- ETF clients buy $12.98 million XRP, boosting total net assets.

- XRP’s demand surges, pushing ETF-held net assets to $1.54 billion.

- Institutional interest grows as XRP Spot ETFs show impressive growth.

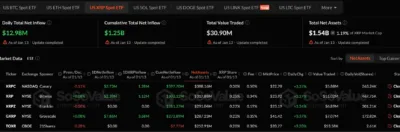

XRP’s ETF market presence continues to gain momentum, with a significant influx of investment in recent days. According to market data, XRP ETF clients have scooped up $12.98 million worth of XRP in just one day, bringing the total ETF-held net assets to an impressive $1.54 billion. This latest surge in demand signals growing institutional interest and a continued rise in XRP’s appeal within the digital asset market.

The recent figures underscore XRP’s rising popularity among ETF investors, with steady daily inflows and the cumulative total net inflow surging to $1.25 billion. These numbers demonstrate the growing appetite for XRP among large investors, signaling confidence in its prospects.

XRP’s Spot ETFs are not just capturing attention but also showing impressive growth. The total value traded as of January 13 reached $30.90 million according to Soso Value data, highlighting the active participation of both institutional and retail investors.

This surge is part of a broader trend, with XRP’s market share in the ETF space continuing to rise. As more investors turn their attention to XRP, the coin’s status as a major asset in the digital currency space strengthens.

Also Read: Egrag Crypto: XRP Structure Is Still Screaming Bullish – What This Means

XRP’s Growing Popularity Across Multiple Platforms

Interestingly, the demand for XRP ETFs is not confined to a single platform. Different issuers have seen notable inflows, showcasing XRP’s growing presence. For example, XRP on NASDAQ, sponsored by Canary, saw a significant $2.73 million net inflow, while XRP on NYSE, backed by Bitwise, recorded $2.39 million in inflows. These figures highlight XRP’s expanding appeal and increasing recognition as a valuable asset across various platforms.

Source: Sosovalue

Moreover, Grayscale’s GXRP ETF reported a $7.86 million net inflow, reinforcing XRP’s status as a preferred choice for both institutional and retail investors. The TOXR ETF, listed on CBOE and managed by 21Shares, reported $252.91 million in total assets, reflecting XRP’s widespread support in the market.

The $12.98 million XRP purchase in just one day underscores the growing demand for the asset. As ETF clients continue to scoop up XRP, the digital asset is on track to play a more significant role in the broader investment landscape.

Also Read: Ripple Chairman Confirms Plan to Replace SWIFT and XRP Role