Last updated on July 31st, 2023 at 08:13 am

Bitcoin price is yet to break the $32,500 level which may indicate a strong potential market structural shift to the upside, influencing a general bullish move to the $48,000 level.

Technical Analysis

Bitcoin Price on Weekly Chart

On the weekly chart, the price of Bitcoin has been trading below the May 30th high, consolidating between the $28,800 and $31,800 levels. With more of a bearish momentum on the weekly, we might see a further push downwards targeting the $28,000 level.

If the market breaks above $30,450, a possible run on price to test the $32,600 mark may play out. A close above this level may likely indicate a strong shift to the upside targeting the $48,000 mark.

Source: TradingView

Bitcoin Price on Daily Chart

On the daily timeframe, the price has been trading between $29,695 and $28,870 with buyers trying to push the price above. If the market rallies and breaks above $29,695 we might see a further push to break the $30k level. A break and close below the $28,800 will see a continuation in the downside possibly targeting the $26k level.

Source: TradingView

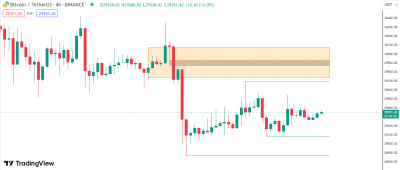

Bitcoin Price on 4Hour Chart

Looking at the 4-hour chart, buyers are trying to push the price above the $30,000 level, which serves as an area of interest for the weekly bearish momentum to make a reversal downside continuing the overall bearish trend of Bitcoin price. If the price fails to break and close above the $30,000 mark, we might see a sharp decline in price continuing the downtrend towards the $26,000 level.

Read Also: Bitcoin Lightning Network Achieves New ATH in USD Transactions

Source: TradingView

1Hour Chart

In the 1-hour timeframe, a break of Bitcoin price above $29,545 may indicate a possible move to $30,000. A break of the price below $29,190 might suggest a bearish continuation which corresponds with the weekly bearish bias and may target $28,870 in the short term.

Source: TradingView

Fundamentals

With the ISM Manufacturing PMI, Non-Farm Payroll (NFP), and Unemployment Rate data coming up next week, the Bitcoin price may see a strong push to the upside if the actual data is below the forecast data.

Disclaimer: The opinions expressed by the writer do not represent the views of 36Crypto. The financial and market information provided on 36crypto is intended for informational purposes only. 36crypto is not liable for any financial losses incurred while trading cryptocurrencies. Investors should conduct thorough research and consider their risk tolerance before making any investment decisions. Also, remember that the cryptocurrency market is highly volatile, and prices can fluctuate significantly.