If you’ve ever tried to automate your trades, you know the struggle – writing code, fixing errors, testing strategies, and hoping it all works before real money is on the line. For many traders, especially those who aren’t developers, this is a big hurdle. Yet automation is becoming too big to ignore.

The global crypto API market is expected to grow at a CAGR of 22%, rising from just over $1 billion in 2025 to nearly $8 billion by 2035 (Future Market Insights).

But here’s the problem – most traders aren’t fluent in Python. That’s where Delta Exchange’s API Copilot steps in. Instead of hiring a coder or juggling third-party algo tools, you can use an AI-powered assistant to create, fix, and test crypto trading strategies directly on a reliable crypto derivatives platform.

In this article, I’ll discuss how API Copilot works, why it matters for both casual and professional traders, and how you can put it to use today.

Why Most Traders Struggle with Algo Trading

- Coding isn’t easy: Writing clean, bug-free code requires knowledge and experience. Even one missing bracket can bring the whole script down.

- Debugging takes time: Even skilled developers spend hours chasing down why an API call failed.

- Expensive platforms: Crypto traders often rely on costly algo platforms to automate simple strategies.

- Testing feels risky: Running untested scripts directly on live markets can lead to potential losses.

These challenges can stop you from exploring automated crypto trading. Many of them may have great ideas – like setting up alerts when BTC options move a certain percentage – but they get stuck at the “how do I code this?” stage.

What is API Copilot and Why Does it Matter?

API Copilot is Delta Exchange’s answer to the automation problem. Think of it as an AI chatbot that helps you write, fix, and understand code for trading APIs. It’s conversational, just like chatting with ChatGPT, but specialised for crypto derivatives trading on Delta Exchange.

Build and test crypto trading strategies with API Copilot on Delta Exchange

Here’s what it does:

- Generates code snippets instantly for your trading requests.

- Helps debug API errors on the spot.

- Explains how to place orders, connect via WebSocket, or fetch market data.

- Guides both beginners and experienced crypto traders through the steps of automation.

In short, you don’t need to be both a great coder and a great strategist. You can focus on building crypto trading strategies while API Copilot handles the technical side of things.

Building and Testing Crypto Trading Strategies With API Copilot

Let me explain how API Copilot helps you build and test crypto trading strategies for futures and options.

