- XRP exchange reserves climb as traders reposition for volatile markets.

- Binance and Upbit inflows signal liquidity buildup.

- Rising XRP balances on exchanges point to heightened short-term trading.

Fresh on-chain metrics have revealed an unusual increase in XRP reserves on top crypto exchanges. According to CryptoQuant data, XRP balances on Binance and South Korea’s Upbit expanded noticeably in January. The movement showed holders shifting tokens onto exchanges instead of private wallets, a pattern often tied to stronger trading expectations and rising liquidity demand.

Per the data, XRP reserves on Upbit have surged to 6.30 billion XRP since the beginning of the year. In December last year, the exchange recorded declining reserves, suggesting that tokens were leaving the exchange to cold storage, a trend often linked to accumulation or off-platform transfers. However, inflow has returned as balances climbed steadily, raising sell-off concerns and signaling retail-driven positioning for active trading, shifting intentions from long-term storage.

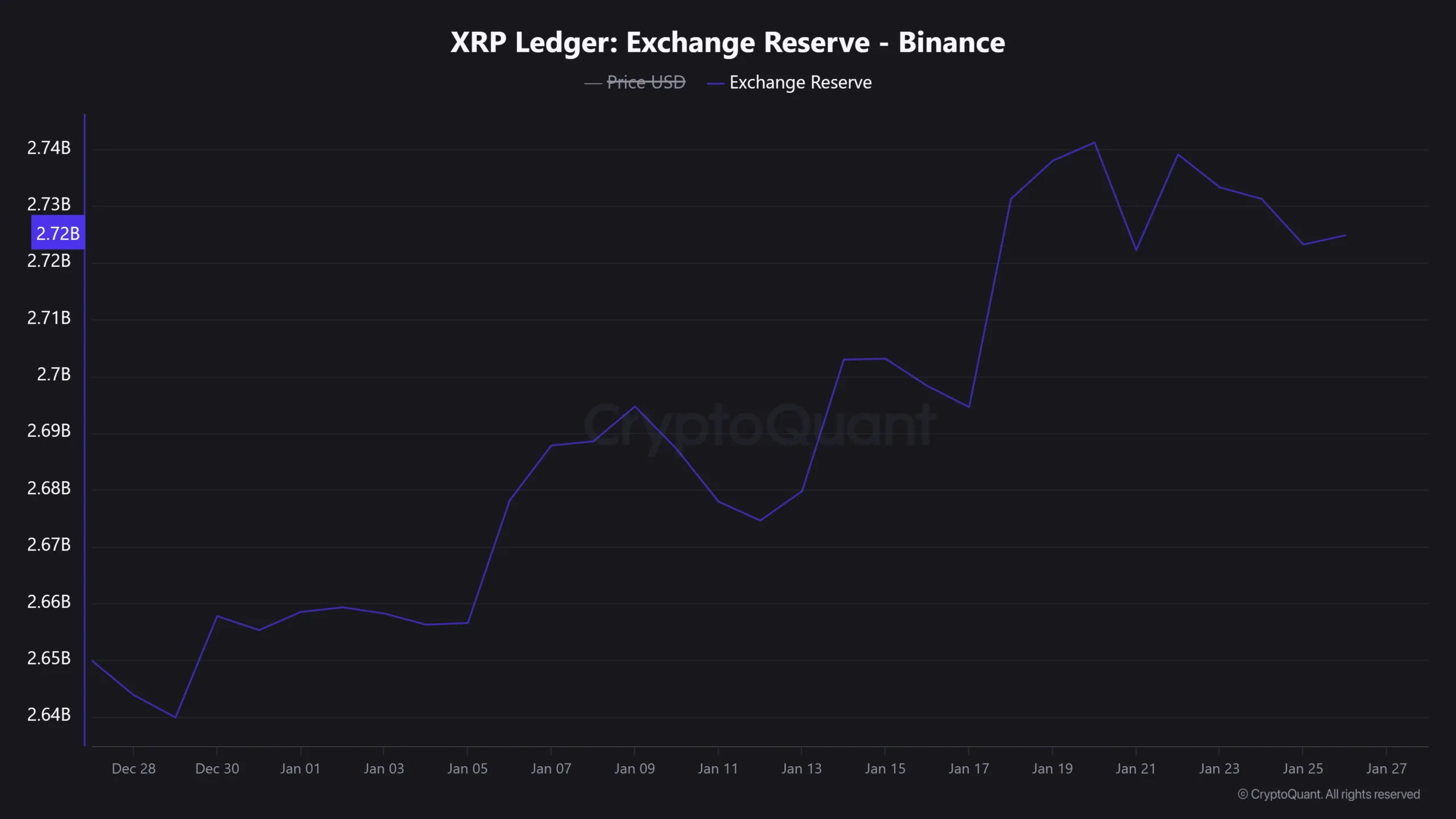

Meanwhile, Binance recorded a parallel increase in XRP reserves, rising to nearly 2.74 billion XRP through a measured structure within the same period. This pattern usually points to large traders positioning liquidity in advance, with reserves staying elevated and signaling a potential sell event.

Also Read: SHIB Burn Rate Explodes 2,807% Yet Price Action Tells a Different Story

Binance and Upbit Reserve Alignment Signals Heightened XRP Trading Activity

Notably, reserve growth appeared across both Binance and Upbit within the same timeframe. Such alignment often reflects broader market positioning rather than isolated exchange behavior. Hence, traders viewed the surge as a volatility signal, with higher exchange balances expanding XRP trading availability.

While rising reserves do not automatically signal immediate selling pressure, they expand the market’s capacity for rapid price movement. XRP price behavior historically becomes more sensitive during similar liquidity expansions. Besides that, past patterns show reserve increases often precede sharp moves in either direction, shifting attention toward short-term dynamics.

Source: CryptoQuant

Source: CryptoQuant

Upbit continues to reflect fast-moving retail sentiment within South Korea’s crypto market. Rising reserves on the platform often coincide with increased transaction volume. In contrast, Binance operates as a global liquidity hub supporting high-volume spot and derivatives trading. Consequently, reserve growth on the platform frequently signals institutional positioning or risk management strategies.

Liquidity conditions across both exchanges now favor active participation over long-term holding. XRP remains readily accessible for traders seeking flexibility in volatile conditions. As exchange reserves stay elevated, short-term market structure and liquidity flows continue shaping XRP’s near-term outlook.

Also Read: Most People Are Not Ready For What Ripple’s GTreasury Represents for XRP: Pundit