- XRP bounced strongly from key “vertical accumulation” support, increasing the odds of a future move into double-digit prices.

- A bull flag consolidation is forming, suggesting a potential breakout once overhead liquidity and resistance are cleared.

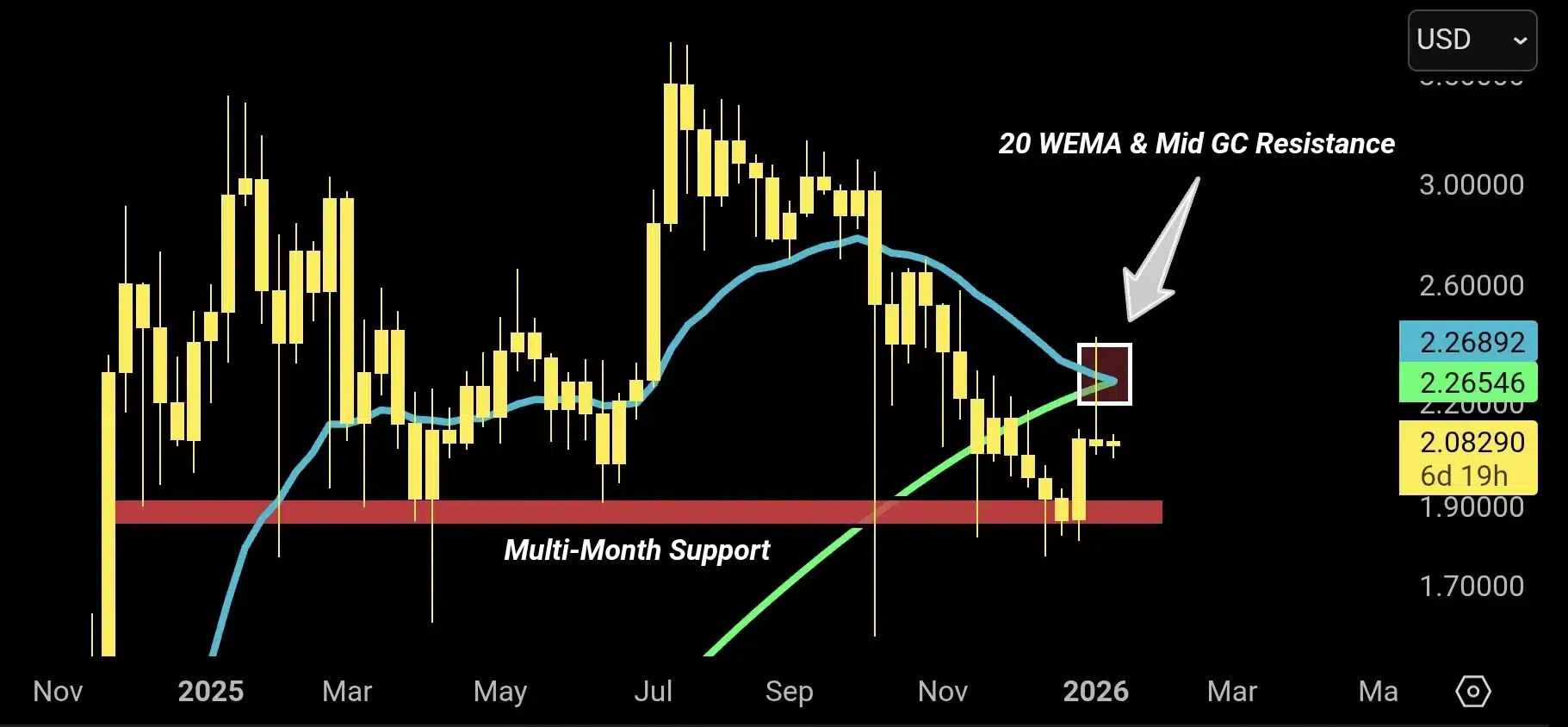

- The critical hurdle is around $2.26, where multiple resistance indicators converge.

Crypto analyst ChartNerd has reignited bullish debate around XRP, pointing to what he describes as a decisive reaction from “vertical accumulation support.” According to the analyst, the recent bounce from this structural base significantly increases the probability that XRP could push into double-digit territory during the next expansion phase.

The rally off support suggests that buyers are defending a key zone where accumulation has previously occurred, reinforcing the idea that longer-term participants are still positioning rather than exiting. ChartNerd notes that this type of vertical accumulation often precedes aggressive continuation moves once resistance levels are cleared.

Bull Flag Structure Signals Potential Breakout Path

His analysis highlights a rectangular bull flag formation following a sharp impulsive move higher, commonly referred to as the “flag pole.” In technical analysis, this structure typically reflects consolidation after strong upside momentum, with price compressing before a potential continuation breakout.

Also Read: XRP Is Repeating This Bullish Pattern – Here’s What Could Happen Next?

⛳️ $XRP: The recent rally on vertical accumulation support has signified a very strong likelihood of pushing into double digits. Hold the line, then vertical accumulation resistance awaits above. It’s go time. https://t.co/1AAmEdxb8h pic.twitter.com/oAjMmagK6B

— 🇬🇧 ChartNerd 📊 (@ChartNerdTA) January 8, 2026

In this case, XRP appears to be consolidating within clearly defined horizontal boundaries, with repeated defenses of the lower range. ChartNerd’s projection places the next major upside target well into double-digit prices if XRP can decisively break above the upper boundary of vertical accumulation resistance. The chart’s measured move implies a powerful expansion phase once liquidity above resistance is unlocked.

Resistance Ahead Could Decide the Next Major Move

Despite the bullish setup, ChartNerd issued a cautionary follow-up, emphasizing that XRP still has “a job on its hands.” His analysis shows that both the Weekly 20 EMA and the middle regression band of the Gaussian Channel are acting as overhead resistance, converging around the $2.26 level.

This confluence creates a technically significant barrier. Failure to reclaim and hold above these indicators could stall momentum and invalidate the immediate breakout thesis. ChartNerd warns that rejection at this zone would likely send XRP back toward multi-month support, where the market would attempt to establish a higher low rather than continue vertically.

Source: ChartNerd/X

Multi-Month Support Remains the Fallback Scenario

If XRP cannot push through the $2.26 resistance cluster, the analyst suggests the market may shift into a corrective or sideways phase. In that scenario, price would likely revisit established multi-month support zones, allowing the structure to reset before another attempt higher.

This fallback is not necessarily bearish in the broader context. A successful higher low would preserve the macro uptrend and keep the longer-term double-digit thesis intact, albeit on a slower timeline.

Market at an Inflection Point

ChartNerd’s analysis frames XRP as sitting at a critical inflection point. Strong defense of vertical accumulation support has tilted probabilities in favor of upside continuation, but confirmation hinges on reclaiming key weekly indicators.

A clean break above resistance could trigger the kind of momentum expansion that sends XRP rapidly into double digits, while failure would shift focus back to structural support and patience.

Also Read: Pundit to XRP Army: This Is One of the Moments That Changes Everything