- The book “Going Infinite: The Rise and Fall of a New Tycoon” by Michael Lewis, was released on the same day as the first hearings on Sam Bankman-Fried’s legal battle. The court case began on October 3, 2023.

- The trial is expected to last for nearly six weeks: first, the court will select the jurors, followed by the prosecution presenting their arguments for four weeks, and then the defense, which will require an additional one to two weeks.

- Bankman-Fried has not admitted guilt and has claimed that the blame lies with Caroline Ellison, who is expected to become the main prosecution witness. It can be assumed that the entrepreneur may use the book to “tell his side of the story to the public.”

What Happened to FTX?

The years 2021–2022 were the most successful for FTX, making it one of the largest players in the cryptocurrency market. In 2021, the exchange’s revenue will exceed $1 billion. Sam Bankman-Fried, the founder of FTX, had a widely recognized reputation as a “crypto wunderkind,” and in 2022, his net worth was estimated at $24 billion.

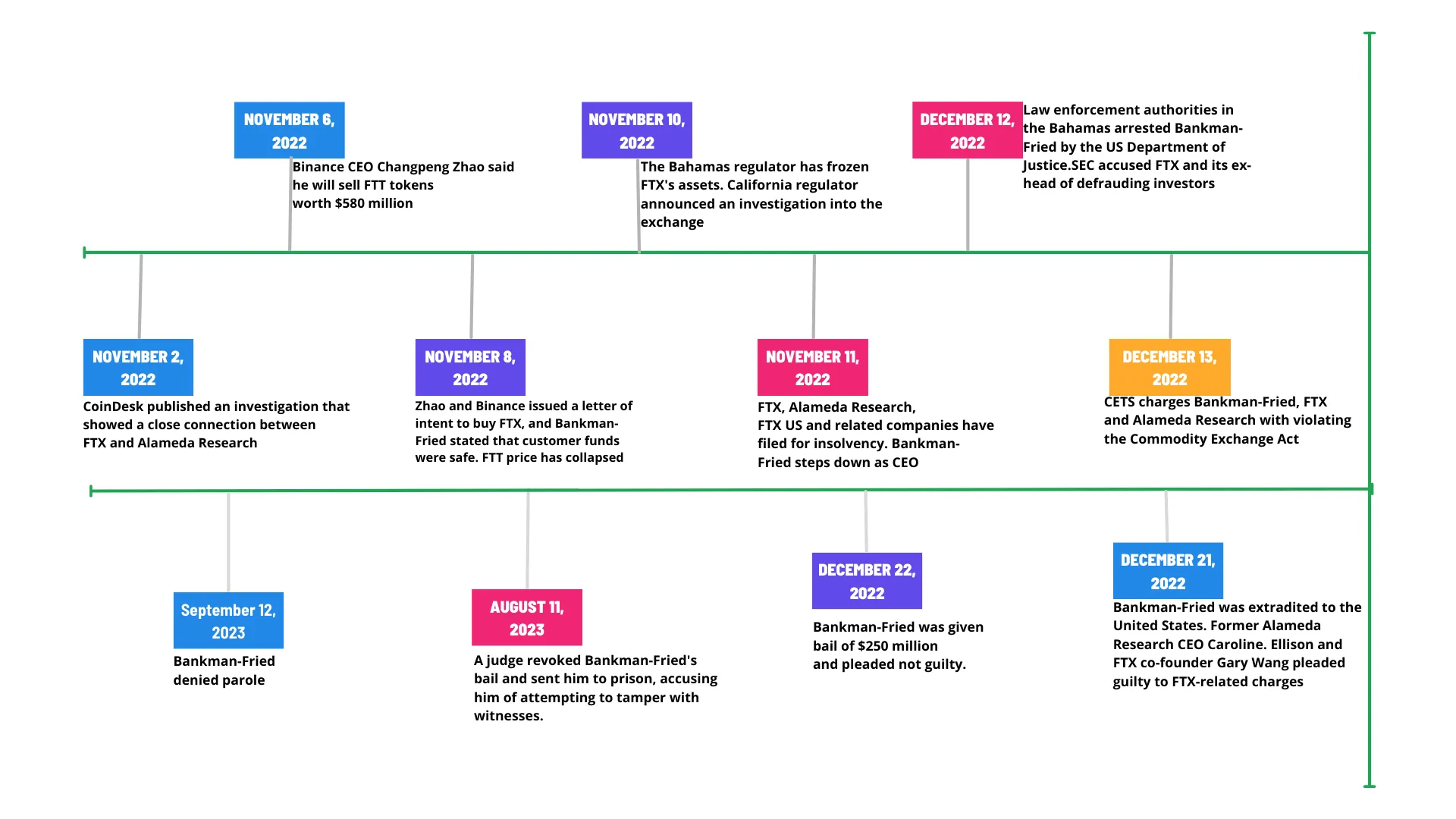

In November 2022, CoinDesk published a report that revealed the relationship between FTX and the trading company Alameda Research, another enterprise of Bankman-Fried. Journalists reported on Alameda’s funding using FTX customer funds and illiquid reserves.

