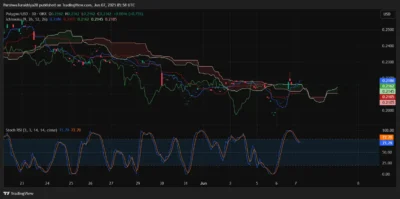

Polygon (POL) showed signs of short-term strength on June 7 after bouncing from the $0.1970–$0.2000 support zone. The token gained 0.75% intraday to trade at $0.2162, reclaiming the 0.786 Fibonacci retracement level at $0.2146.

This breakout follows a descending wedge formation visible on the 4-hour chart, signaling a possible short-term recovery. The current pattern has shifted price action back into a rising wedge structure, pointing to renewed optimism if buyers maintain control.

The token now faces strong resistance near the EMA cluster, with 20-, 50-, 100-, and 200-period moving averages aligning between $0.2127 and $0.2251. This level will be critical in determining the continuation of the trend.

Also Read: MSTR Skyrockets 126% in a Year—Crushing Tesla, Bitcoin, and Meta Gains

Technical Analysis

These indicators are now supporting the bulls, as the 4-hour RSI has increased to 60.34, indicating that the price trend is strengthening beyond the midpoint of 50. A bullish crossover added to MACD’s strength, and positive momentum is increasing, as shown by the green bars in the histogram.

Source: Tradingview

The indicator has returned to a positive value on the chart for the first time this month. This indicates that investors are now shifting money into the market due to its recent stability.

Bollinger Bands are starting to widen once more on the 4-hour chart, with the midline now surpassed and the price heading toward the upper zone. This indicates that higher values may be ahead if volatility remains elevated.

Source: Tradingview

The 30-minute Ichimoku Cloud shows that the price is trading above the Kumo Cloud and that the distortion line has crossed above the baseline. Yet, the cloud is quiet and could lead to a sudden downward move if prices do not hold above the recent highs.

With a Stochastic RSI reading of 72, we understand that the asset might be too high at this time. This might lead to prices remaining flat for a time before more gains take place.

Source: Tradingview

Should bulls move above $0.2251 and close above it, their next upside levels would be at $0.2369, followed by the resistance zone formed at $0.2440–$0.2480. Moving below either $0.2108 or $0.2082 could result in the price falling to $0.2023 or $0.1970.

Bearish or Bullish: What Lies Ahead for Polygon?

As long as the price holds above the 0.618 Fib level at $0.2108, the bullish outlook remains valid. The $0.2250 resistance range now serves as a key barrier that could either extend the rally or cap gains. Failure to maintain momentum may lead to further consolidation. However, increased interest in Layer-2 tokens could continue to support demand for POL through mid-June.

POL Price Prediction Table: 2025–2029

| Year | Minimum Price | Average Price | Maximum Price |

| 2025 | $0.197 | $0.225 | $0.265 |

| 2026 | $0.215 | $0.260 | $0.305 |

| 2027 | $0.240 | $0.280 | $0.330 |

| 2028 | $0.265 | $0.315 | $0.375 |

| 2029 | $0.285 | $0.345 | $0.405 |

Yearly Outlook

2025

Polygon got the support it needed and is now valued at over the 0.786 Fib level. For the bull market to keep rising, it needs to overcome $0.2251 and maintain $0.2108.

2026

Should Layer-2 networks keep being desired, POL could see an average price of $0.260 through the year 2026. As a longer-term barrier, the $0.305 level will make things difficult for the price.

2027

Polygon’s increased involvement in the DeFi and Web3 sectors may increase its appeal to investors. This is predicted to bring the price close to $0.330 by the end of the year.

2028

As Polygon develops its network and infrastructure and benefits from market support, POL may rise to $0.375. However, the average price may stay close to $0.315.

2029

If the involvement in scaling and developing the blockchain ecosystem continues, POL may move toward $0.405. What matters most in success is the application’s usefulness and users’ tendency to use it regularly.

Conclusion

Polygon’s price has picked up after a noticeable fall in the previous weeks. Because of the breakout, the token has entered a key zone of resistance at $0.2251. Bulls have to hold prices above $0.2150 to confirm that more gains are possible.

If it falls beneath these support levels, POL may return to the range from the past. As the year continues, trading volume and the market’s mood will be very important factors.

FAQs

1. Why is the Polygon (POL) price rising today?

POL rebounded from support between $0.1970 and $0.2000 and broke above a short-term wedge, reclaiming the $0.2146 Fibonacci level.

2. What is the next key resistance level for POL?

The next resistance is between $0.2240 and $0.2251, where the EMA cluster and supply zone converge.

3. What happens if Polygon drops below $0.2108?

A drop below $0.2108 may lead to renewed downside pressure and a retest of $0.2023 or $0.1970.

4. Is POL currently overbought?

A stochastic RSI near 72 shows overbought conditions, which could lead to short-term consolidation before any move higher.

5. Can Polygon reach $0.2440 in 2025?

If POL breaks $0.2251 and maintains bullish volume, a rise toward $0.2440–$0.2480 remains possible this year.

Also Read: Mask Network Price Prediction 2025–2029: Will MASK Hit $3.90 Soon?