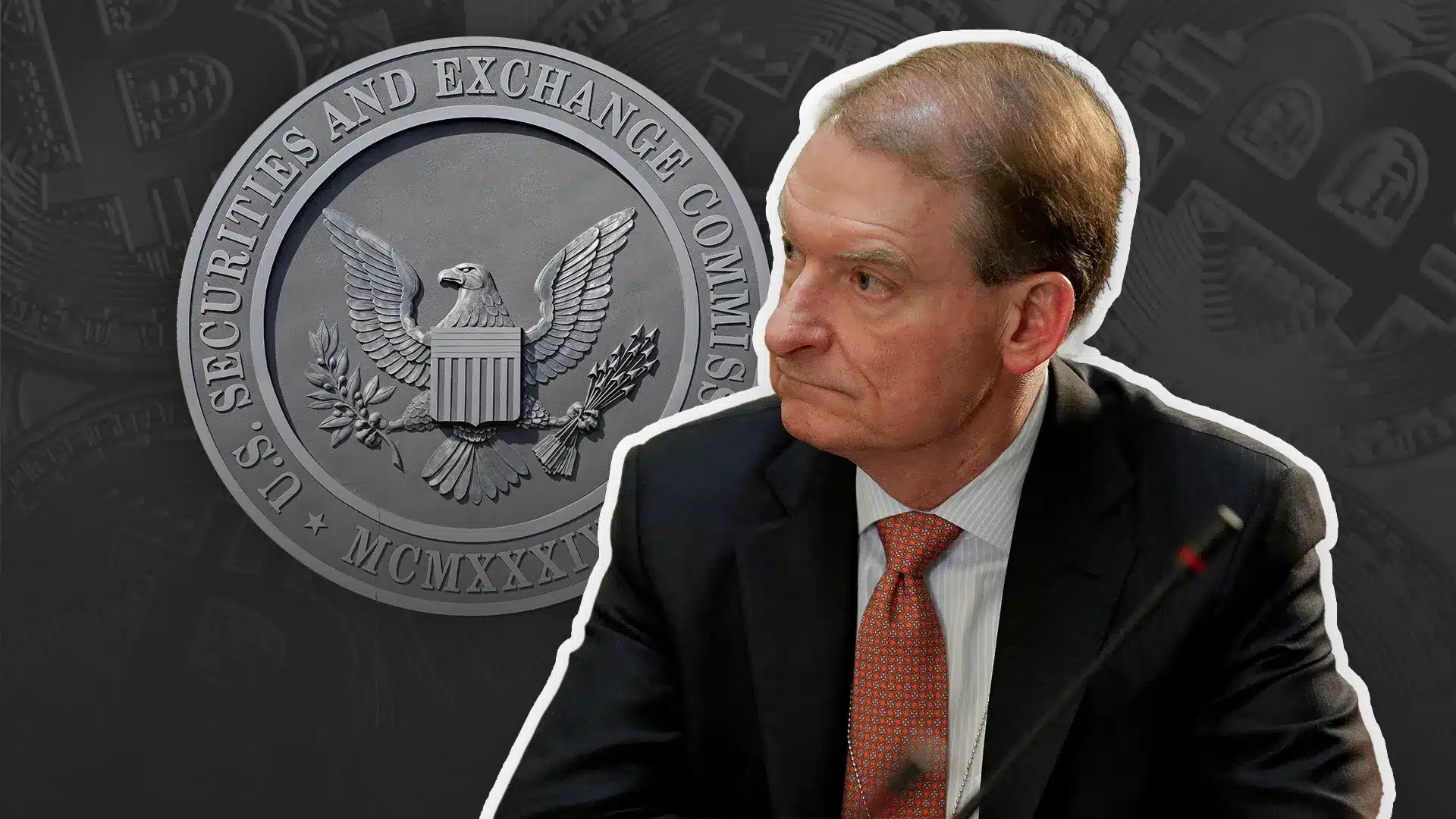

Paul S. Atkins has officially begun his tenure as the 34th Chairman of the U.S. Securities and Exchange Commission following his swearing-in on April 21, 2025. His appointment comes as the agency faces pressure to bring greater regulatory certainty to the cryptocurrency industry and resolve several long-standing enforcement matters.

Atkins was nominated by President Donald J. Trump on January 20 and confirmed by the U.S. Senate on April 9. Returning to the SEC after previously serving as Commissioner from 2002 to 2008, Atkins emphasized his commitment to investor protection and efficient capital markets in his first official statement.

“I am pleased to join with my fellow Commissioners and the agency’s dedicated professionals to advance its mission,” Atkins stated in the official SEC press release. His swearing-in was also confirmed publicly by journalist Eleanor Terrett, who noted that his leadership has now officially begun.

Also Read: Paul Atkins Sworn In as SEC Chair, Crypto Market Braces for Big Changes

Significance for Ripple and XRP

Atkins’ arrival could accelerate developments in unresolved digital asset cases, including the SEC’s ongoing lawsuit against Ripple Labs. The agency previously requested a pause in proceedings following a partial ruling, but has yet to issue a formal update on its intentions since that request.

With new leadership in place, the SEC may now be in a position to finalize its next steps. Observers within the XRP community and broader crypto market are speculating that Atkins’s confirmation might prompt a quicker resolution, either through settlement or a formal withdrawal of the appeal on programmatic sales.

The presence of crypto-friendly Commissioners Hester Peirce and Mark Uyeda may further influence the agency’s internal stance, increasing the likelihood of policy shifts that prioritize clarity over continued enforcement.

Market participants have consistently highlighted the need for standardized regulatory frameworks, particularly for tokens like XRP.

XRP closed April 21 with a modest 0.39 percent gain, reaching $2.0855, after a slight decline the day before. It briefly hit a six-day high at $2.1393 before retracing. The token’s price movements remain closely tied to developments in the Ripple case, which continues to weigh on investor sentiment.

Clarity from the SEC regarding XRP’s classification could open the door to renewed institutional interest and support future moves toward an XRP-spot ETF. Legal resolution is seen as a key step in unlocking broader access and reducing the regulatory uncertainty that has surrounded the token since late 2020.

Conclusion

With Paul Atkins now officially leading the SEC, attention turns to how swiftly the agency will act on unresolved digital asset matters. The Ripple case remains central to this discussion, and the coming weeks may offer critical insight into whether the new leadership intends to close the chapter on one of crypto’s most closely followed legal battles.

Also Read: Whale Buys $48M in Pi Coin as Price Stalls—Is a Massive Breakout Coming?