- Unexpected XRP escrow release sparks speculation about Flare Network involvement.

- Enosys Loans enables XRP holders to mint stablecoins without selling.

- Flare Network’s role in expanding XRP’s DeFi potential grows.

A transaction involving the release of 4 million XRP, worth approximately $10.12 million, has raised concerns within the cryptocurrency community. Initially flagged by Whale Alert as an unknown escrow release, it led to speculation regarding the true origins and intentions behind the transfer, especially since it diverges from the usual escrow patterns associated with Ripple.

Escrow releases are typically scheduled, with XRP being gradually distributed over time to prevent market disruption. However, this mid-month release surprised many, as it didn’t align with Ripple’s usual escrow practices. Initially marked as an unknown wallet transfer, the nature of the transaction sparked uncertainty among XRP holders, particularly regarding its legitimacy.

Also Read: Cardano Founder Confirms XRP is ISO 20022 Compliant Alongside ADA, HBAR, ALGO

The True Destination: Flare Network

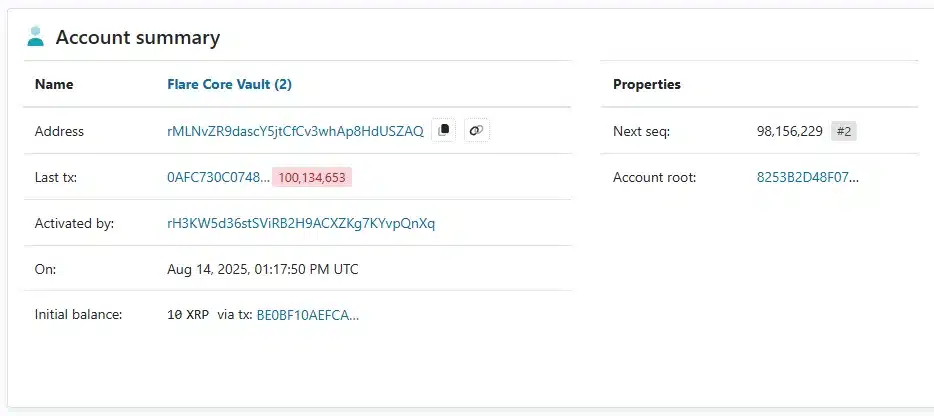

Upon closer inspection using XRPSCAN, it became clear that the 4 million XRP had been sent to the Flare Network, rather than Ripple. This unexpected destination raised several questions, as Flare is primarily known for integrating smart contract functionality with XRP, but it hasn’t previously been associated with escrow releases. The shift of such a significant amount of XRP to Flare could suggest a new development or partnership, but the details remain unclear.

Flare’s role in expanding XRP’s use case beyond payments is well-documented, yet the sudden, mid-month release of XRP has left the community questioning the motives behind this move.

Source: XRPScan

Enosys Protocol Expands XRP’s Role in DeFi

In other news, Enosys introduced the Enosys Loans protocol, allowing XRP holders to mint stablecoins without selling their assets. This collateralized debt position (CDP) protocol, built on the Flare Network, marks a major step for XRP in decentralized finance (DeFi).

The wrapped XRP, or FXRP, enables users to use XRP as loan collateral, paving the way for increased use of XRP in DeFi applications. Enosys plans to expand its services further by incorporating staked XRP (stXRP) in the future, enhancing liquidity and the protocol’s utility within the DeFi ecosystem.

Also Read: CleanSpark Seeks $1B in Convertible Bonds to Expand Operations and Repurchase Shares