- The new REX-Osprey XRP ETF (XRPR) launched with record trading volumes, far surpassing earlier XRP futures products.

- Despite the ETF’s success, XRP’s price fell ~2%, pressured by bearish derivatives sentiment and a long/short ratio at a 30-day low.

- While institutions are embracing ETF exposure, retail and futures traders remain cautious.

The newly launched REX-Osprey XRP ETF opened trading with record-breaking volumes, signaling strong institutional appetite for XRP-backed investment products. However, despite the historic debut, XRP’s spot price has failed to benefit, slipping by 2.13% over the last day.

Institutional Demand Surges Through XRPR

According to early market data, trading activity in the XRPR ETF outpaced earlier XRP-linked futures products launched this year by more than fivefold within its first hour and a half on the market. Analysts say the strong launch underlines growing demand from institutional investors looking for regulated exposure to XRP.

Greg King, CEO of REX Financial and Osprey Funds, described the launch as a milestone for the digital asset market, noting that the ETF provides a bridge between XRP’s real-world use case in cross-border payments and traditional capital markets.

Also Read: Another Big Day for XRP Today – Here’s What’s Coming

$XRPR traded $37.7m on Day One, which edges out $IVES for the biggest day one (natural) $ volume of any 2025 launch. $DOJE is no slouch at $17m, which would be Top 5 for year.. out of 710 launches. Good sign for the onslaught of 33 Act ETFs coming soon.. pic.twitter.com/JaQP9ekFIq

— Eric Balchunas (@EricBalchunas) September 18, 2025

Traders Remain Cautious Despite Historic Launch

Even with the surge in institutional activity, XRP’s spot price has struggled to maintain upward momentum. At press time, the token was trading around $3.04, down nearly 2.2% over the past day. Market observers suggest that bearish sentiment among derivatives traders is weighing heavily on price performance.

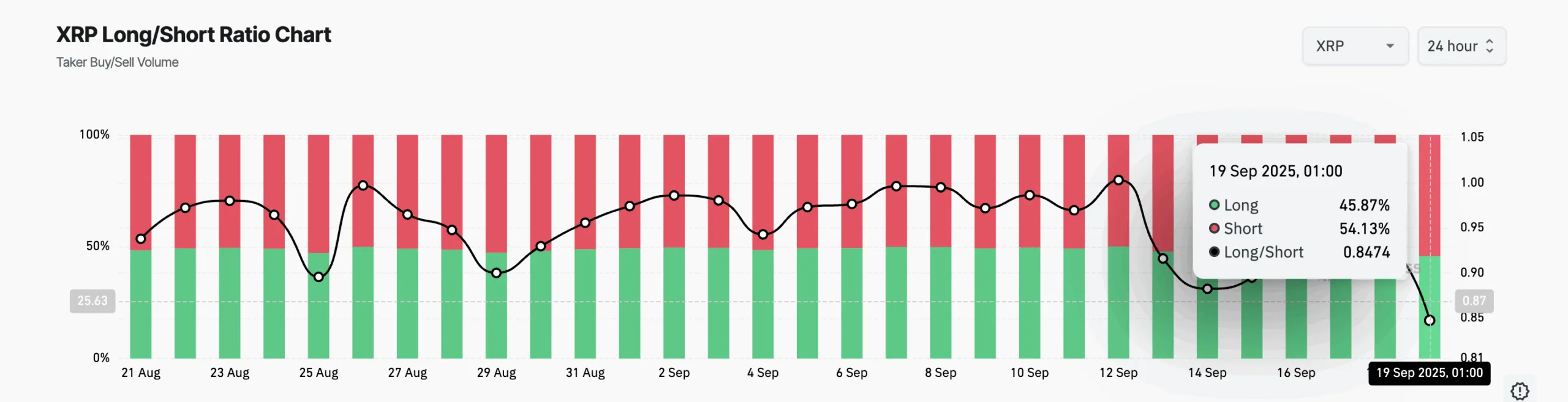

Meanwhile, data shows XRP’s long/short ratio has fallen to a 30-day low of 0.84, reflecting a clear dominance of short positions. In simple terms, more traders are betting on XRP’s decline than its rise, which signals weakening confidence in its short-term trajectory.

Source: Coinglass

The muted price reaction highlights the divergence between institutional and retail sentiment. While professional investors appear eager to gain ETF-based exposure, spot and futures traders remain skeptical of XRP’s ability to break higher in the near term.

This caution comes despite broader optimism in the crypto market. Some analysts suggest the hesitancy could be tied to profit-taking by whales who previously accumulated positions.

What Comes Next for XRP?

Market strategists argue that XRPR’s debut could still have a delayed impact on price, especially if the ETF attracts steady inflows in the coming weeks. The product’s strong start could encourage other issuers to push for additional XRP-focused funds, adding further legitimacy to the asset class.

For now, however, the short-term outlook remains bearish as futures traders continue to hedge against a rally.

Also Read: XRP Surges with $9 Billion Open Interest as Bullish Momentum Builds for New ATH