The broader crypto market is showing renewed strength, with the global capitalization holding steady above $3.35 trillion. As Bitcoin climbs past $97,000, confidence has returned, pushing more capital into high-upside assets and reigniting early-stage speculation.

In these conditions, coins that offer not just hype but structural entry advantages can rise quickly, and that’s exactly why Zero Knowledge Proof (ZKP) is drawing attention as the best crypto for 2026.

Momentum is shifting fast. While Solana continues to hold strong and Hyperliquid has shown recovery signs, it’s ZKP that analysts now describe as the project with the clearest upside potential. The demand curve is steepening, the price action is getting tighter, and the presale dynamics are creating what many believe could be a 5000x setup in progress.

ZKP Auction Demand Builds Daily Pressure

Zero Knowledge Proof (ZKP) is structured around a live auction model that resets daily. Instead of fixed pricing tiers, tokens are distributed based on real-time demand, creating a pricing system that evolves each day. Around 200 million tokens are released every 24 hours, with a $20 minimum entry and a hard cap of $50,000 per wallet per day.

This format is gaining recognition for leveling the field. Smaller buyers can participate consistently, while large wallets are blocked from dominating early distribution.

Analysts are pointing to this structure as one of the key reasons ZKP is emerging as the best crypto for 2026. Price is shaped by live demand, not predetermined schedules.

The pace of participation has now become its own signal. Auction trackers note that token allocations are being claimed rapidly, with new buyers entering earlier each day to secure positions.

This pattern is turning the system into a supply race, where pricing reacts to competitive pressure rather than organic pacing.

Experts are modeling the outcome as a compounding price curve. If demand continues pushing into the same fixed daily supply, then price floors may rise faster than expected, reinforcing early positioning as a critical variable in the long-term return profile.

