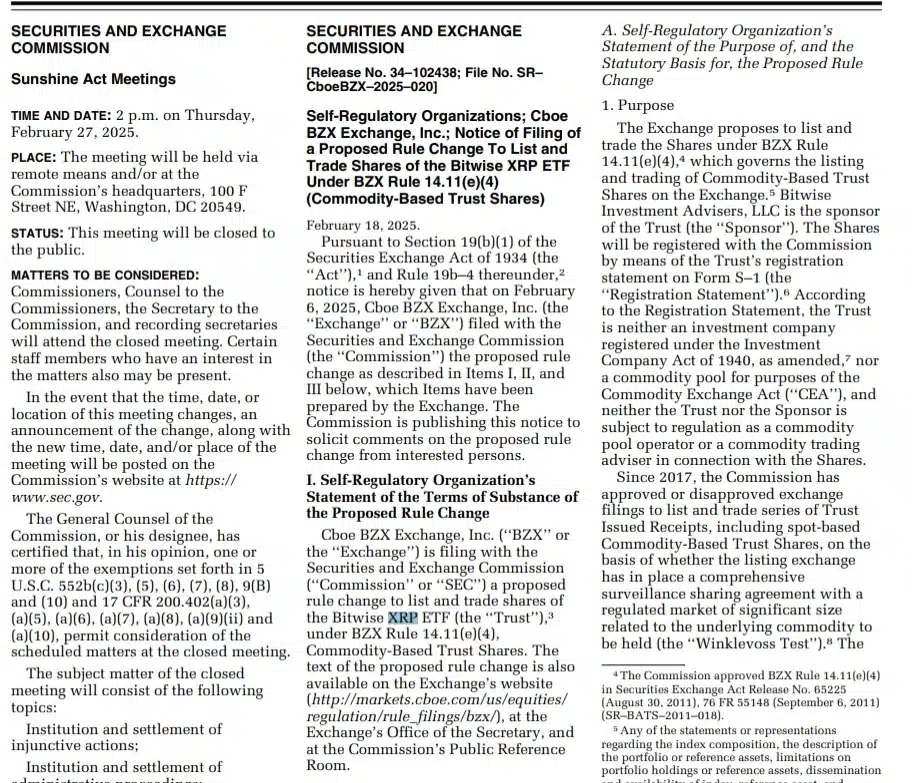

Notably, a separate filing submitted by Cboe BZX Exchange, Inc. on February 6, 2025, has further intensified interest. The proposal seeks approval to list and trade the Bitwise XRP Exchange-Traded Fund (ETF) under BZX Rule 14.11(e)(4), which applies to Commodity-Based Trust Shares.

The filing confirms that Bitwise Investment Advisers, LLC, the trust sponsor, has registered the ETF with the SEC. From the registration statement, it was discovered that the trust is not a registered investment company as defined under the Investment Company Act of 1940.

It is also not recognized as a commodity pool under the Commodity Exchange Act (CEA), and its sponsor or manager is not a commodity pool operator or trading adviser.

The SEC has traditionally analyzed similar filings concerning whether the listing exchange has a robust surveillance-sharing arrangement with a regulated, large market. Similar arguments will likely be used to evaluate the Bitwise XRP ETF proposal.

Potential Regulatory Implications for XRP and the Broader Crypto Market

With the SEC having concluded enforcement actions against major cryptocurrency platforms like Coinbase and Uniswap Labs, XRP’s regulatory future has become a focal point. The agency’s approach to digital assets has been widely debated, especially in light of its legal battle with Ripple Labs over XRP’s classification.

While the proposed Bitwise XRP ETF operates independently of Ripple, its approval—or rejection—could influence market sentiment and regulatory clarity for XRP. If the SEC provides any indication of its stance on XRP during the meeting, it could shape the digital asset’s trajectory in the coming months.

Also Read: XRP Lawsuit: Former SEC Official Discloses Signs of Imminent Ripple Appeal Dismissal