Binance CEO Changpeng Zhao also announced the sale of FTT tokens, stating that the investigation had triggered a mass withdrawal of funds from FTX accounts. Ultimately, this led to the bankruptcy of the industry giant, just a few months after it had seemingly rescued other crypto companies from collapse. However, subsequent reports revealed serious internal problems within FTX.

In November 2023, FTX entered into a restructuring process, which is ongoing. Initially, it was reported that $9 billion in funds were lost, but under the management of John Jay Ray III, FTX managed to consolidate assets and resume processing compensation claims from affected customers. The platform is even considering the possibility of a relaunch in the future.

Chronology of FTX’s Collapse and the Bankman-Fried Case

Who’s Who in the Trial?

Sam Bankman-Fried

Sam Bankman-Fried, Founder of Alameda Research and the associated cryptocurrency exchange FTX. The Southern District of New York’s prosecutor’s office has charged him with fraud and money laundering conspiracy, with a potential combined sentence of 115 years.

However, Bankman-Fried has not admitted guilt, citing a lack of evidence of his influence on Alameda Research’s actions, particularly those of the company’s CEO, Caroline Ellison.

Sam Bankman-Fried

In December 2022, he was placed in detention with a $250 million bail, which was posted by sureties. In August 2023, bail was revoked due to the former FTX CEO’s attempts to pressure witnesses. At present, the founder and former CEO awaits trial while in custody in Brooklyn.

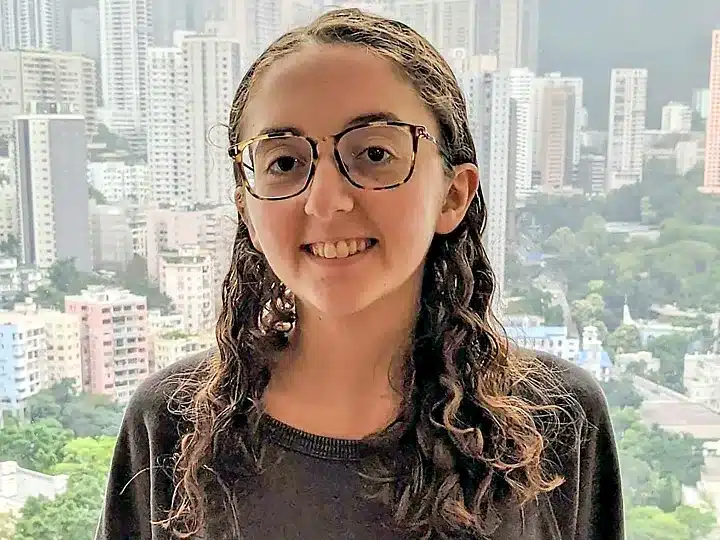

Caroline Ellison

Caroline worked as a trader at Alameda Research since 2018. In 2021, Bankman-Fried appointed her and Sam Trabucco as co-CEOs of the company, with a focus on FTX. In the public space, Alameda and FTX were positioned as independent entities.

Alongside Bankman-Fried, Ellison is considered a key figure in the case because she was aware that Alameda Research received loans using funds from the exchange’s users. She has been charged with seven counts, including fraud, money laundering conspiracy, and bribery of a Chinese official.

Caroline Ellison

Like some other top executives of Alameda Research and FTX, Ellison has admitted her guilt and agreed to cooperate with the investigation. She has stated that the use of customer funds and other illegal activities were carried out at the direction of Bankman-Fried, and she has provided details of special arrangements for Alameda Research outlined in FTX’s code.

It is expected that Caroline Ellison will become the main prosecution witness, providing evidence for the case, including personal notes, correspondence, and details of relationships (including personal ones) within the team.

