Last updated on March 25th, 2025 at 07:52 am

Selecting secure crypto wallets and exchanges is very crucial when you intend to start your cryptocurrency journey. Inexperienced crypto investors who need to store their digital assets securely might face the challenge of choosing a crypto wallet or exchange they can trust.

Although the industry has gained significant popularity and cryptocurrency services provide a reasonable level of security, it is crucial to follow specific guidelines when choosing a platform.

Crypto exchanges are online platforms (marketplaces) where you can buy, sell, trade, and in most cases store your cryptocurrencies. However, saving your assets on these platforms is not advised fully. The best way to store cryptocurrency remains using cold crypto wallets.

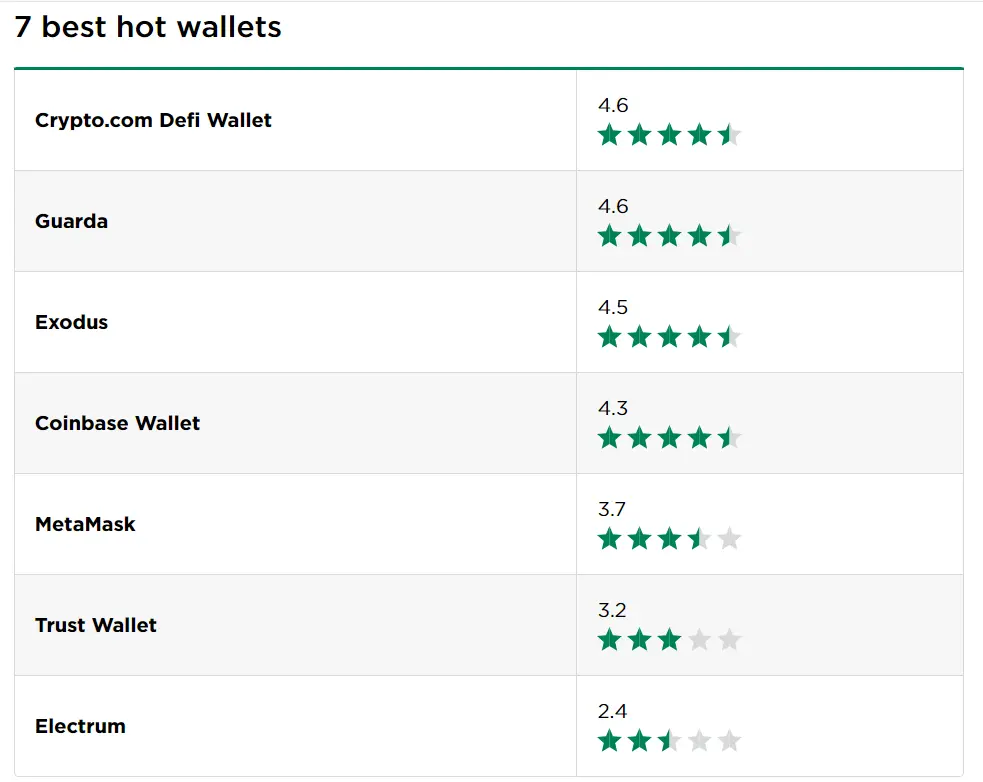

Crypto wallets are either software (hot wallets) or hardware (cold wallets) platforms or devices where you can securely store your digital assets. These wallets store users’ private keys while also providing an easy-to-use interface to manage your portfolio.

If you are a beginner in the crypto space, selecting what works for you may take time and effort, therefore, in the following section, we will be giving factors to consider before choosing a crypto wallet as well as a cryptocurrency exchange.

5 Things to Consider When Choosing Crypto Wallets

1. Security

Avoid using a wallet that doesn’t provide robust protection for your keys. An insecure wallet is vulnerable to hacking, putting your assets at risk. Before choosing a wallet, thoroughly research the security features and protocols offered by the wallet provider.

