- XRP breaks long-held supports as selling pressure accelerates across key charts

- Bearish structure deepens after XRP revisits price levels last seen 2024

- Technical indicators signal continued downside as buyers remain largely absent

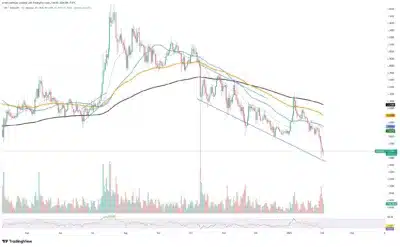

XRP has broken below several key support levels and fallen into price territory last seen in early 2024, reflecting sustained selling pressure with little evidence of buyer defense. Market structure now points to continuation of the broader bearish trend rather than a short-lived pullback, as XRP’s price action has remained consistently weak for several months. Each rebound attempt since the midcycle peak has resulted in a lower high, while successive sell-offs have pushed the asset to deeper lows. This combination reinforces the presence of a well-defined downtrend across higher time frames.

Repeated failures at resistance levels often confirm seller control, pushing market sentiment further toward caution as downside pressure persists. Furthermore, the latest decline forced XRP below multiple daily support zones that previously absorbed selling pressure and acted as stabilization points during earlier corrections. However, the recent breakdown removed that structural support entirely, leaving XRP trading at levels many participants associate with early 2024.

Also Read: ‘Don’t Get Deceived,’ Here’s When The Next Major XRP Pump Will Come: Analyst

Technical signals confirm growing downside pressure

Significantly, XRP slipped beneath the lower boundary of a descending channel that had guided price action for weeks, signaling accelerating bearish momentum. The breakdown occurred alongside rising sell volume, which typically strengthens confirmation of a prevailing trend. Additionally, moving averages continue to trend lower across medium-term and long-term horizons, with XRP trading well below these indicators. Recent recovery attempts failed near these averages, which limited any sustained upside movement.

Volume behavior further reinforces the bearish outlook, as sell-offs consistently attract higher activity while rebound attempts show muted participation. This imbalance suggests traders continue to use short-term rallies as exit opportunities rather than accumulation points. Consequently, signs of accumulation remain absent at current levels, even as momentum indicators drift closer to oversold territory. However, oversold conditions within strong downtrends often favor continuation rather than reversal, keeping downside risk elevated.

Psychological factors also add pressure to market sentiment, since the loss of 2024 price levels weakens confidence among holders who viewed those zones as long-term support. Traders may hesitate to enter new positions until price stability returns. Overall, XRP’s recent breakdown reflects structural weakness rather than isolated selling events. The loss of key supports marks a decisive shift in market behavior, leaving sellers firmly in control as the downtrend continues to intensify.

Also Read: Bitcoin Outlook Draws Attention as Analyst Flags $82K CME Gap and Key $98K Confirmation Level

Related