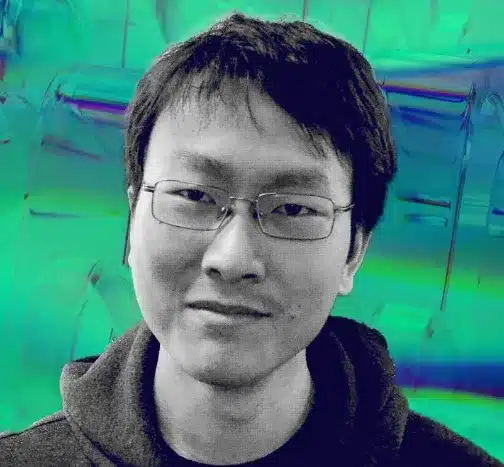

Gary Van and Nishad Singh

Among other figures in the case are the co-founder of the cryptocurrency exchange, Gary Van, and its former technical director, Nishad Singh. They, too, have admitted guilt and agreed to cooperate with the investigation. It is not excluded that in the future, Bankman-Fried’s parents, who were involved in running Alameda and FTX, may also be brought into the case.

Nishad Singh

In addition to criminal charges from the US Department of Justice, the leadership of Alameda and FTX also faces civil lawsuits from the cryptocurrency exchange itself, deceived users, and investors.

The US Securities and Exchange Commission (SEC) and the US Commodity Futures Trading Commission (CTFC) have also filed statements against Bankman-Fried and his associates. However, their consideration has been postponed pending the court’s decision on the prosecutor’s charges.

Gary Van

Statement by the US Department of Justice and the Start of Hearings

On September 30, the US Department of Justice published a preliminary statement on the case against Sam Bankman-Fried.

According to the document, the charges anticipate:

- Testimonies from platform users and institutional investors regarding their understanding of FTX’s role and obligations in safeguarding their funds.

- Evaluation of Bankman-Fried’s public statements on Twitter regarding the platform’s solvency and the safety of user assets.

- Testimonies from witnesses who have admitted guilt and agreed to cooperate with the investigation.

Mark Cohen from Cohen & Gresser represents Bankman-Fried’s interests. The defense had previously claimed that the prosecution of the Southern District of New York lacked sufficient evidence. A more detailed position will be presented during the trial. The Financial Times suggests that it may involve shifting blame onto other managers of related companies and discrediting witnesses.

The first hearing in the case of Sam Bankman-Fried is scheduled for Tuesday, October 3, 2023. It will begin with jury selection and is expected to last approximately six weeks.

Sam Bankman-Fried Legal Case

What charges have been filed against SBF?

31-year-old Bankman-Fried will stand trial on seven counts of electronic fraud, securities fraud, and money laundering, or conspiracy to commit these crimes. Prosecutors will also present evidence that Bankman-Fried violated campaign finance laws by using stolen funds to make political donations totaling $100 million.

What will happen if Sam Bankman-Fried pleads guilty?

If he pleads guilty to all charges, he could face more than 100 years of imprisonment in a federal prison, where inmates do not receive significant sentence reductions for “good behavior.”

Sam Bankman-Fried also faces a second trial in March 2024 on five additional charges that have been filed against him, one of which alleges that Bankman-Fried violated the U.S. Foreign Corrupt Practices Act by paying a $40 million bribe to one or more Chinese officials to unfreeze Alameda Research’s accounts.

3 Important Steps for Safeguarding Bitcoins After the FTX Crash

In all the cryptocurrency crashes that occurred in 2022, including 3AC, Terraform Labs, Celsius, Voyager, and FTX, eroding investor trust was a widespread and evident theme. Cryptocurrency exchanges are widely used for buying, selling, and trading cryptocurrencies in exchange for a small fee. To protect yourself from potential risks, here are some advice on where to best store your crypto assets.

- Don’t keep all your assets in one place; strive to store the majority of your assets in different locations.

- Storing on hardware wallets can be a great alternative for assets with which you interact less frequently. Ledger and Trezor are industry leaders in cold storage. The downside of hardware wallets is that they can be expensive compared to software cryptocurrency wallets.

- Some cryptocurrency exchanges prioritize the security of their client’s assets by storing a significant portion of their holdings in cold wallets.

Here are some examples:

- Bitfinex, following a reliable security protocol, stores over 95% of its users’ funds in cold wallets.

- Binance, utilizing a multi-tier security system, holds more than 90% of its customers’ crypto assets in cold storage.

- WhiteBIT, known for its transparent policies and security measures, also utilizes cold wallets to store a significant portion of its digital assets (96%).

Conclusion

Sam Bankman-Fried’s legal battle has captured the attention of both the financial world and the public at large. The trial promises to be a protracted affair, spanning several weeks, and will undoubtedly shed light on the inner workings of the cryptocurrency industry, raising important questions about the safeguarding of assets in this rapidly evolving digital landscape.

As we await the trial’s outcome, it is evident that the lessons learned from the FTX case will continue to shape the practices of cryptocurrency exchanges and investors alike, emphasizing the crucial importance of security and transparency in the world of digital assets.