- Ethereum sees major selloff, triggering $362 million in liquidations.

- SoftBank’s Nvidia stake sale sparks volatility across crypto markets.

- Ethereum tests critical support levels amid broader market uncertainty.

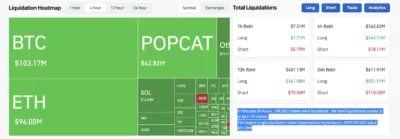

According to Coinglass data, the cryptocurrency market was hit by a massive wave of liquidations this week, with more than $362 million in leveraged positions wiped out in just four hours.

The sharp downturn was primarily driven by a significant selloff in Ethereum (ETH), which saw its price dip below $3,400 for the first time this month. The sudden price drop was compounded by a series of market-moving events, leading to cascading liquidations across various digital assets.

Market turmoil began on Tuesday following SoftBank’s decision to offload part of its stake in Nvidia, which had an immediate impact on tech stocks and, by extension, the crypto market.

Additionally, the uncertainty surrounding the U.S. government shutdown added further strain. Traders, reacting to this unpredictable environment, quickly unwound their positions, triggering the massive liquidation wave that affected over 160,000 traders in the past 24 hours.

The majority of these liquidations, totaling $613.16 million, were long positions, with approximately $503.23 million wiped from long traders, while short traders lost about $110 million.

Source: Coinglass

Also Read: XRP Floodgates Are About to Open, Here’s What’s Coming

Ethereum Faces Strong Resistance as Market Reacts to Downtrend

Ethereum’s price movement reflects the broader volatility in the market. ETH recently dipped to $3,448, representing a 2.86% decline after facing rejection at $3,587. The price breakdown pushed ETH below its 20-day simple moving average (SMA), which stood at around $3,463, signaling a weakening short-term trend.

The widening Bollinger Bands suggest that volatility is likely to continue, with the lower band now near $3,225. If Ethereum closes below this level, further downside could be expected, possibly testing the $3,100 mark.

Critical Support Levels in Focus for Ethereum’s Recovery

However, if ETH manages to reclaim the $3,463 level, it could signal a potential reversal, restoring some bullish sentiment. The MACD indicator is currently in bearish territory, with a -73.12 signal gap, indicating a continuation of the negative momentum. For Ethereum bulls, defending the $3,300–$3,350 support range is crucial to avoiding further losses and stabilizing the price above the $3,500 resistance.

The market’s high volatility, fueled by macroeconomic factors and technical selloffs, has left traders on edge. Ethereum and other cryptocurrencies like Bitcoin and Solana saw significant drops in open interest, highlighting traders’ reluctance to take on further risk amid the uncertain environment.

As the cryptocurrency market continues to navigate through these turbulent times, traders will be closely watching the upcoming price actions of Ethereum and other major assets. The current market conditions, marked by heightened risk aversion and extreme liquidations, suggest that caution will be key for the foreseeable future.

Also Read: XRP Analysis Amid ETF Launch: “The Longer the Base, the Bigger the Breakout” – See Targets