- Analyst EtherNasyonaL says XRP is following the Wyckoff Accumulation model, signaling a potential breakout phase ahead.

- Current structure mirrors XRP’s 2017 setup, but with a more developed market environment.

- Gradual accumulation zones suggest XRP is nearing the end of consolidation.

Crypto market analyst EtherNasyonaL believes XRP is closely following the Wyckoff Accumulation pattern, a classic market cycle model that often precedes major price breakouts. In a recent tweet on X, the analyst wrote, “XRP is progressing on the Wyckoff method. The structure is still progressing in line with the Wyckoff accumulation phase.”

Comparing current market behavior with the 2017–2018 cycle, EtherNasyonaL noted a high degree of similarity in the technical structure but emphasized that “this time the market is more mature.” The tone of the outlook remains optimistic, but, as the analyst put it, “this time it’s not just hope; the technical structure also creates similar expectations.”

$XRP is progressing on the Wyckoff method.

The structure is still progressing in line with the Wyckoff accumulation phase.

The similarity to the 2017 formation is striking, but this time the market is more mature.

Although it’s still early, the picture resembles the calm… https://t.co/EjJCRgJ9BQ pic.twitter.com/752wZQiUs5

— EᴛʜᴇʀNᴀꜱʏᴏɴᴀL 💹🧲 (@EtherNasyonaL) October 20, 2025

Also Read: Pundit Connects Walmart’s OnePay Crypto Deal to Ripple – Here’s How

Chart Analysis: Echoes of 2017 With Structural Maturity

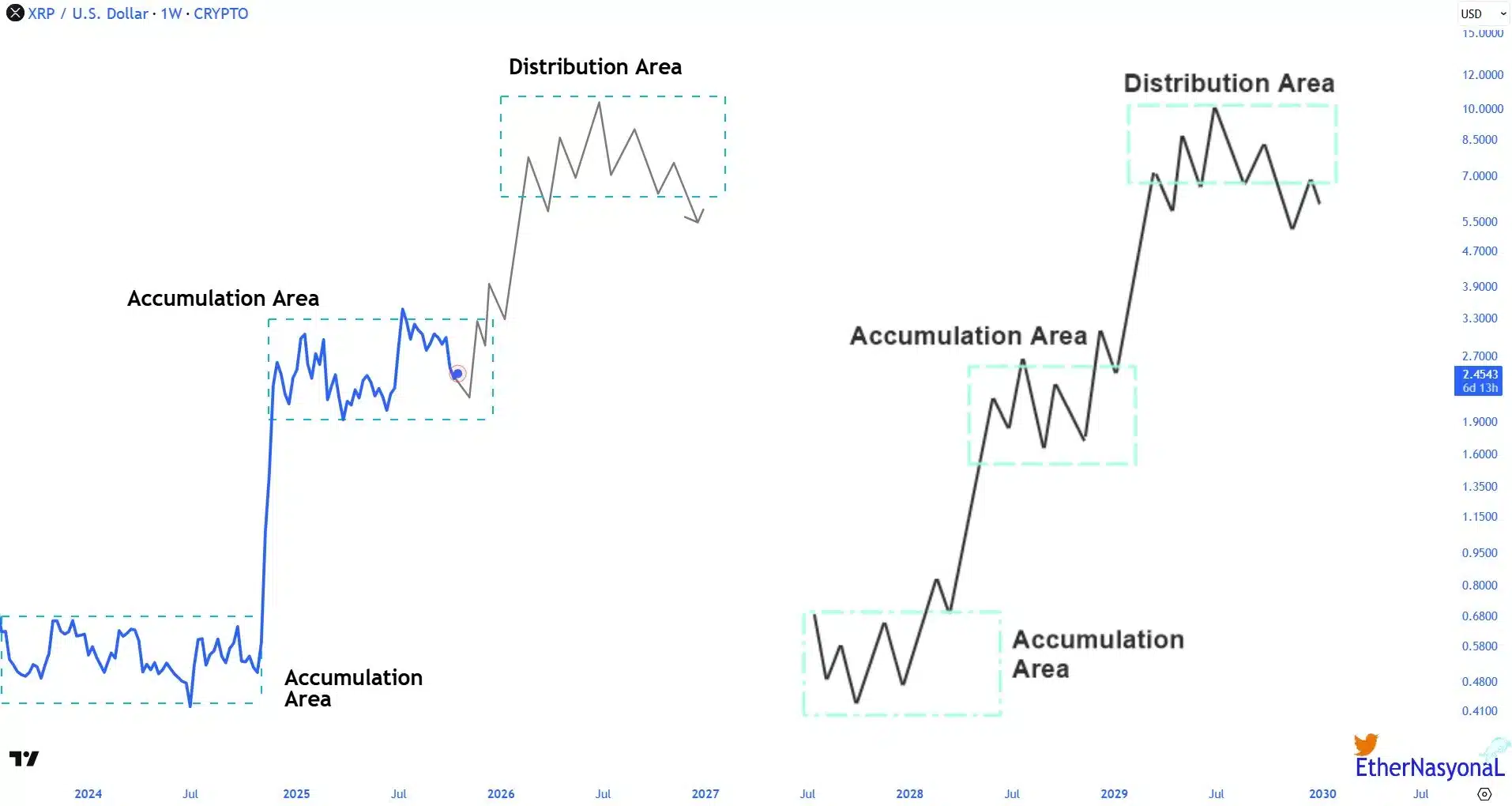

The chart shared by EtherNasyonaL offers a side-by-side comparison of XRP’s current price action (on the left) and a projected path (on the right), both mapped against Wyckoff’s accumulation and distribution phases.

On the left side, the live XRP/USD weekly chart reveals two distinct accumulation areas, one from early 2024 and a second, more recent zone, forming throughout 2025. These are characterized by relatively tight price movement with signs of gradually higher lows, consistent with early-to-mid accumulation stages.

Following the second accumulation zone, a sharp upward breakout occurs, briefly consolidates again, and begins forming what appears to be a third accumulation region, a potential stepping stone before another leg higher.

Source: EtherNasyonaL/X

On the right side of the image, a schematic projection based on Wyckoff theory outlines what could come next: a strong markup phase, followed by a distribution area, the final stage before a trend reversal. According to the projection, XRP could reach significantly higher levels before encountering major resistance.

Market Context: Calm Before the Storm?

EtherNasyonaL’s analysis frames the current market phase as a calm before a breakout, a moment where volatility may be temporarily subdued, but underlying buying pressure is building. The analyst suggests that XRP is repeating the 2017 setup, where a prolonged accumulation led to an explosive rally.

However, there is one key difference this time: the market itself is “more mature.” Unlike in 2017, XRP now exists in an environment with broader institutional attention, real-world adoption, and growing integration with traditional financial rails through developments like tokenization and regulatory engagement.

These factors, combined with technical structure, may add credibility to the idea that XRP is preparing for a sustained upward move.

Final Thoughts

If XRP continues to follow the Wyckoff methodology, the market could be witnessing the tail end of the accumulation phase, with a markup period, or breakout, looming. While nothing in markets is guaranteed, the alignment of the current structure with historical patterns has analysts like EtherNasyonaL leaning bullish.

“The expectation is optimistic,” the analyst concludes, “but this time it’s not just hope.”