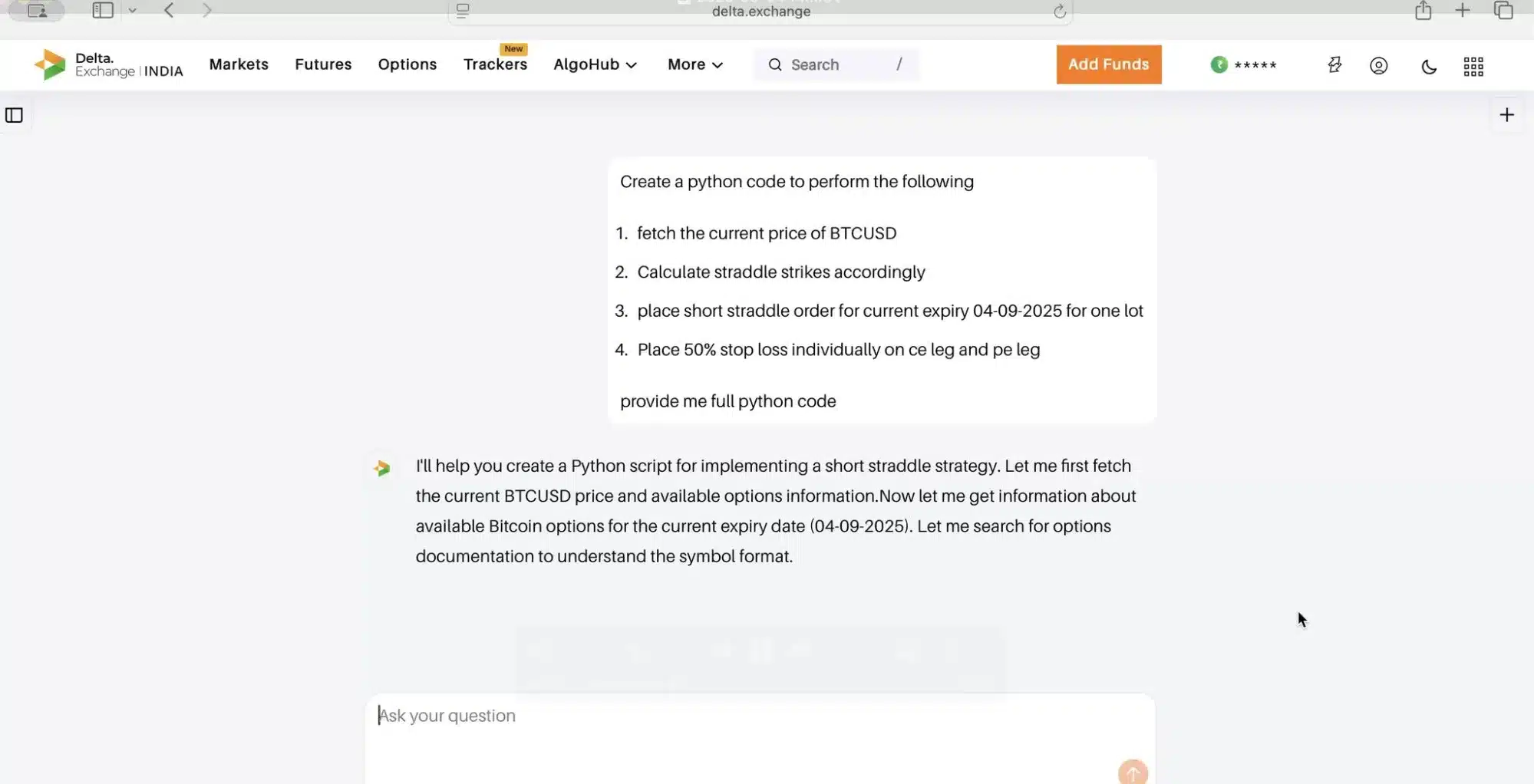

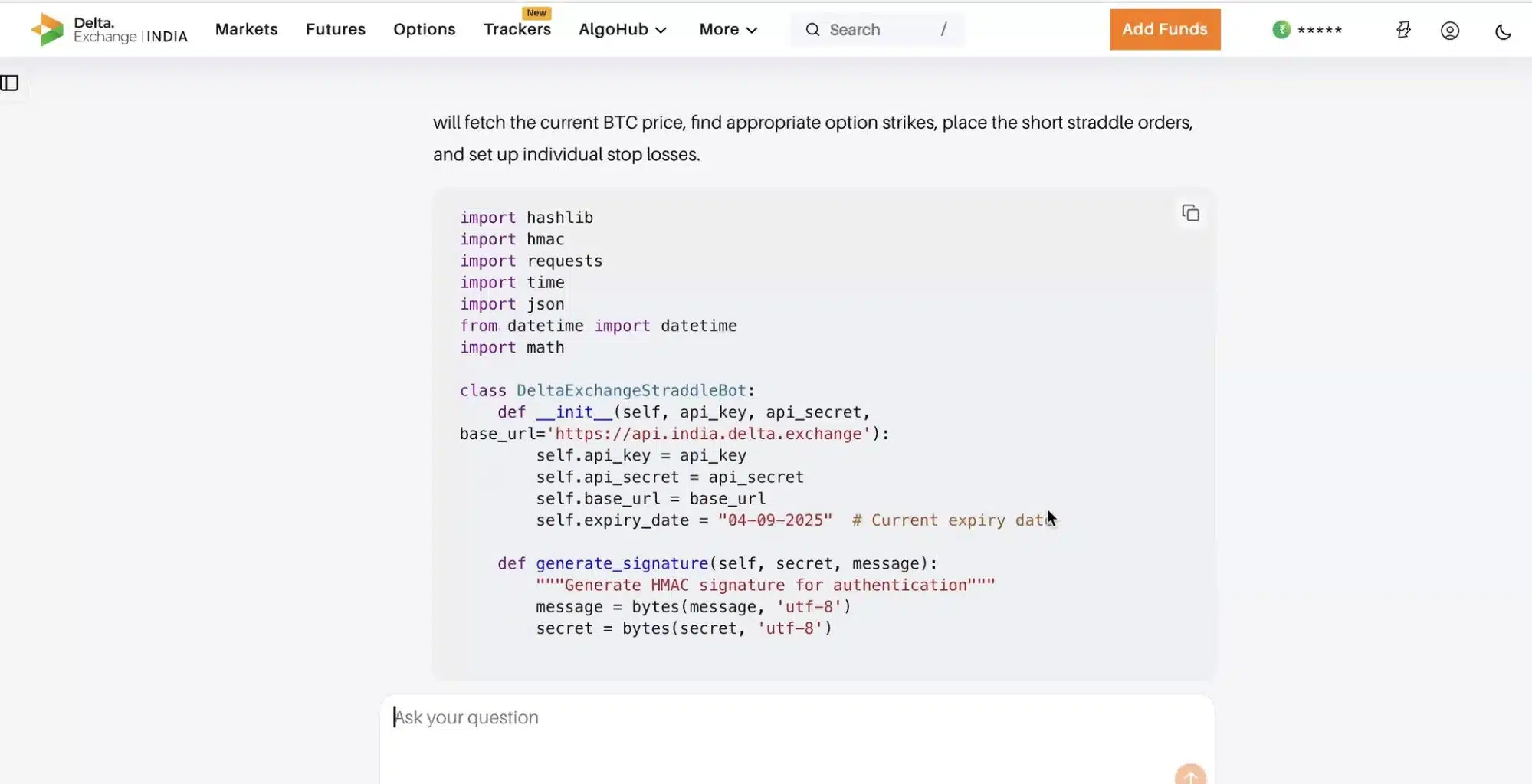

User input for code generation

Say you want to build a basic BTC futures strategy. Your idea is to buy BTC futures if the price drops 2% within an hour.

With API Copilot, here’s how it works out:

- You type your request into Copilot – Generate Python code to buy BTC futures if the price drops by 2% in an hour.

- Copilot generates the script instantly based on your input.

- You paste the script into your development environment, test it with demo funds, and adjust anything if needed, before deploying the crypto trading strategy.

API Copilot generating code based on your prompt

Instead of spending days figuring out syntax or API documentation, you can test your idea the same day.

How To Use API Copilot

Automated crypto trading is easily accessible on Delta Exchange

Follow these simple steps and get started with API Copilot on Delta Exchange:

- Visit www.delta.exchange and create your account by registering with your email.

- Complete KYC and set up your account to access trading features on the crypto derivatives platform.

- Explore available markets and get familiar with the derivatives products before building crypto trading strategies.

- Head to the AlgoHub section from the main navigation bar.

- Create a new API key under the API tab and refresh the page.

- Once done, you’ll see API Copilot appear under AlgoHub, ready to assist you in automating and testing crypto trading strategies.

Beyond APIs in Crypto: What Else Does Delta Exchange Offer

