The SEC’s latest closed-door meeting has set the crypto industry abuzz, with many speculating whether Ripple’s long-standing legal battle could end. As the regulatory landscape shifts, the commission’s stance on crypto enforcement appears to be softening.

The meeting, scheduled for today, February 27, will address enforcement actions and litigation settlements, fueling expectations that an appeal withdrawal may be on the table.

Former SEC Officials See Appeal Withdrawal as Likely

Former head of the SEC Office of Internet Enforcement, John Reed Stark, has spoken on unfolding events in the commission. According to Stark, the rapid dismantling of the SEC’s crypto enforcement program indicates that the Ripple case appeal may soon be next.

He clarified that the SEC recently dismissed Uniswap and OpenSea investigations after issuing Well Notices under the Gensler regime.

Also Read: 370,000,000 XRP in 4 Days? Here is What Happened

The SEC had filed an appeal-related opening brief on January 15 in response to Judge Analisa Torres’ July 2023 ruling. The ruling was that the programmatic sales of XRP failed to satisfy the third prong of the Howey Test, a legal test used to determine whether an asset is a security.

Because the agency retreated from several key cryptocurrency enforcement actions, the chances of it going forward with or abandoning the appeal in the Ripple case have sparked significant speculation.

SEC Commissioners’ Vote Could Determine Appeal’s Fate

The upcoming meeting could be pivotal in deciding whether the SEC will continue its appeal against Ripple. Acting Chair Mark Uyeda and Commissioners Hester Peirce and Caroline Crenshaw may cast votes on the matter.

Since SEC rules require a quorum of at least three Commissioners, the decision to withdraw the appeal could be made without waiting for a full commission vote.

Some analysts believe the SEC’s recent dismissal of its lawsuit against Coinbase on February 21 could indicate a broader shift in its enforcement approach. Further indications point to a possible strategic change within the agency: the reassignment of Jorge Tenreiro, the lead litigator in the Ripple and Coinbase cases.

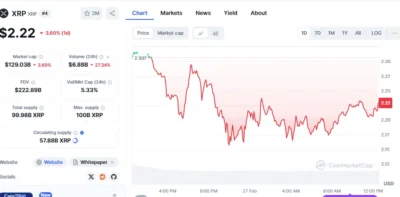

XRP Price Reactions Amid Legal Uncertainty

XRP’s price has been under pressure recently, mirroring broader market trends. The XRP price plunged by 3.60% on February 27 to $2.22, with the cryptocurrency reaching its high at $2.307. The decline came after a broader crypto market correction that saw the total market capitalization dip 4.42% to $2.75 trillion.

Market sentiment regarding XRP is tied closely to the SEC’s legal actions. If the commission officially withdraws its appeal, XRP could see a sharp rally, with analysts predicting a potential surge beyond its all-time high of $3.5505.

However, continued legal uncertainty may push the price below $1.50. Another key factor influencing XRP’s trajectory is the possibility of an XRP-spot exchange-traded fund (ETF), which could attract institutional investment and drive the asset toward the $5 mark.

Conclusion

The SEC’s upcoming closed meeting is expected to play a crucial role in determining the future of its appeal against Ripple. With internal dynamics shifting and key enforcement figures reassigned, the likelihood of an appeal withdrawal is growing.

Market participants will closely monitor the outcome, which could have significant implications for XRP’s price and broader regulatory clarity in the cryptocurrency sector.

Also Read: SEC Dismisses Another High Profile Investigation, Ripple (XRP) Lawsuit Next?