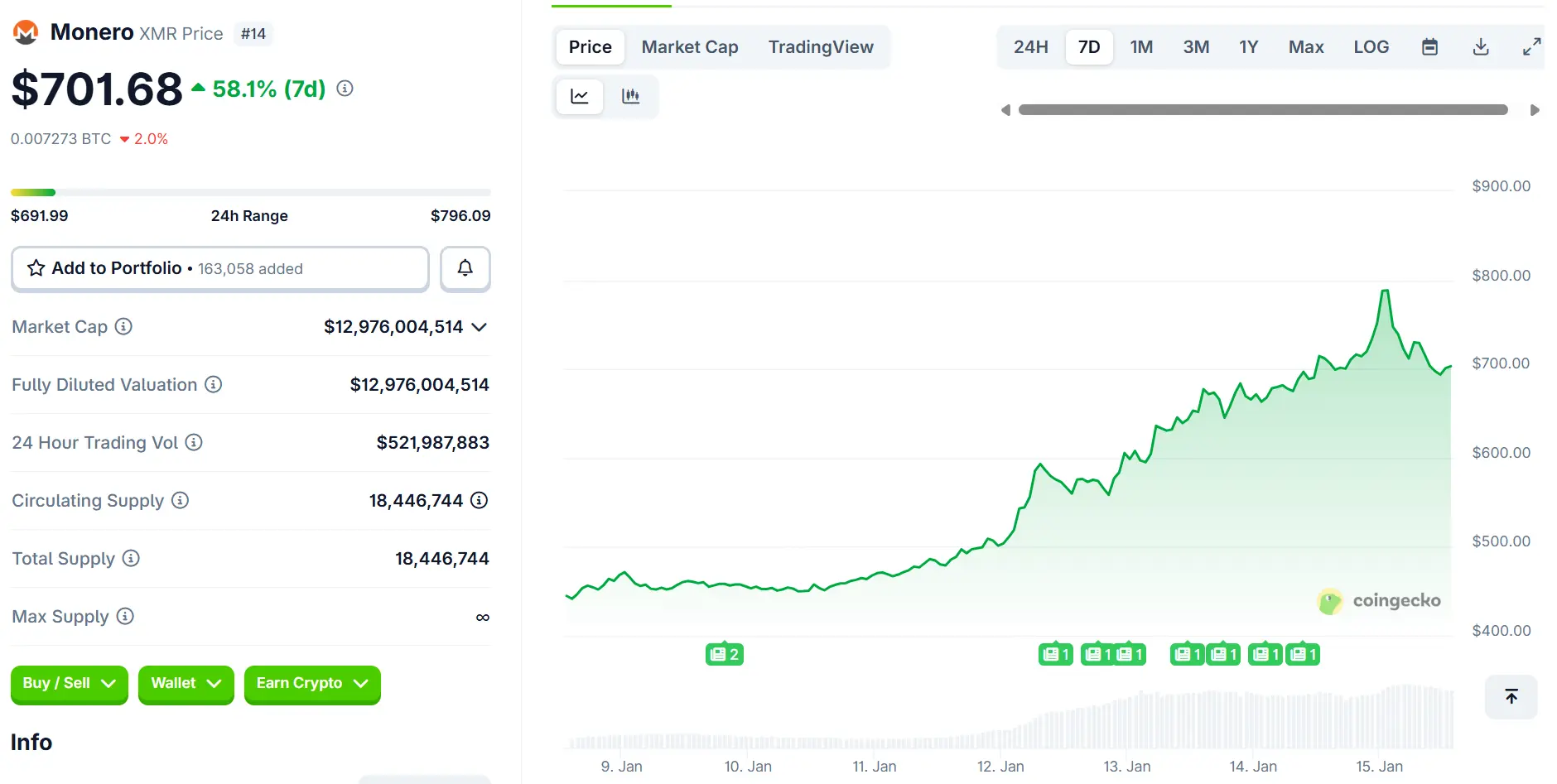

Monero Rally Holds Above $700

The Monero (XMR) price rally remains in focus. As of the latest update, XMR is trading near $705, supported by steady daily volume in the $488 million to $503 million range. That level of activity keeps Monero firmly among the most-watched large-cap privacy coins.

With its market cap approaching $13 billion, Monero sits just outside the top 10 by valuation. Traders continue to monitor its proximity to its all-time high of $797, a zone that historically brings high volatility. Price swings in this range can appear quickly, especially when volume remains elevated, and market sentiment leans bullish.

For short-term traders, XMR remains a favored chart, but for long-term buyers looking beyond immediate gains, the remaining upside may appear more limited now that much of the recent move has played out.

LINK Whale Moves Tighten Supply

Chainlink (LINK) continues to hold near $14, with daily trading volume steady between $573 million and $586 million. The token’s market cap sits just under $10 billion, and recent whale activity has sparked renewed attention.

A large wallet recently withdrew over 342,000 LINK, worth roughly $4.8 million, from Binance over two days. Moves like this often reduce sell pressure on exchanges and suggest accumulation rather than distribution.

Chainlink also gained support from the launch of the Bitwise CLNK ETF, giving institutional investors a regulated entry route. Together, these developments have helped strengthen sentiment, even as the price remains in consolidation.

For long-term holders, this accumulation trend supports a strong base. But in contrast to ZKP’s accelerating auction model, LINK appears to be moving in slower cycles with less aggressive upside signals.

Final Thoughts: Why ZKP Stands Apart in 2026

Monero’s recent price surge and Chainlink’s whale-driven stability both reflect market strength. But analysts continue to highlight Zero Knowledge Proof as structurally different.

ZKP isn’t driven by sentiment alone; it is designed to escalate pricing through a demand-restricted system, where auction mechanics amplify each new wave of participation.

That’s why some market researchers are calling ZKP the best crypto for 2026. It doesn’t rely on timing major exchange listings or reacting to news cycles.

It relies on a predictable daily format where buyers compete for allocation in a limited window. As demand scales and supply stays fixed, the pricing curve becomes tighter, lifting the value of early entries.

This difference may be the reason why more capital is rotating into ZKP while others begin to plateau. The protocol is turning scarcity into strategy, and that may be the most important factor for buyers evaluating long-term potential.

Find Out More about Zero-Knowledge Proof:

Website: https://zkp.com/

Auction: https://auction.zkp.com/

Telegram: https://t.me/ZKPofficial