Alchemy Pay (ACH) has been gaining traction due to its role in bridging fiat and cryptocurrency transactions. As the token continues to develop within the digital economy, investors are looking to understand its price trajectory for the coming years.

With a bullish outlook, projections suggest that ACH could reach as high as $2 by 2025, depending on market trends and adoption.

Also Read: Spell Token (SPELL) Price Prediction (2025-2029): Can SPELL Hit $0.03?

What is Alchemy Pay (ACH)?

Alchemy Pay was founded in 2018 to integrate fiat and cryptocurrency payments, making it easier for businesses and individuals to transition between the two financial systems.

The project operates in over 70 countries, supports over 300 payment channels, and connects with over 2 million merchants through major partnerships, including Binance, Shopify, NIUM, and QFPay. ACH, the platform’s native ERC-20 token, is used for transaction settlements, staking, and incentives within its ecosystem.

Technical Analysis and Market Trends

Bollinger Bands and Market Volatility

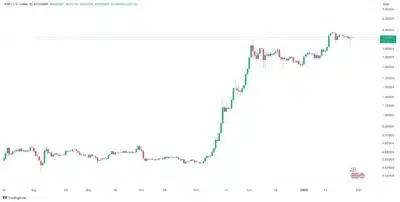

The price chart shows the Bollinger Bands, which help measure market volatility. The ACH/USDT price has recently surged, touching the upper band and indicating increased buying pressure. The widening bands suggest heightened volatility, meaning potential price fluctuations in the short term.

If the Price remains above the mid-band, bullish sentiment could persist. However, if the price retraces toward the lower band, it could signal a cooling-off period or consolidation.

The Bollinger Bands indicator suggests that ACH is experiencing increased volatility and trading near key resistance levels.

If the token successfully breaks past $0.04, bullish momentum could drive it closer to the projected $2.5 target. However, if bearish sentiment takes over, a retest of support levels around $0.02 may occur before an upward trend resumes.

Relative Strength Index (RSI) Analysis

The RSI chart below the price graph indicates market momentum. Currently, the RSI is around 68.31, nearing the overbought zone. This suggests that while buyers are in control, a pullback could occur if overbuying leads to profit-taking.

If RSI moves above 70, it may indicate an overbought condition, signaling a potential correction. Conversely, if it remains stable around 60, it could support continued bullish momentum.

Source: Tradingview

Alchemy Pay (ACH) Price Prediction (2025-2029)

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2025 | 0.02 | 0.05 | 2.00 |

| 2026 | 0.035 | 0.085 | 0.85 |

| 2027 | 0.65 | 1.85 | 3.75 |

| 2028 | 2.15 | 4.50 | 8.50 |

| 2029 | 10.00 | 15.00 | 22.50 |

Yearly Price Insights

2025

Alchemy Pay is poised for a strong performance in 2025, particularly if bullish momentum continues. The platform’s role in facilitating crypto payments could help drive further adoption, potentially pushing the Price toward $2.00. However, a key resistance level of $0.04 must be surpassed before realizing significant gains.

2026

Following a bullish phase in 2025, a market correction could result in a period of consolidation. ACH may trade between $0.035 and $0.85, with long-term holders accumulating in preparation for future growth.

2027

By 2027, the broader crypto market is expected to recover, potentially fueled by institutional adoption and increased DeFi participation. If Alchemy Pay continues expanding its services, its token price could range between $0.65 and $3.75.

2028

Bitcoin’s 2028 halving event may trigger a widespread market rally, benefiting projects like Alchemy Pay. Enhanced staking participation and new partnerships could drive ACH toward $8.50 by the end of the year.

2029

The post-halving cycle in 2029 could set new all-time highs for ACH, with projections estimating between $10.00 and $22.50. Institutional adoption of crypto payments may further support the token’s price appreciation.

Conclusion

Alchemy Pay (ACH) has strong potential for long-term growth due to its innovative payment solutions, increasing adoption, and key partnerships. While short-term fluctuations are expected, ACH may reach $2 in 2025 before consolidating in 2026.

As crypto adoption expands, ACH could climb toward $8.50 by 2028, possibly surpassing $22.50 by 2029.

FAQs

Will ACH reach $1 by 2027?

Based on current projections, ACH could potentially exceed $1 by 2027, mainly if adoption in crypto payments accelerates.

Is ACH a good long-term investment?

With its role in crypto payment solutions and increasing merchant adoption, ACH appears to have strong long-term potential.

What factors will influence ACH’s Price?

ACH’s price trajectory will depend on adoption rates, institutional participation, and overall market conditions.

Could ACH surpass $10 by 2029?

If the crypto market maintains bullish momentum and institutional interest rises, ACH could reach $10 or higher by 2029.

Also Read: Another XRP Crash Coming? See This Analysis