- XRP is in a prolonged accumulation phase, with over eight years of consolidation that the analyst views as structural base-building.

- Technical patterns point to a breakout setup, with triangle formations and Fibonacci extensions suggesting $6 as a conservative target.

- Boredom and low volatility are seen as bullish signs, indicating quiet accumulation before a major upside expansion.

Crypto analyst X Force Global has reignited bullish sentiment around XRP, arguing that the asset is in a prolonged accumulation phase that could precede a major breakout.

In a recent post on X, the analyst emphasized that investors should focus on assets showing sustained accumulation across both macro and micro timeframes, a condition he believes XRP clearly satisfies.

According to X Force Global, XRP has been locked in a broad range for more than a year and, more broadly, for over eight years. Rather than signaling weakness, he views this extended consolidation as a structural base-building phase that often precedes powerful upside expansions.

“$6 is still the conservative target, and the higher targets sit well above what most are prepared for,” he wrote, underscoring his long-term bullish outlook.

Eight-Year Consolidation Signals Structural Accumulation

X Force Global’s core thesis centers on XRP’s unusually long consolidation period. He notes that the asset has spent more than eight years oscillating within a broad range, with the past year marked by particularly tight price compression.

From a technical perspective, such prolonged ranging behavior often reflects large-scale accumulation, where stronger hands build positions while price remains suppressed. The analyst argues that this kind of structure typically resolves with a sharp, directional move once supply is sufficiently absorbed.

In his view, XRP’s muted price action is not a sign of stagnation, but rather evidence that the market is quietly positioning for a future expansion phase.

Also Read: Alert: XRP’s Current Pattern Is Mirroring This Historical Structure, Details

