- $0.80–$0.84 remains a critical barrier for Cardano.

- The $0.75–$0.76 zone is essential for the bulls to maintain control.

- Short-term weakness, but long-term potential exists with Cardano Foundation’s liquidity roadmap.

Cardano (ADA) is currently trading at $0.78 after facing strong selling pressure around the $0.82–$0.84 range. Despite this, buyers are working hard to defend the $0.75–$0.76 support zone, which has become a crucial area for ADA in the short term. The market is currently weighing technical weakness against the long-term optimism stemming from the Cardano Foundation’s $50 million liquidity initiative, which could provide a significant boost to the ecosystem.

The ADA price has struggled to reclaim the $0.80 resistance level, which has proven to be a tough ceiling. A failure to break this level has left the price in a bearish channel, but the Cardano Foundation’s liquidity roadmap could provide the necessary catalyst for a price recovery if it succeeds in attracting more institutional support and expanding the ecosystem.

Also Read: STBL (Stablecoin 2.0) Price Prediction 2025–2030: Will STBL Hit $6.50 Soon?

Recent Price Dynamics and Technical Outlook

Currently, ADA is caught below the $0.80 resistance zone. The 4-hour chart shows ADA stuck below key Fibonacci retracement levels, with the price being rejected near the 23.6% level at $0.83. At present, ADA is trading just under the 20-day EMA at $0.79. The 50-day EMA at $0.82 and the 100-day EMA at $0.84 form a strong resistance cluster, which ADA must break to establish a sustained rebound.

The Parabolic SAR flipped bearish earlier this week, indicating that the short-term trend is still tilted to the downside. If ADA fails to hold the $0.75–$0.76 support area, the next key demand zones lie near $0.68. On the flip side, a daily close above $0.83 could open the door for a rally toward $0.87 and $0.90.

Technical indicators remain cautious, with the RSI in neutral territory, indicating that ADA has some room for movement in either direction. For ADA to shift its momentum to the upside, it needs to break through the $0.84–$0.85 resistance zone, which is the critical ceiling that must break for a more sustained rally.

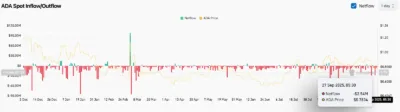

On-Chain Data Shows Persistent Outflows: Will ADA Rebound?

Cardano’s on-chain data reveals a fragile demand situation, with a negative $2.54 million in net outflows recorded on September 27. This continues a trend of inconsistent activity that has persisted for weeks.

While occasional inflows have appeared, the overall sentiment remains cautious, with investors reluctant to commit to ADA in large volumes. As a result, ADA’s price remains vulnerable to downside risks unless these outflows reverse.

Source: Coinglass

The lack of consistent inflows, coupled with muted open interest, suggests that traders are holding back from committing aggressively at current levels. Analysts warn that unless Cardano can generate more consistent demand, it could continue to face a cycle of failed rallies and retests of support.

Cardano Foundation’s $50 Million Liquidity Roadmap: A Potential Tailwind

On a more positive note, the Cardano Foundation recently announced a $50 million liquidity initiative, which is focused on boosting adoption within stablecoins, decentralized finance (DeFi), and real-world asset integration. The roadmap aims to strategically deploy ADA to strengthen liquidity pools and attract developers to the Cardano ecosystem, positioning it as a major player in the DeFi sector.

This initiative has sparked optimism in the Cardano community, with supporters believing it will help Cardano gain traction among institutional investors and developers. However, critics have raised concerns about the risks of deploying ADA into liquidity pools, which could create short-term supply issues. Despite this, the long-term outlook remains positive, as the liquidity roadmap could enhance Cardano’s ecosystem and drive more sustainable growth.

Resistance and Support Levels to Watch

For ADA’s price action to shift positively, it must overcome the resistance levels in the $0.80–$0.84 zone. A sustained break above this range could see ADA testing higher levels like $0.87 and even $0.90. On the other hand, ADA’s immediate support zone is located at $0.75–$0.76. If this area is broken, ADA could see further downside toward $0.68.

Traders should focus on the $0.80–$0.84 resistance and the $0.75–$0.76 support zones. A clear breakout above $0.84 could lead to a more substantial recovery, while failure to hold above $0.75 would likely result in further price declines.

Short-Term Price Action Outlook for ADA

The immediate price action for ADA depends heavily on its ability to maintain above key support levels and absorb the news surrounding the Cardano Foundation’s liquidity plan. The technical indicators are leaning toward short-term weakness, but there is still room for a rebound if buying volume accelerates.

If ADA can sustain above $0.75, it could attempt a recovery towards $0.83–$0.90. However, failure to defend these critical support levels could invite a deeper correction toward $0.68.

Cardano Price Forecast 2025–2030

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2025 | 0.70 | 0.80 | 1.00 |

| 2026 | 0.90 | 1.20 | 1.60 |

| 2027 | 1.50 | 2.20 | 3.00 |

| 2028 | 2.00 | 3.50 | 4.50 |

| 2029 | 3.00 | 5.00 | 6.50 |

| 2030 | 4.00 | 6.50 | 8.00 |

Year-by-Year Outlook

2025

ADA could move within the $0.75–$0.84 range for the majority of 2025, with a potential breakout to $1.00 if bullish momentum returns.

2026

With the Cardano Foundation’s liquidity roadmap in play, ADA could establish a firm base above $1.00, aiming for $1.60 by 2026.

2027–2028

As ADA continues to grow its presence in the DeFi space, ADA could test $3.00 by 2028, with potential for further institutional adoption.

2029–2030

By 2030, ADA could reach $6.50, driven by broader DeFi adoption and the Cardano ecosystem’s growth.

Conclusion

Cardano’s price remains in a fragile equilibrium, caught between technical resistance and the potential catalyst of the Cardano Foundation’s liquidity roadmap. In the short term, ADA faces a tough battle against resistance levels around $0.80–$0.84. However, the long-term outlook is more optimistic, with the liquidity initiative positioning Cardano for future growth. If ADA can hold its ground above $0.75, a move toward $1.00 is plausible by 2025, with higher targets expected as the ecosystem develops.

FAQs

1. Is Cardano (ADA) bullish in the long term?

Yes, despite the short-term technical weakness, the long-term outlook for ADA is supported by the Cardano Foundation’s $50 million liquidity roadmap and increasing institutional interest.

2. What is the next major resistance for ADA?

The critical resistance zone for ADA is at $0.80–$0.84. A breakout above this range could propel ADA toward higher levels.

3. Where is the best support for ADA?

ADA’s immediate support lies in the $0.75–$0.76 range, which must hold for the bulls to regain control.

4. Will ADA hit $1.00 by the end of 2025?

If ADA can break above $0.84 and gain bullish momentum, a price of $1.00 by 2025 is achievable.

5. What’s behind Cardano’s growth?

Cardano’s growth is primarily driven by the $50 million liquidity initiative, which aims to attract more liquidity, developers, and institutional interest to the Cardano ecosystem.

Also Read: ether.fi (ETHFI) Price Prediction 2025–2030: Will ETHFI Hit $24.36 Soon?