- XRP broke below a key yearly support on the weekly chart, raising short-term downside risk.

- On-chain data shows a spike in new XRP addresses, hitting a monthly high, suggesting fresh network participation.

- The setup is mixed: technically fragile in the near term, but growing network activity hints the move could be a shakeout.

XRP has come under renewed scrutiny after slipping below a key yearly support level, prompting questions among traders about whether the move signals deeper downside or a temporary shakeout. At the same time, on-chain data shows a notable increase in new network participants, creating a mixed technical and fundamental picture for the asset.

XRP Breaks Below Yearly Support on Weekly Chart

According to analyst StephIsCrypto, XRP recently lost its yearly support zone on the weekly Binance XRP/USDT chart. The highlighted support region, which had previously acted as a floor during multiple pullbacks throughout 2025, failed to hold as the price dipped toward the $1.80–$1.90 range.

From a technical perspective, losing a long-term support level often raises short-term risk, as it can trigger additional sell pressure from traders who were relying on that zone as a defensive level.

The chart shows a clear sequence of lower highs leading into the breakdown, suggesting weakening momentum before the support gave way. However, the move has so far remained contained, with price hovering just below the former support rather than accelerating sharply lower. This behavior can sometimes indicate a liquidity sweep or temporary deviation rather than the start of a sustained downtrend.

Also Read: Why is XRP Price Suddenly Rising Today?

$XRP just lost yearly support.

Should we be worried? 👇 pic.twitter.com/A3oBtET21V

— STEPH IS CRYPTO (@Steph_iscrypto) January 1, 2026

New XRP Addresses Hit Monthly High

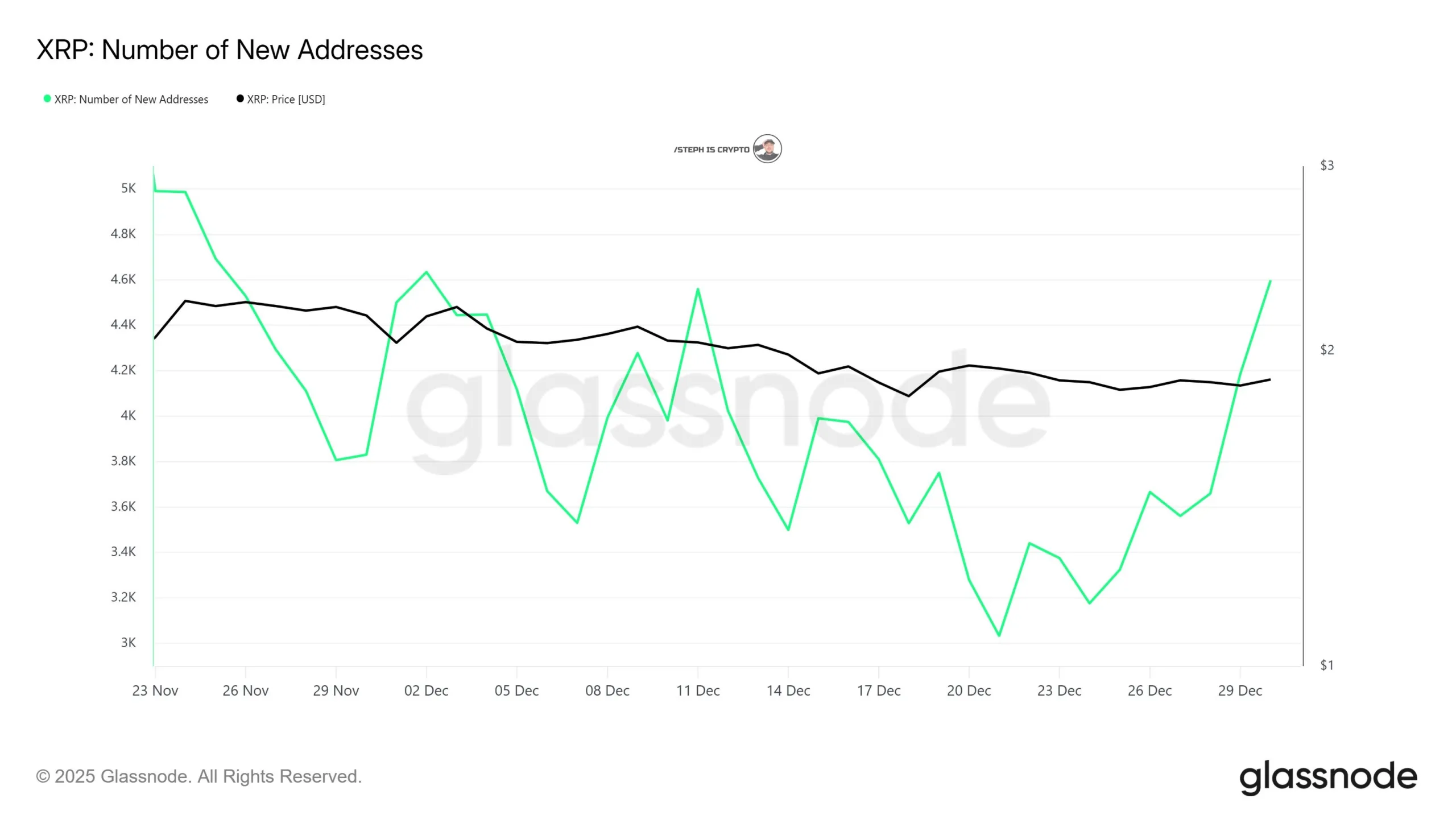

While price action has softened, on-chain metrics tell a different story. In a follow-up post, StephIsCrypto noted that new XRP addresses spiked to around 4,600, marking the highest daily level in roughly a month.

Data from Glassnode shows the number of new addresses rising sharply toward the end of December, even as XRP’s price (plotted alongside) remained relatively flat to slightly lower. Historically, an increase in new addresses is often interpreted as fresh participants entering the network, which can be a constructive signal from a medium- to long-term adoption standpoint.

This divergence, rising network participation alongside weakening price, suggests that new users may be accumulating during periods of uncertainty rather than chasing higher prices.

Source: Glassnode

Divergence Between Price Weakness and Network Growth

The contrast between the technical breakdown and the on-chain activity highlights a key tension in XRP’s current setup. On one hand, the loss of yearly support increases the risk of further volatility and forces bulls to reclaim that zone to restore confidence.

On the other hand, growing address activity implies that interest in the XRP Ledger itself is picking up, potentially laying groundwork for future demand. Analysts often view such divergences as neutral-to-cautiously bullish over longer horizons, especially if price stabilizes while network metrics continue to improve.

What Traders Are Watching Next

Market participants are now closely monitoring whether XRP can reclaim the former yearly support area or establish a new base slightly below it. A swift recovery back above support would reduce downside risk, while continued weakness could open the door to testing lower demand zones.

At the same time, sustained growth in new addresses would strengthen the argument that the recent dip is attracting new entrants rather than driving users away.

For now, XRP’s outlook remains mixed: technically fragile in the short term, but supported by signs of renewed network participation that suggest the broader story may not be as bearish as the price chart alone implies.

Also Read: Expert Says Ignore XRP in 2026 at Your Own Peril, Here’s Why