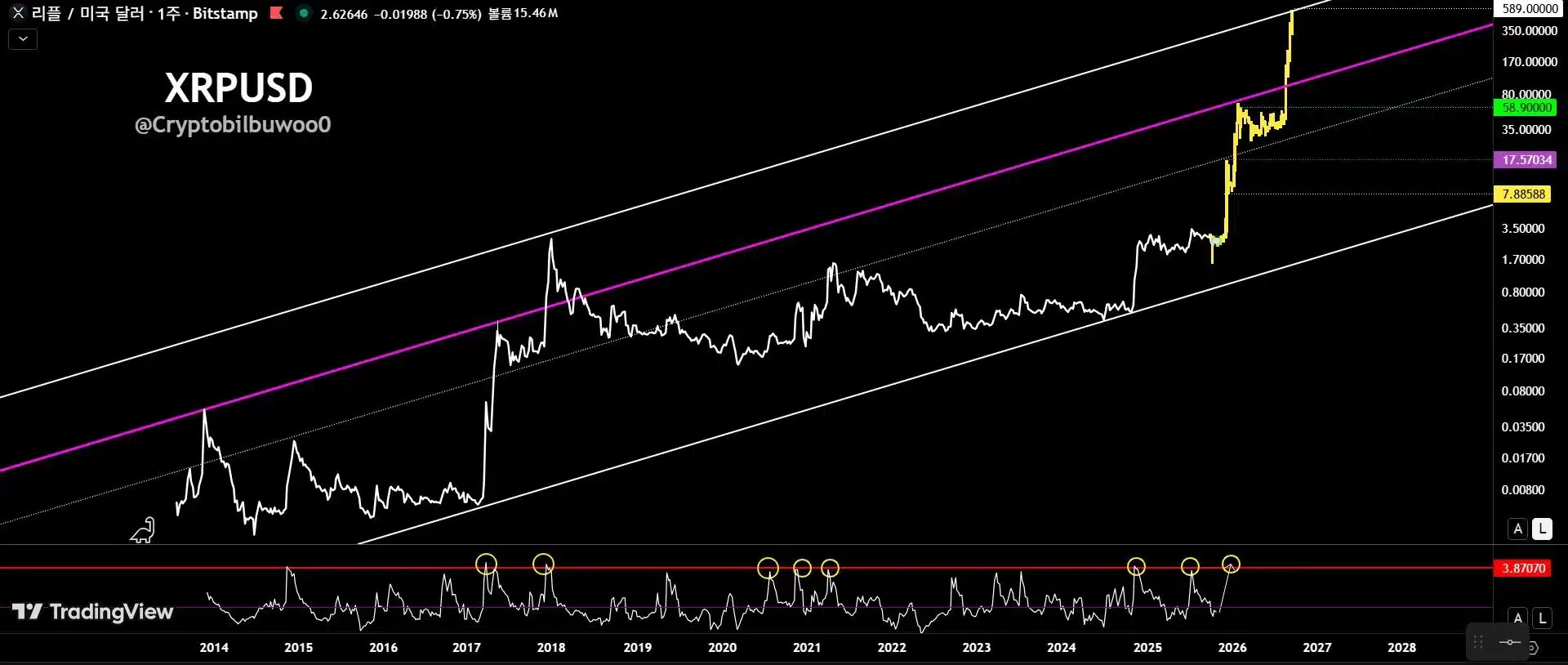

- Analyst Amonyx’s long-term chart shows XRP breaking above a decade-long ascending channel.

- RSI signals resemble those seen before XRP’s 2017 and 2021 rallies, with projections suggesting possible targets between $17 and $80.

- The analysis coincides with shrinking exchange reserves and renewed optimism that XRP may be entering a macro bull phase.

Crypto analyst and investor Amonyx has shared a striking long-term chart projection suggesting that XRP may be entering one of the most explosive phases in its trading history. Posting on social platform X, Amonyx wrote:

“The chart doesn’t lie — it screams. History repeats, but this time the breakout looks violent. $XRP just entered the phase nobody’s ready for.”

The accompanying chart, published under his handle, shows XRP/USD trading within a long-term ascending channel dating back to 2014, with the price now appearing to break decisively above the upper midline trend, signaling potential for a parabolic move.

Also Read: XRP Supply Shock? 300,000,000 XRP Exits Binance – What is Happening?

🔥🚀 The chart doesn’t lie — it screams.

History repeats, but this time the breakout looks violent.$XRP just entered the phase nobody’s ready for.

Do you see the pattern… or will you realize it too late? 💎#Crypto #BullRun pic.twitter.com/ArHbloo0GU

— Amonyx (@amonbuy) October 28, 2025

Historical Pattern Reemerges — But With Greater Intensity

The analysis highlights repeated RSI peaks (circled in yellow) that historically preceded major XRP rallies, such as those in 2017 and 2021. The latest RSI breakout mirrors these prior moves, indicating a possible cycle repetition.

However, this time, the slope of the price action suggests what Amonyx calls a “violent breakout,” potentially surpassing all previous cycles in strength.

The chart’s projection, extending through 2026–2028, outlines potential upper targets ranging between $17 and $80, with extreme top-channel resistance near $589, levels that would represent an unprecedented expansion for XRP if realized.

Source: Amonyx/X

Market Sentiment Turning Bullish Amid Supply Contraction

This analysis comes amid on-chain data showing shrinking XRP reserves on major exchanges such as Binance, with nearly 300 million XRP withdrawn in October alone. The convergence of technical breakout signals and supply reduction may be fueling renewed optimism among investors.

Amonyx’s post has since circulated widely across the XRP community, with traders debating whether the latest move marks the beginning of XRP’s long-awaited macro bull phase or another false breakout.

While the outcome remains uncertain, the sentiment is clear: XRP’s chart is once again commanding attention, and as Amonyx suggests, “the phase nobody’s ready for” may have just begun.

Also Read: XRP ETF Approval Just Around the Corner – Will It Unlock Billions in Capital?