- XRP is compressing inside a year-long wedge, a rare setup analysts say often precedes explosive breakouts.

- Breakout targets imply a parabolic phase, with projections pointing to a sharp multi-month rally once wedge resistance is cleared.

- Macro models show XRP nearing a historical expansion zone, suggesting the current consolidation is structural preparation, not weakness.

XRP is once again at the center of bold long-term forecasts, as two widely followed crypto analysts point to a rare technical setup that could precede a major breakout. CryptoWzrd and Egrag Crypto both argue that XRP’s current structure is not random consolidation but a macro pattern that historically resolves in explosive moves.

Their analyses suggest that patience, timing, and understanding large-scale structure may be far more important than short-term price noise.

XRP Is Coiled Inside a Year-Long Wedge

CryptoWzrd says XRP has spent nearly a full year trading inside a tightening wedge formation, a classic technical structure that often precedes powerful trend expansions. According to the analyst, this wedge has been compressing price action while volatility steadily declines, signaling that the market is storing energy rather than losing interest.

The structure is defined by a descending resistance line and a rising support line, forcing XRP into a narrowing range. In his view, the eventual breakout from this wedge will not occur in isolation. CryptoWzrd believes it will coincide with a rollover in Bitcoin dominance, a market shift that historically sends capital flowing from Bitcoin into large-cap altcoins like XRP.

“A breakout would send XRP parabolic,” he said, emphasizing that patience has been the defining lesson of this market cycle for XRP holders.

Also Read: Cardano’s CEO Slams Ripple’s CEO Over Crypto Bill Support – Major Fallout!

Source: CryptoWzrd/X

Wedge Target Points to a Sharp Vertical Expansion

His analysis shows XRP forming a long consolidation channel after an earlier impulsive move higher. The wedge’s apex is approaching, meaning the price is running out of room to continue sideways. Projected breakout targets on the chart suggest that once XRP clears the wedge resistance, price could accelerate rapidly toward a much higher zone, creating what the analyst describes as a parabolic phase.

The structure also includes an earlier “pole” move, which technicians often use to estimate upside targets after a breakout. Using that method, the projected move implies a multi-month rally rather than a short-lived spike.

