- XRP trades near $2.86, with heavy resistance at $2.90–$2.95; a breakout above $3 could spark a short squeeze.

- Turnover surged to 155M XRP, while long-term holders booked $2B+ in profits, signaling ongoing distribution.

- With 94% of holders in profit and liquidity stacked above $3, XRP faces either a sharp rally on breakout or deeper correction if rejected.

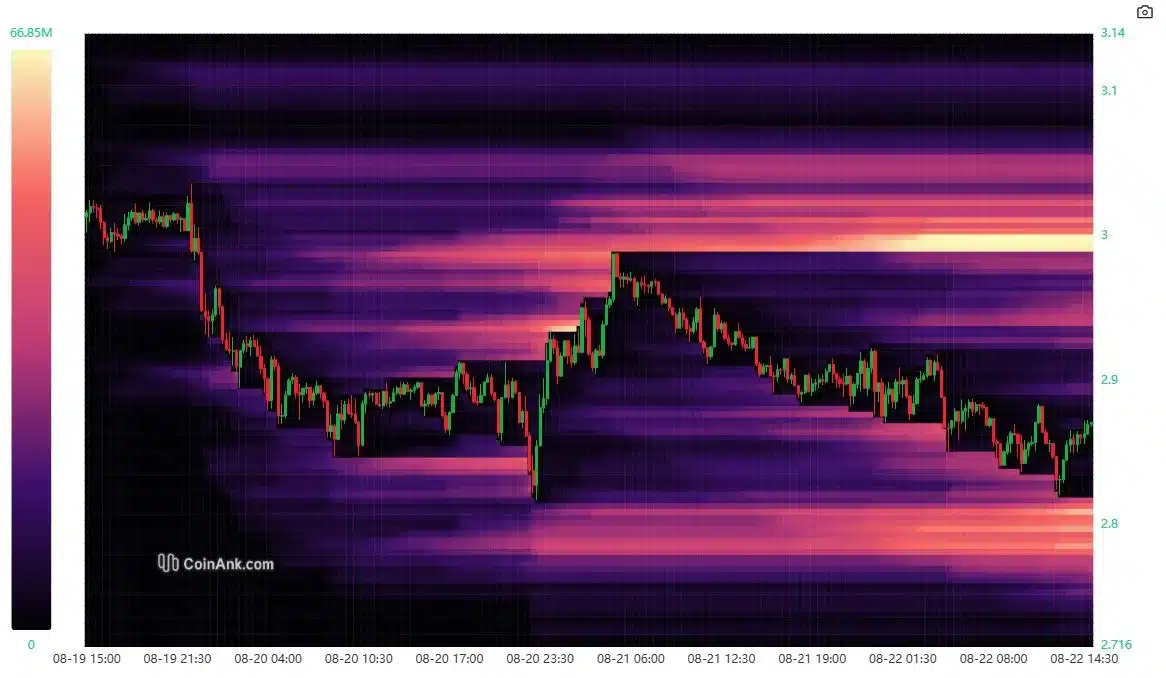

XRP is sitting at a crucial level in the market as traders brace for potential volatility around the $3 mark. Analysts warn that heavy clusters of short positions above current prices could trigger a wave of liquidations if the token breaks higher, setting the stage for a possible squeeze-driven rally.

The token is currently changing hands at $2.86, having slipped 1.53% in the past day and nearly 8.91% over the last week. Resistance has formed between $2.90 and $2.95, creating a narrow band that separates the market from the $3 threshold.

Trading volumes remain strong at more than $4.6 billion in 24 hours, keeping XRP among the most liquid digital assets despite its recent pullback.

Also Read: Prepare Your Bags: Something Huge Coming For XRP Holders on August 25 – Gemini

When $XRP reaches $3, a large number of short positions will be liquidated. pic.twitter.com/7NspGqkgRU

— CW (@CW8900) August 22, 2025

Institutional Flows and On-Chain Signals

On-chain metrics suggest that large investors are still active in the market. Recent sessions saw XRP’s turnover jump to 155 million tokens, well above its 63 million average, highlighting steady participation from institutional players even as prices edge lower.

Data also shows long-term holders taking profits during the correction. Realized gains have surpassed $2 billion since the latest downturn began, suggesting distribution is ongoing. This follows a familiar pattern: in late July, XRP holders booked more than $375 million in a single day when the price briefly touched $3.55, leading to the sharpest daily decline in months.

Whales, Liquidity, and Short Risk

Market heat maps show a significant build-up of liquidity above the $3 level, which analysts believe could become a flashpoint. If buying pressure lifts XRP past resistance, a cascade of forced short-covering could amplify momentum and push prices higher.

Source: CW/X

At the same time, liquidity pools between $3 and $4.50, left behind after July’s rally, are now acting as overhead resistance zones that bulls must clear.

According to on-chain data, more than 94% of XRP holders are currently in profit, a figure typically seen near cyclical peaks. While this reflects strong investor confidence, it also raises the risk of selling pressure as traders lock in gains. Analysts caution that this dynamic places XRP in what some call the “belief-to-denial” zone, where bullish conviction can quickly turn to doubt if momentum stalls.

Outlook

For now, XRP’s future hinges on the $3 barrier. A decisive move above it could trigger a powerful short squeeze, but failure to reclaim that level may invite deeper retracement as profit-taking continues. With liquidity stacked overhead and whales still active, the next move will likely be sharp.

Traders are watching the $2.90–$3.00 range closely, as a clean breakout could shift momentum in favor of bulls, while another rejection could deepen the correction.

Also Read: Ripple to Introduce RLUSD Stablecoin in Japan with SBI VC Trade in 2026