- XRP’s spot ETF shows impressive daily inflows, attracting institutional interest.

- Despite challenges, XRP’s ETF performance continues to show solid growth.

- Institutional demand for XRP ETFs rises, signaling positive market sentiment.

XRP’s spot ETF has been a topic of interest in the cryptocurrency market, with strong inflows highlighting a growing institutional appetite. Among these are the newly launched Grayscale XRP ETF and Franklin Templeton XRP ETF, both of which are already making their mark in the market.

These new ETFs have attracted attention due to their impressive early performance, especially in the last 24 hours. Since its launch, Grayscale XRP ETF has managed to pull in $67.36 million in total net assets, with $29.81 million coming in as cumulative inflow.

Over the last 24 hours, the ETF experienced a +0.55% increase in daily change, with a notable $6.52 million in value traded. This solid performance indicates that Grayscale’s offering is being well-received in the market, likely due to its strong reputation in the crypto ETF space.

Source: Sosovalue

On the other hand, Franklin Templeton XRP ETF has also seen encouraging results. It has accumulated $62.59 million in total net assets, with $27.70 million in cumulative net inflows. This ETF has seen a +0.24% increase in its daily change, with a solid $23.53 million in value traded.

Despite being newer to the market, Franklin Templeton’s XRP ETF is showing promising growth, with the company likely benefiting from strong institutional interest in digital assets.

These new XRP ETFs are important players to watch, as they contribute to the overall growth and diversification of the XRP market in the institutional investment space. Their early success sets a positive tone for XRP’s continued institutional adoption.

Also Read: Egrag Crypto: Exponential Assets Like XRP Don’t Obey Moving Averages, Here’s Why

How Does XRP Compare to Other Cryptos in the ETF Space?

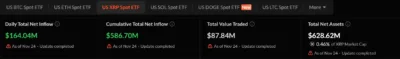

The total US XRP Spot ETF market has shown significant progress, with a daily net inflow of $164.04 million and $586.70 million in cumulative net inflows. Despite representing a relatively modest 0.46% of XRP’s total market cap in total net assets, it remains a strong contender in the digital asset ETF market. With $87.84 million in total value traded, the ETFs continue to show positive momentum, with institutional investors taking a keen interest.

Source: Sosovalue

Notably, XRP’s performance still lags behind Bitcoin and Ethereum in terms of total assets and market share, with the US BTC Spot ETF holding $116.20 billion in assets, representing 6.54% of Bitcoin’s market cap. Ethereum’s US ETH Spot ETF also boasts $18.44 billion in assets, or 5.14% of Ethereum’s market cap. Still, XRP’s consistent inflows signal growing acceptance in the institutional investor community.

While the total value traded for XRP’s ETF is $87.84 million, far less than Bitcoin’s $5.44 billion or Ethereum’s $1.54 billion, it remains a solid performance when compared to newer ETFs in the space.

XRP’s Path Forward in the ETF Landscape

Although XRP spot ETFs have made a solid start, they are still far from competing with the established dominance of Bitcoin and Ethereum in the ETF space. With $628.62 million in assets, XRP has a long way to go before matching the figures seen in Bitcoin and Ethereum ETFs. Nevertheless, the growing daily inflows point to a promising future.

The performance of XRP’s spot ETF shows that institutional interest in the asset remains strong. As the cryptocurrency space continues to evolve, XRP’s position could improve further. The ETF’s success could serve as a stepping stone to broader adoption and greater market share in the future.

Also Read: SEC Grants No-Action Letter to Fuse Crypto, Clearing Path for FUSE Token Offering