- A massive leveraged XRP trade shifts attention toward derivatives-driven markets.

- Whale timing and position size spark renewed scrutiny across XRP.

- Hyperliquid transparency exposes large positions, influencing short-term sentiment and volatility.

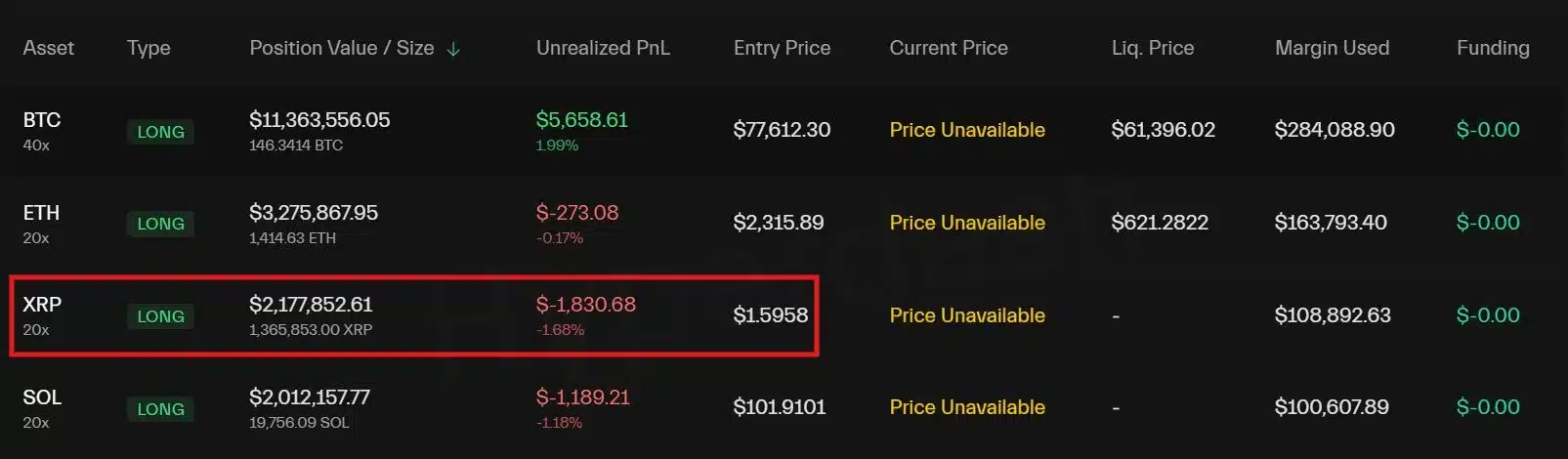

Crypto market analyst Xaif Crypto highlighted interesting derivatives activity after identifying a large XRP position on Hyperliquid. In his post on X, Xaif Crypto disclosed that a single trader opened a leveraged XRP long exceeding $2,177,000. The size and timing of the trade quickly shifted attention toward XRP trading behavior.

Details from the platform showed that the position used 20x leverage and provided exposure to more than 1.3 million XRP tokens. Entry data placed the trade near the $1.59 price level. At the time of observation, the position showed a small unrealized loss while remaining active.

Margin commitment for the trade stood close to $109,000, reflecting standard leverage mechanics while still controlling significant notional exposure. As a result, the position drew closer scrutiny from traders tracking derivatives data.

Beyond XRP, the same wallet maintained leveraged long positions in Bitcoin, Ethereum, and Solana. Exposure across several large-cap digital assets suggested coordinated derivatives activity rather than isolated execution. Moreover, the distribution indicated a broader market stance instead of a single-asset focus.

Also Read: Vitalik Buterin Unveils Bold Creator Token Plan to Fight AI Content Flood

🚨 HYPERLIQUID WHALE ALERT 🐳

A mega whale just opened a HUGE $XRP LONG on Hyperliquid 💥

Smart money is positioning early.

If this move hits, candles won’t wait for anyone pic.twitter.com/UUrNTVOEpA

— Xaif Crypto🇮🇳|🇺🇸 (@Xaif_Crypto) February 1, 2026

Trade Timing Raises Market Curiosity Around XRP

Attention centered on the XRP position due to its appearance ahead of any confirmed price breakout. Such timing often prompts increased monitoring from market participants. Consequently, XRP price levels near the entry range came under closer observation.

Historical data shows that XRP has experienced sharp price movements following consolidation periods. These phases frequently coincide with rising derivatives interest. Additionally, visible large positions can influence short-term trading activity and volatility expectations.

Funding rate data remained stable during the period observed. This stability pointed to balanced participation between long and short traders. As a result, derivatives markets showed no immediate signs of overcrowded positioning.

Source: Hyperliquid

Hyperliquid Transparency Brings Whale Exposure Into View

Hyperliquid’s public dashboard allows real-time tracking of large open positions, giving traders access to leverage, position size, and entry pricing. This transparency has increased the visibility of whale activity across derivatives markets.

Public access to such data often shifts short-term market focus, and in this case, the XRP position became a reference point for monitoring leverage conditions. Trading behavior around the disclosed entry level continued to draw attention.

Large positions alone do not indicate future price direction, as high-capital traders often manage risk dynamically or adjust exposure. Still, the presence of a $2.17 million XRP long placed added focus on leverage-driven activity.

The opening of a $2,177,000 XRP long on Hyperliquid has redirected market attention toward derivatives exposure and trade timing. The scale and structure of the position prompted broader interest in whether near-term volatility may follow. XRP remains under close observation as traders continue tracking leverage, volume, and price behavior while the position stays active.

Also Read: Vitalik Buterin Unveils Bold Creator Token Plan to Fight AI Content Flood