- RWA tokens surge as investors favor real-world asset backing.

- Provenance, Stellar, Injective lead gains in strong RWA rally.

- Institutional interest grows as regulation supports tokenized asset expansion.

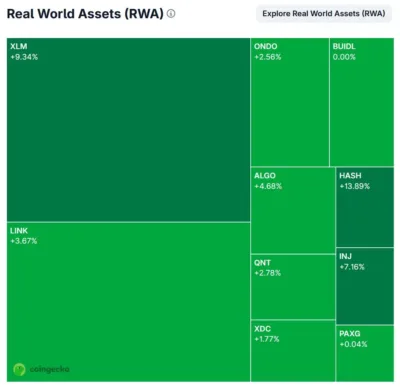

Crypto tokens tied to real-world assets outperformed the broader market on Monday, leading all sector gains. The RWA tokenization category rose by 6.9 percent in 24 hours, surpassing the market-wide average of 1.5 percent.

According to CoinGecko data, key RWA-linked tokens recorded sharp increases. Provenance Blockchain’s HASH token surged 13.89 percent, Stellar (XLM) climbed 9.34 percent, and Injective (INJ) rose by 7.16 percent. These gains came as Bitcoin and Ethereum posted smaller increases, helping lift overall market sentiment.

Investor movement into RWA tokens was largely driven by a shift toward assets with practical applications and clearer value backing. This type of capital rotation typically intensifies during uncertain market phases when traders prioritize sectors with more stable fundamentals.

The appeal of the RWA sector has grown due to increased adoption of tokenized commodities such as gold and gemstones. Projects like GEMtrust DAO, which operates on the Arbitrum blockchain, have already launched initiatives to tokenize these real-world assets.

Moreover, stablecoins and tokenized financial instruments are gaining more institutional support. The recent implementation of the GENIUS Act in the United States has opened the door for traditional financial institutions to explore RWA markets more aggressively.

Also Read: Coinbase CEO Blasts UK After Crypto Ad Ban Sparks Major Backlash

Institutional Entry and Regulation Boost Confidence in RWA Tokens

Major firms are now expanding beyond traditional crypto into asset-backed token markets. Coinbase confirmed its intention to support tokenized real-world asset trading as part of its broader strategy.

In parallel, payment giants such as Visa have started integrating stablecoins like EURC into their networks across multiple blockchains. This development has strengthened infrastructure around real-world asset applications, improving investor confidence in the space.

Despite the strong showing, RWA tokens remain correlated with overall market trends led by Bitcoin and Ethereum. However, the recent uptick reflects a growing preference for tokens supported by underlying physical or financial assets.

The sharp gains in RWA tokens highlight rising investor interest in more grounded crypto sectors. As regulatory clarity and institutional activity increase, the RWA space may continue attracting capital amid broader market shifts.

Also Read: Whales Scoop Up 160,000 BTC as Bitcoin Dips Below Key Support Zone