- Logan Paul’s $16.49M Pokémon card sale shatters previous records.

- A.J. Scaramucci buys rare card amid Liquid Marketplace controversy.

- Digital collectibles surge as tokenized items gain massive market traction.

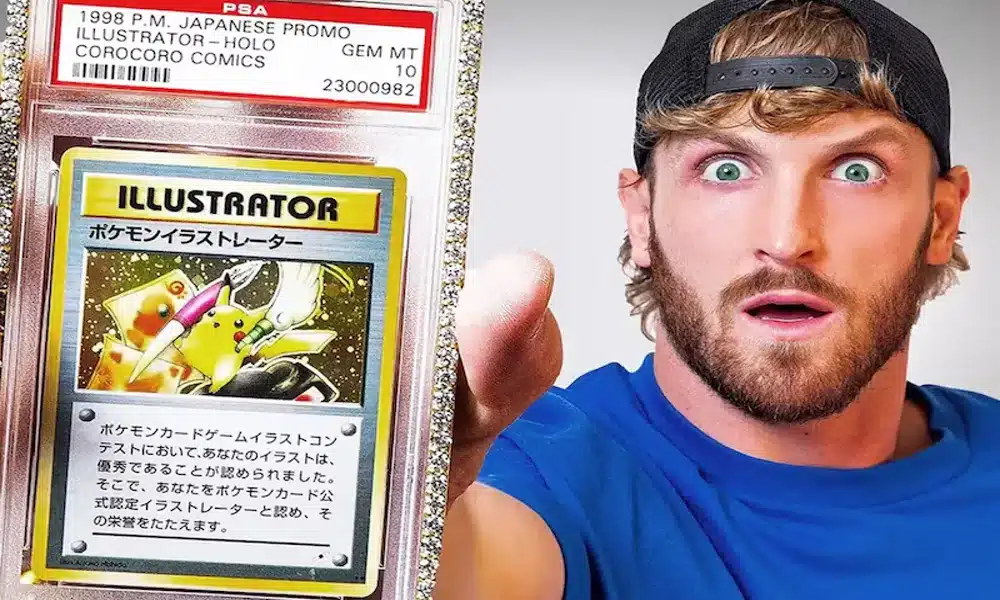

Logan Paul has made headlines once again, but this time it’s not for his YouTube antics or WWE appearances. The popular figure sold his rare and infamous Pokémon Illustrator card to A.J. Scaramucci, son of SkyBridge Capital founder Anthony Scaramucci, for a staggering $16.49 million. This record-breaking sale has shattered previous high marks in the world of trading cards, surpassing the previous record of $13 million set by a Michael Jordan-Kobe Bryant Dual Logoman card.

The Pokémon Illustrator card, released in 1998, is one of the most coveted and rare trading cards in existence, with only 39 copies in circulation. However, this particular card is the only one graded PSA 10, meaning it is considered a virtually perfect specimen. It boasts sharp corners, glossy finishes, and no visible flaws, making it even more valuable to collectors.

Also Read: Strategy Acquires $168M in Bitcoin, Now Holds $48.8B—Here’s What’s Next!

A Controversial Sale Amid Legal Scrutiny

Logan Paul originally purchased the card for $5.3 million in July 2021. Shortly after, he launched Liquid Marketplace, a platform designed to tokenize collectibles for online trading. In 2022, the card was listed for sale on this marketplace, but the sale wasn’t without controversy. Paul’s Liquid Marketplace, which had attracted attention for its unique fractional ownership model, came under fire after facing legal challenges. The Ontario Securities Commission charged the platform with securities violations, causing a stir in both the crypto and collectibles communities.

Despite the backlash, Paul addressed the controversy surrounding the card’s sale. He explained that although he had initially intended to sell up to 51% of the card on Liquid Marketplace, only a small fraction—5.4%—was sold. In May 2024, Paul repurchased the card for the same price it was sold for, allowing users to withdraw their funds and assuring them that the site was back up and running.

Impact on the Growing Digital Collectibles Market

The sale of the Pokémon Illustrator card has raised eyebrows not only in the collectibles world but also in the growing intersection of physical assets and digital collectibles. As the market for tokenized items continues to expand, platforms like Liquid Marketplace are likely to see more attention, though they may continue to face scrutiny from regulators.

The timing of this sale is also notable, as the collectibles market has been experiencing a surge. Digital platforms like Collector Crypt, which tokenizes graded Pokémon cards as NFTs, have reported significant growth. In early January 2024, Collector Crypt generated $37 million in volume, a record high for the platform, showing that the appetite for rare collectibles, both physical and digital, remains strong.

Also Read: Ethereum’s Price Potential for Rebound as Multiple CME Gaps Await Filling