- Major U.S. banking associations are urging the OCC to delay approving national bank charters for crypto firms like Ripple, Circle, and Fidelity.

- Traditional banks warn that granting charters to crypto firms not engaged in fiduciary services could create regulatory loopholes.

- If approved, these charters would allow crypto companies to bypass state regulations and compete directly with banks.

Major banking and credit union associations in the United States are pushing back against federal efforts to grant national bank charters to leading crypto firms, including Circle, Ripple Labs, and Fidelity Digital Assets.

In a formal letter to the Office of the Comptroller of the Currency (OCC), the groups requested that the agency delay any approvals until more transparency is provided regarding the applicants’ business plans.

The letter, signed by the American Bankers Association, Independent Community Bankers of America, and several credit union trade groups, warned that the OCC’s current course of action could mark a substantial policy shift with potential long-term implications for the financial system.

Bank Associations Cite Lack of Public Disclosure

The banking groups argue that the public versions of the applications submitted by the crypto companies lack sufficient detail to allow for meaningful public review.

Also Read: XRP Now Bigger Than Some of the World’s Most Valuable Assets – Here’s the Latest

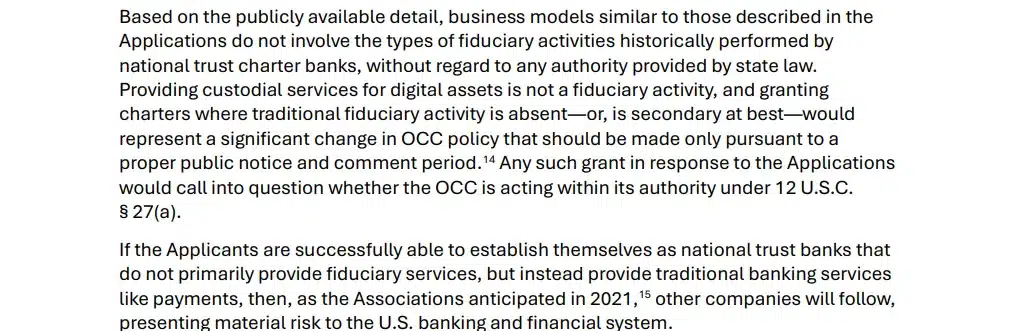

They emphasized that granting national trust bank charters, typically reserved for firms performing fiduciary duties, could create a regulatory loophole, since the applicants do not appear to be offering traditional fiduciary services.

“There are significant policy and legal questions as to whether the applicants’ proposed business plans involve the types of fiduciary activities performed by national trust banks,” the letter stated. The associations are calling for a pause in the process until a formal notice-and-comment period can be held.

Excerpt from the official letter by the American Bankers Association

Crypto Firms Seek Nationwide Banking Access

Several prominent digital asset companies, including stablecoin issuer Circle and enterprise blockchain firm Ripple, have applied for national trust bank charters with the OCC. If approved, these charters would give them the ability to operate nationwide under a single federal license, bypassing the need for state-by-state approval.

The OCC has previously granted limited-purpose charters to fintech and crypto firms, but the current wave of applications represents a potential expansion into offering services traditionally handled by federally regulated banks, such as payments, custody, and digital asset clearing.

Approval of these applications could allow crypto-native firms to become direct competitors to traditional financial institutions, offering faster settlement, lower fees, and broader accessibility to crypto-based services.

Concerns Over Financial System Stability

The banking associations expressed concern that granting such charters could open the door for other companies to follow suit, effectively reshaping the structure of the U.S. banking system without a comprehensive review.

“Providing custodial services for digital assets is not a fiduciary activity,” the letter added. “Granting charters where traditional fiduciary activity is absent—or secondary at best—would represent a significant change in OCC policy.”

The groups argue that this move could present a “material risk” to the U.S. banking and financial system, especially if companies with minimal capital requirements are allowed to operate with the same privileges as fully regulated banks.

Looking Ahead

The OCC has not yet publicly responded to the request, but the debate underscores the growing tension between traditional banking institutions and digital finance firms vying for a larger role in the regulated financial system.

The outcome could significantly influence the future of crypto regulation in the United States. With policymakers still navigating how to balance innovation and systemic risk, the resolution of this issue may set a precedent for how fintech and blockchain firms integrate into the legacy banking framework.

Also Read: Massive Crypto Gains: Solana, DOGE, and XRP Lead 24‑Hour Charge