While hot wallets are user-friendly, they carry a higher risk of being hacked. Prioritize the security of the wallet when making your selection. A reliable hot wallet should offer biometric verification and two-factor authentication.

Additionally, a wallet that provides multiple signature options can be a good choice. Finally, if you want to avoid falling victim to scammers, search the internet for information on any documented hacking incidents that the wallet may have experienced. If a wallet has been hacked multiple times, it’s advisable to look for a different provider.

2. Supported Currencies

Most wallets in the market support a wide range of cryptocurrencies. However, some wallets only support major currencies like Bitcoin and Ethereum. If you need to store specific currencies, write to customer support to know if the wallet supports them before opening an account.

3. Fees

One of the advantages of crypto wallets is that each wallet has its fee structure. Some wallets charge a specific fee for transactions, while others may also have network usage fees. There are also wallets that offer all their services for free or have minimal fees. When choosing the best wallet, it’s crucial to consider the fees charged by the wallet. If you prefer frequent transactions, opt for a wallet with low fees.

4. NFT or Web3 Support

There is no doubt that non-fungible tokens (NFTs) are becoming an important part of the cryptocurrency world. If you are investing in NFTs, you may need a crypto wallet or exchange that supports them.

Select a wallet/exchange that can easily connect your NFTs to various trading platforms. Select a platform that makes buying and selling NFTs more convenient. The same goes for Web3 technologies. Recently, a huge amount of crypto exchanges integrated the Web3 wallet deposit methods. For example, on the WhiteBIT exchange-users can deposit ETH tokens and related networks such as Polygon, Arbitrum, Optimism, and many others via Web3 Wallet.

5. Customer Support

Finally, if you want to invest in a good crypto wallet, ensure that the wallet provider has an excellent customer support department. In case of any transaction issues or disputes, a wallet with strong customer support will help you resolve the problem quickly.

5 Factors to Consider Before Choosing a Cryptocurrency Exchange

If you decide to store your digital assets on a crypto exchange, then you should consider the following factors:

1. Convenience

Exchanges offer a user-friendly interface for trading and investing in cryptocurrencies, especially for beginner investors. You can create an account on the exchange’s website or app, where you can easily view your balance and conduct transactions.

2. Reliability

The large centralized exchanges provide users with a high level of security for transactions and trading on their platforms. They implement features like two-factor authentication (2FA) to add an extra layer of security to the platform. Also, some of these exchanges store the majority of users’ funds in cold storage. With Coinbase, 98% of the assets in your vault are stored offline in safe deposit boxes and physical vaults around the world.

WhiteBIT stores more than 96% of the assets in cold storage. Similarly, Gemini holds 95% of assets in cold storage wallets.

