- Franklin Templeton’s XRP ETF accumulates 118.3 million XRP in 3 months.

- XRP’s growing institutional demand signals tighter supply and potential price surge.

- Franklin Templeton’s ETF offers traditional investors a new way to access XRP.

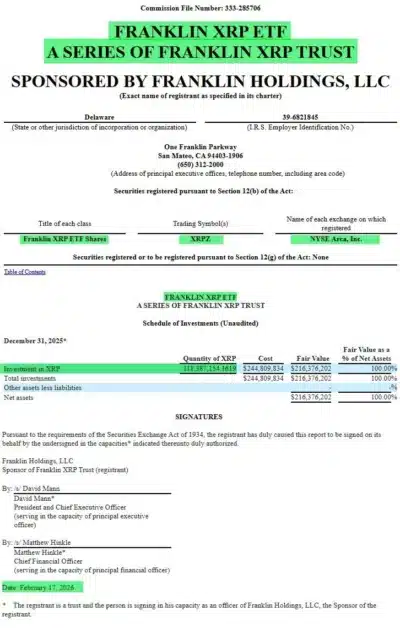

Franklin Templeton’s first quarterly report on its XRP ETF has turned heads in the financial world, revealing that the fund has accumulated an impressive 118.3 million XRP in just three months. This rapid growth in such a short period signals the increasing popularity of XRP within the regulated financial ecosystem. The ETF, which launched on November 24, 2025, already holds $216 million worth of XRP, showing its immediate success in attracting significant investment.

The Franklin XRP ETF, listed on NYSE Arca under the ticker symbol XRPZ, is designed to provide institutional and retail investors with exposure to XRP without the complexities of purchasing and holding the cryptocurrency directly. This move offers a new path for investors seeking entry into the digital asset market through the structure and reliability of traditional exchange-traded funds.

Rapid ETF Growth: What It Means for the Market

The rapid accumulation of 118.3 million XRP has raised eyebrows, particularly given the ETF’s short history. According to the report, the ETF had accumulated the entire amount of XRP by the end of 2025, totaling a value of $216,376,202. The success of the XRP ETF highlights growing demand for XRP as a tradable asset in mainstream finance.

Also Read: Ethereum Surges While Bitcoin Dips: Top Crypto Trends You Can’t Miss Today!

Source: X

While this surge in investments may seem like a singular event, it reflects broader market trends. The ETF model allows traditional investors to gain exposure to digital assets like XRP, bypassing the need to deal directly with the volatility and security challenges of cryptocurrency exchanges. Franklin Templeton’s ability to absorb large quantities of XRP shows a solid institutional interest in the asset, and this may pave the way for other funds to follow suit.

Institutional Interest in XRP Grows

XRP’s growing role in institutional portfolios could continue to increase, especially as ETFs like Franklin Templeton’s offer exposure to the asset without the complexities associated with direct ownership. Consequently, XRP could see a tightening supply, which might drive its value higher as more institutional capital flows into the cryptocurrency space.

In conclusion, Franklin Templeton’s XRP ETF report has captured significant attention, illustrating the growing appetite for digital asset exposure within mainstream financial markets. With 118.3 million XRP accumulated in just three months, the report signals a potential shift in how cryptocurrencies are integrated into traditional investment portfolios.

Also Read: Stripe’s Bridge Gets Approval to Become a National Bank – What This Means for Crypto!