The XRP community witnessed a significant milestone today as Brazil’s Securities and Exchange Commission (CVM) approved the launch of the world’s first spot XRP exchange-traded fund (ETF).

This groundbreaking decision has sparked enthusiasm among investors, as it further legitimizes XRP in the global financial markets. According to the update from a local news website, the approval was granted to Hashdex, positioning Brazil as a leader in regulated cryptocurrency investment products.

Hashdex has been granted authorization by the CVM to launch an XRP spot ETF in Brazil, marking the first exchange-traded fund backed by the native token of the blockchain created by Ripple.

The HASHDEX NASDAQ XRP INDEX FUND was established on December 10th last year and remains in the pre-operational phase.

Also Read: Big Day for XRP: SEC’s Latest Update Sparks Excitement

Genial Investimentos is the administrator of the ETF, and while the official launch date is yet to be confirmed, Hashdex has assured that more details will be provided soon regarding its listing on B3, Brazil’s stock exchange.

This approval comes as Brazil continues to embrace cryptocurrency-based financial products. It builds on previous regulatory progress, such as the approval of the Hashdex Nasdaq XRP index fund in December last year.

While the CVM has not provided further details on the launch timeline, Hashdex has confirmed the regulatory clearance and assured investors that updates on trading availability will be announced soon.

Institutional Interest and Market Impact

The introduction of an XRP-focused ETF is expected to attract both institutional and retail investors looking to gain exposure to the digital asset within a regulated framework. With XRP’s established role in financial transactions and cross-border payments, the asset has drawn considerable institutional interest.

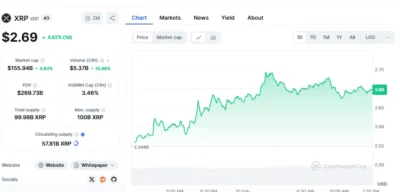

Over the past 24 hours following the ETF approval in Brazil, XRP has surged by approximately 4.82%, bringing its current price to $2.69. Additionally, the market capitalization has now reached $155.94 billion, reinforcing its position as the third-largest cryptocurrency globally, trailing only Bitcoin and Ethereum.

Source: CoinMarketCap

“XRP is a natural choice for an ETF due to its real-world utility, growing institutional demand, and its overall market cap,” stated Silvio Pegado, managing director of Ripple in Latin America.

He also highlighted Brazil’s regulatory vision, noting that “following the approval of one of the first Bitcoin ETFs in 2021, the approval of the first XRP ETF by the CVM demonstrates Brazil’s visionary approach to crypto markets and financial advancements.”

Market analysts suggest that if similar ETFs are approved in the United States, they could bring in fresh investments ranging from $3 billion to $6 billion. This speculation has fueled discussions among investors and financial institutions regarding the potential impact of such financial instruments on XRP’s adoption and valuation.

Regulatory Developments in the United States

The approval of the XRP ETF in Brazil could set a precedent for other major markets, particularly the United States, where multiple proposals for similar products are under review.

Companies including Rex-Osprey, Canary, and 21Shares have submitted applications for XRP ETFs, indicating a growing demand for regulated investment vehicles centered around the cryptocurrency.

The U.S. Securities and Exchange Commission (SEC) has acknowledged various ETF filings, including Bitwise’s XRP ETF, categorized as a commodity-based trust share. Additionally, the Cboe BZX Exchange has filed a proposal to list shares of the Bitwise ETF.

Other asset management firms, such as WisdomTree and 21Shares, have also joined the race to secure approval for XRP-based investment products. The SEC has a maximum review period of 240 days from the publication of these filings in the Federal Register to make a final decision.

As regulatory authorities evaluate these applications, market participants will closely monitor developments, given the potential impact on XRP’s market positioning and institutional adoption.

Conclusion

Brazil’s approval of the world’s first spot XRP ETF highlights the country’s progressive approach to digital asset integration. As the regulatory landscape for cryptocurrency investment products evolves globally, the potential for XRP ETFs in the U.S. and other major markets remains a key focus.

Investors will continue to watch for further updates on regulatory decisions that could influence XRP’s standing in the financial market.

Also Read: Ripple Lawsuit Update: Here is Why SEC Has Not Dropped the Ripple Appeal Yet