Chart Analysis Points to a Breakout Structure

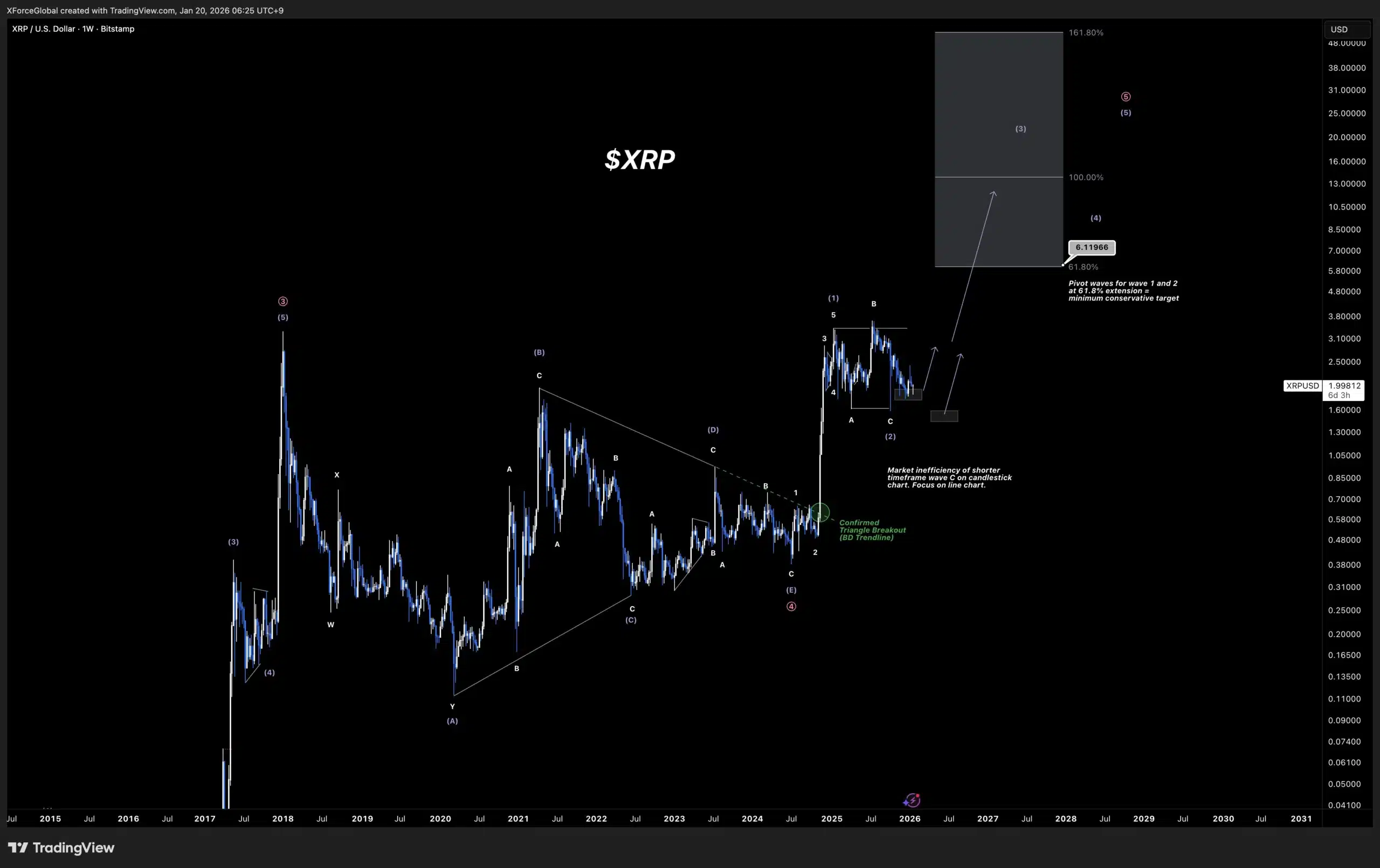

The analysis shared by X Force Global adds technical weight to his bullish thesis. It shows XRP forming a long-term triangular consolidation pattern that spans multiple market cycles. Within this structure, price action appears to be coiling beneath a descending trendline that has capped upside attempts for years.

The chart also highlights a confirmed breakout from a more recent triangle formation, followed by a strong impulsive move and a corrective consolidation. This type of sequence, breakout, impulse, and consolidation, is often interpreted as a continuation structure in classical and Elliott Wave analysis.

Source: X Force Global/X

Notably, a projected Fibonacci extension zone on the chart places a conservative upside target near the $6 region, aligning closely with X Force Global’s stated baseline objective. Higher extension levels on the same projection suggest substantially larger long-term targets if XRP enters a full expansion phase.

The analyst also points to what he describes as “market inefficiency” on shorter timeframes, implying that XRP’s recent consolidations are forming bullish continuation setups rather than topping structures.

“Boredom Is a Feature of Accumulation,” Analyst Says

In a follow-up post, X Force Global addressed the psychological challenge many investors face during extended consolidation phases. “Remember, boredom isn’t a flaw — it’s literally a feature of accumulation,” he wrote. “But it’s also the most rewarding.”

He explained that he has remained disciplined with his XRP strategy, buying during periods of market apathy and offloading into strength when upside momentum warranted it. According to him, this cycle of risk-taking during pessimism and profit-taking during euphoria is a repeatable process he intends to continue.

“I’ve remained true to my $XRP buys and sells — taking risk when it was required, and offloading when it was required. I will rinse and repeat,” he added.

Remember, boredom isn’t a flaw – it’s literally a feature of accumulation.

But, it’s also the most rewarding.

I’ve remained true to my $XRP buys and sells – taking risk when it was required, and offloading when it was required.

I will rinse and repeat.https://t.co/Qy6jqKh0Zw

— XForceGlobal (@XForceGlobal) January 19, 2026

Why $6 Is Only a “Conservative” Target

While a $6 XRP price would already represent a multi-fold increase from current levels, X Force Global argues that this figure may only reflect a minimum projection based on technical extensions and historical market behavior.

The higher long-term targets shown on his chart extend far beyond the $6 zone, suggesting that a full macro breakout could carry XRP into price territory that most investors are not psychologically prepared for.

His broader message is that XRP’s extended compression phase, combined with emerging breakout structures and long-term accumulation signals, sets the stage for a potentially dramatic repricing once momentum returns.

Long-Term Patience Remains the Central Theme

X Force Global’s analysis reinforces a familiar theme among long-term XRP bulls: that patience through extended consolidation is often rewarded when accumulation phases resolve.

With XRP still trading within a multi-year range, the analyst believes the groundwork is being laid for a major upside move. While timing remains uncertain, his technical roadmap places $6 as a conservative milestone, with substantially higher levels possible if the broader crypto market enters a new expansion cycle.

For now, XRP’s quiet price action may continue to test investor conviction, but if X Force Global’s thesis plays out, the next phase could be anything but boring.

Also Read: XRP Will ‘Easily’ Jump to $100 If This Happens: Analyst