The “Bent Fork” and Macro Compass Model

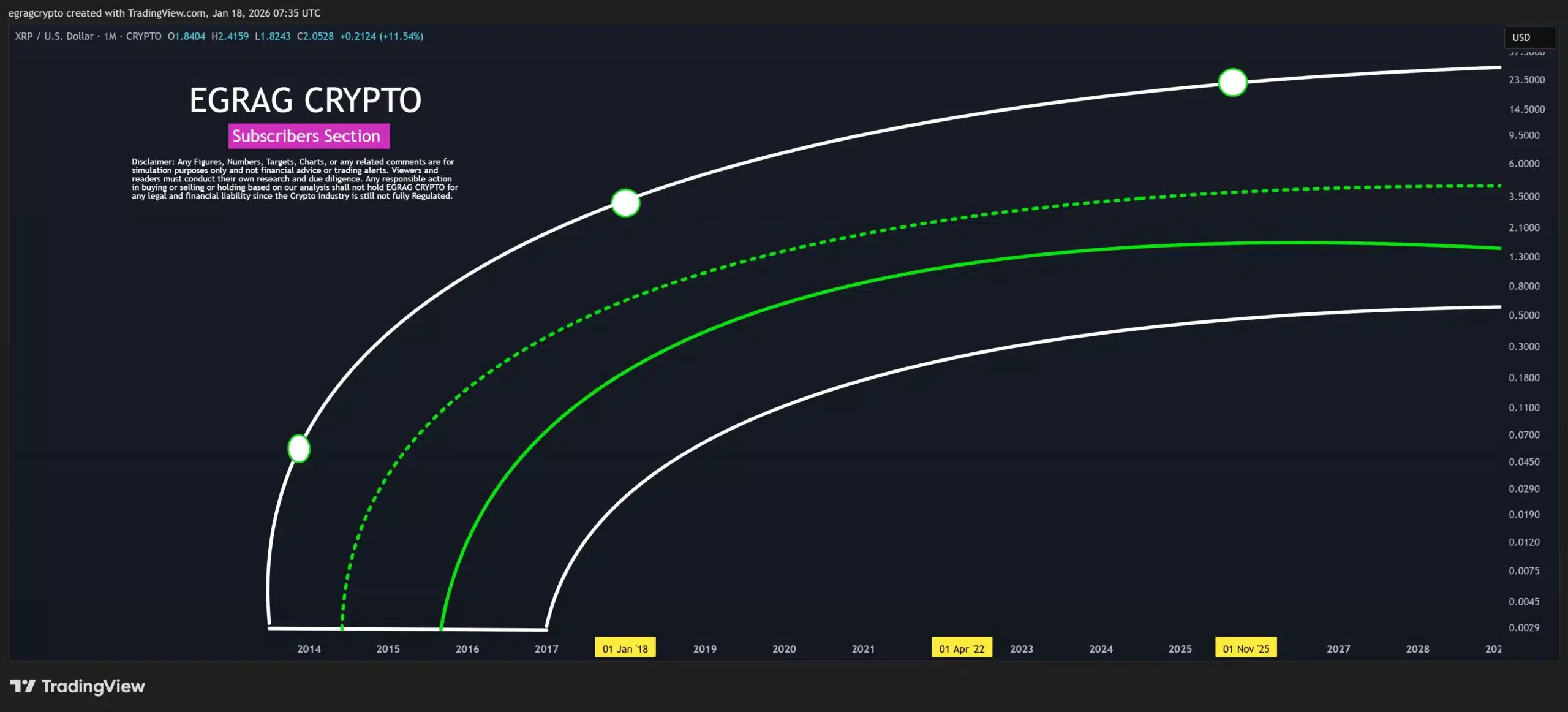

Egrag Crypto reinforced the bullish narrative with what he calls the “Bent Fork” and “Macro Compass” model, a large-scale geometric structure that only becomes visible on long-term charts. According to Egrag, XRP follows a repeating macro pattern that aligns price with curved growth trajectories rather than straight trendlines.

Each time XRP has followed this structure in past cycles, the market reacted in a highly predictable way: prolonged accumulation followed by an exponential rally phase. “This isn’t about hype. It’s about geometry, structure, and timing,” Egrag said, stressing that the model focuses on where XRP sits in the broader cycle rather than short-term indicators.

Source: Egrag Crypto/X

Long-Term Curves Point to a Cycle Expansion Phase

Egrag’s macro chart displays XRP tracking within rising curved bands that resemble long-term growth arcs. Green and white guide curves show XRP consistently oscillating between lower and upper macro channels.

According to the model, XRP is now approaching a zone where past cycles transitioned from consolidation into full trend expansion. The upper macro arc suggests long-term price objectives that stretch far beyond current levels if history repeats. Highlighted time markers on the chart indicate that XRP is entering a window where previous cycles began accelerating sharply upward.

Analysts: This Is About Structure, Not Short-Term Noise

Both analysts agree on one core point: XRP’s current behavior is not a weakness, but preparation. CryptoWzrd sees a coiled spring forming inside a wedge that will resolve violently once broken. Egrag Crypto views XRP as following a hidden macro roadmap that only reveals itself on multi-year charts.

Together, their analyses suggest XRP may be far closer to a major inflection point than most traders realize. While both analysts remain firmly bullish, they acknowledge that XRP must still confirm the breakout.

A failure to break wedge resistance or a renewed surge in Bitcoin dominance could delay or invalidate the parabolic scenario. In that case, XRP may remain range-bound longer than many expect. Still, from a structural and macro perspective, both CryptoWzrd and Egrag argue that XRP is entering a historically significant zone where patience could be rewarded.

Also Read: Bitcoin, Ethereum, and XRP Slip as Crypto Market Turns Red in 24 Hours