Delta Exchange isn’t only about APIs in crypto. This crypto derivatives platform brings together features that make day-to-day trading easier, whether you’re testing new crypto trading strategies or running automated setups:

- INR trading allows smooth deposits and withdrawals without the hassle of multiple conversions.

- Integrations with TradingView, Tradetron, AlgoTest, and NextLevelBot let you connect strategies directly instead of relying on third-party tools.

- Small lot sizes starting from ₹5,000 and ₹2,500 make it possible to try crypto trading strategies without putting too much capital at risk.

- A demo account allows you to practice automated crypto trading in a safe space before finalising your trades.

- Low-latency execution helps both retail and institutional traders run algos efficiently.

The Bottomline

To sum up, many traders are turning to APIs in crypto as a way to gain an edge, reduce risks, and stay active in the 24/7 running crypto markets. Tools like API Copilot on Delta Exchange make it easier to build and test crypto trading strategies without starting from scratch – but they also don’t replace knowledge or expertise.

Automated crypto trading can help you manage volatility and scale ideas faster, yet your results still depend on how well you understand the dynamics of a crypto derivatives platform.

To start testing crypto trading strategies on derivatives, visit www.delta.exchange and join the community on X for the latest updates.

Disclaimer: Investing in cryptocurrency entails bearing the high risk of market volatility. Kindly research before investing.