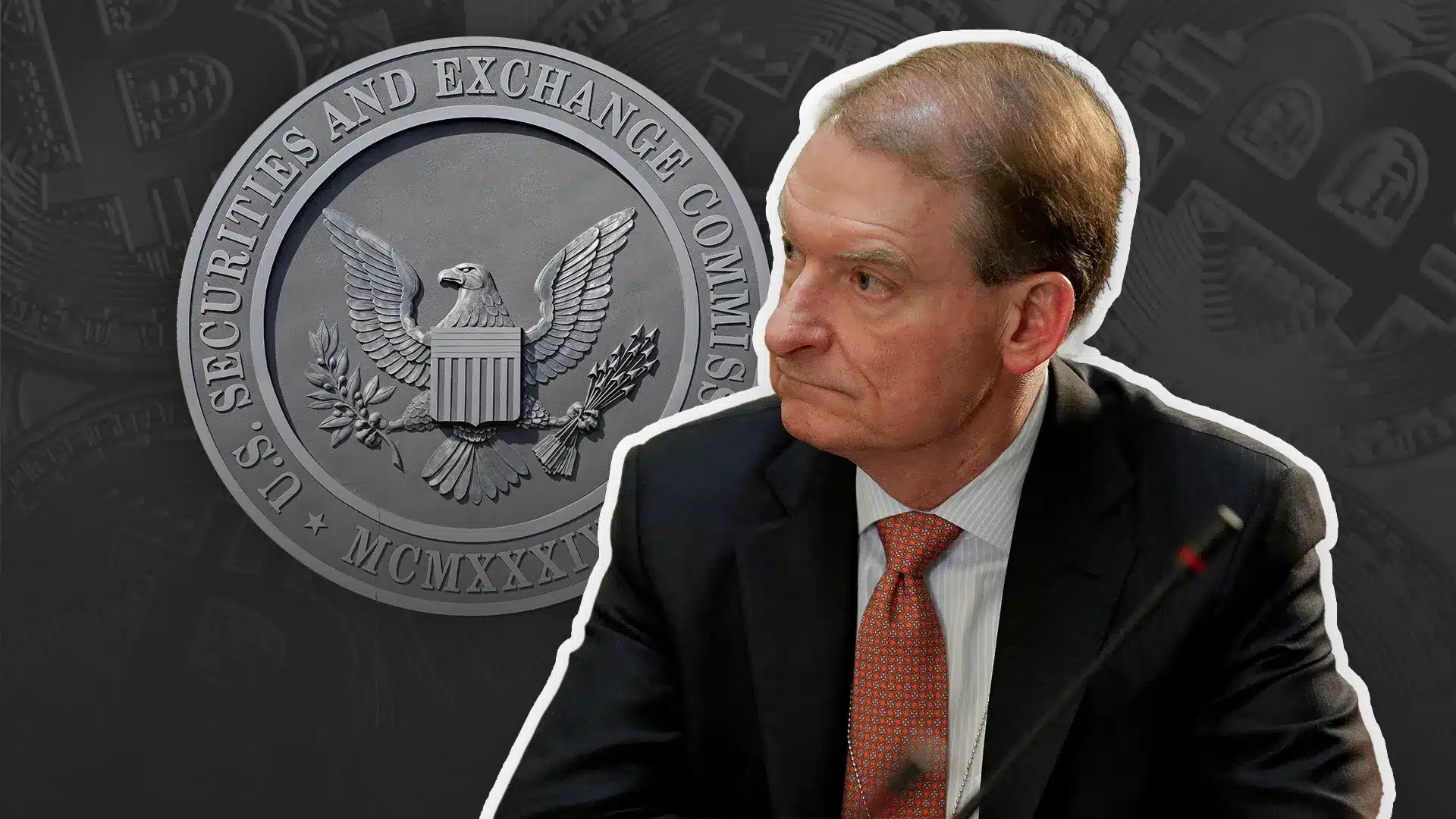

Paul Atkins, President Donald Trump’s nominee to chair the Securities and Exchange Commission (SEC), is set to testify before the Senate Banking Committee on Thursday. His appearance is expected to signal a new regulatory direction, particularly regarding oversight of the digital asset industry.

Atkins plans to emphasize the need for a more transparent framework for cryptocurrencies. He stated in his prepared remarks that unclear regulations have generated market instability and reduced innovative activity in cryptocurrency markets. He declared his primary goal would be to collaborate with Congress and commissioners to build a systematic approach for digital assets.

Dodd-Frank Act regulations and other post-crisis rules receive criticism from Atkins as the next SEC chairman. Scott Bessent stands with his position as Treasury Secretary by advocating for banks to obtain more freedom for enhanced lending and economic growth.

Also Read: Binance Shuts Door on Pi Coin — The Real Reason Behind the Shocking Decision

Atkins, who served as an SEC commissioner from 2002 to 2008, also confirmed he would step down from his regulatory consulting firm, Patomak Global Partners, if confirmed. He has pledged to divest his ownership, valued at over $25 million, to avoid conflicts of interest.

Crypto Regulation Under Scrutiny Amid Senate Questions

Senator Elizabeth Warren is expected to confront Atkins over his consulting work for major banks and his regulatory decisions before the 2008 crisis. In a 34-page letter sent before the hearing, Warren also raised concerns about his connection to the collapsed crypto exchange FTX and questioned his interpretation of the Howey test.

A digital asset can qualify as a security based on the examination method specified in the 1946 Supreme Court’s Howey test that the SEC uses. The former SEC Chair Gary Gensler stimulated legal battles against major companies and crypto exchange platforms because his agency classified most cryptocurrencies as financial securities.

The SEC currently demonstrates a different approach compared to its previous aggressive stance. The SEC has withdrawn multiple enforcement actions that targeted Coinbase and other cases. Commissioner Hester Peirce leads a task force that examines crypto regulations to provide better guidelines to the sector.

The Trump administration has also taken supportive steps, including executive orders that back the creation of a strategic Bitcoin reserve and legislative efforts favorable to the crypto industry.

Conclusion

Paul Atkins’ confirmation could mark a significant turning point in U.S. crypto regulation. His testimony will likely provide key insights into the future path of digital asset oversight.

Also Read: Crypto Shake-Up Incoming as SEC Ditches Lawsuits for Roundtable Talks