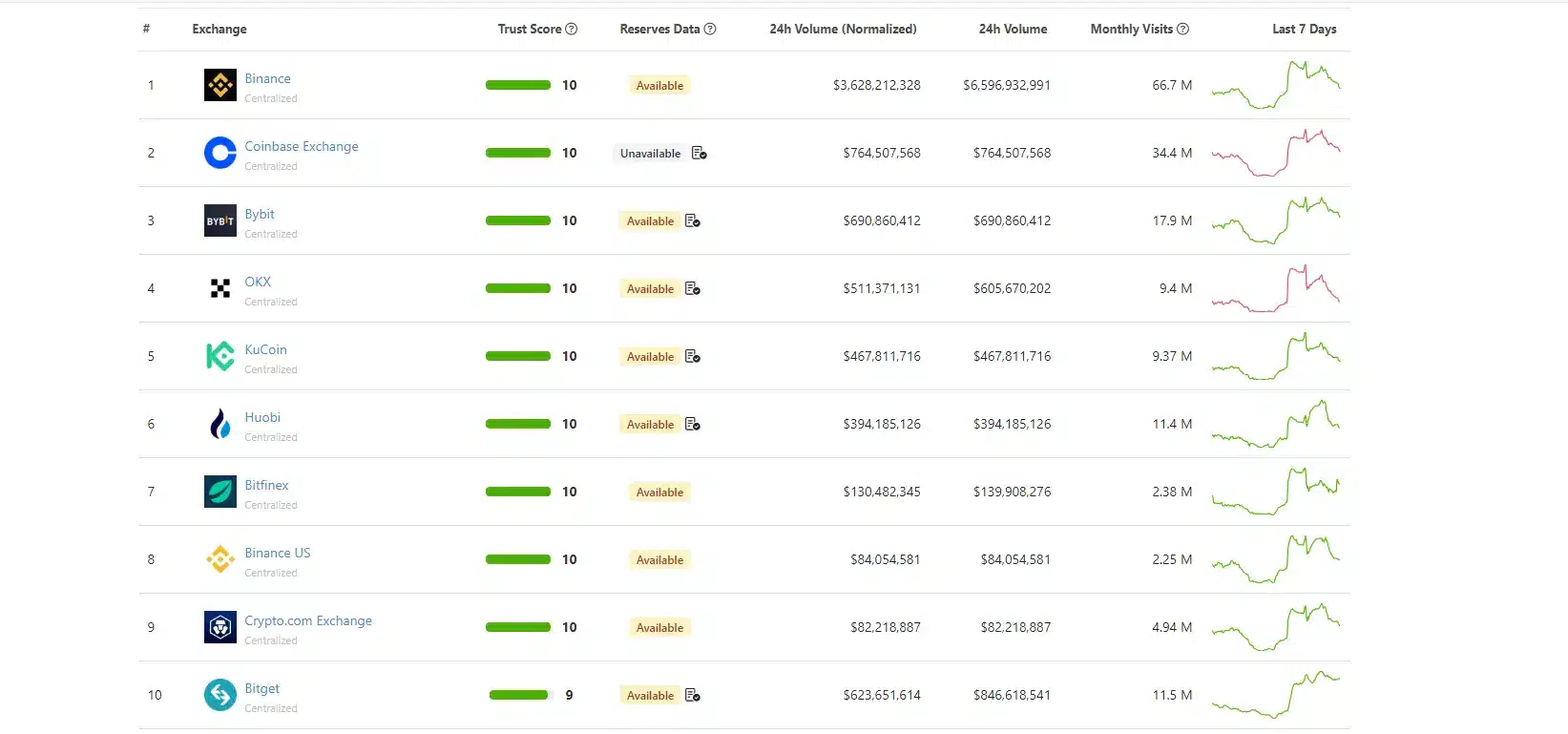

3. Exchange Size

The size of an exchange directly impacts its reliability. The larger the exchange in terms of trading volume and user base, the more stable it tends to be. The financial stability of an exchange determines its ability to fulfill its obligations regarding deposit payouts.

Several factors affect the financial stability of an exchange, including the number of registered users, the amount of funds deposited by clients, the total trading volume, and the duration of the exchange’s operation in the market.

4. Exchange Jurisdiction

The jurisdiction of a cryptocurrency exchange is formally determined by the country where the exchange’s servers are located. While cryptocurrency markets are not directly regulated by governments or financial organizations of specific countries, some platforms impose various restrictions (including registration denials). It’s important to consider the jurisdiction of the exchange.

5. Coin Variety

Find out on the exchange’s website if it offers the ability to trade the specific coins (cryptocurrencies) you are interested in.

Conclusion

When choosing the right platform for storing assets, it is significant to pay attention to several key factors. In addition to using crypto wallets, cryptocurrency exchanges can also be a secure and practical way to store digital assets. When selecting an exchange, factors such as reputation, security, support for different currencies, fees, and level of customer support should be considered.

Overall, security, and caution are key aspects when selecting crypto wallets or exchanges. Using reliable and trusted platforms, as well as adhering to basic security measures, can help mitigate the risks of leakage and loss of digital assets.

Disclaimer: The content on this page is for educational purposes and should not be taken as a recommendation. Please be cautious and conduct thorough research before selecting any exchange or engaging in cryptocurrency trading.