XRP investors received a major boost following a key development involving one of the largest financial institutions in the United States. Bank of America is now reportedly utilizing XRP for 100 percent of its internal transactions, which could mark a significant turning point for Ripple’s adoption in mainstream finance.

Crypto analyst @Crypt0Senseii announced the update on X, which excited XRP community members. This shows a substantial institutional adoption of the token, demonstrating increasing connections between Ripple’s technology and traditional banking infrastructure.

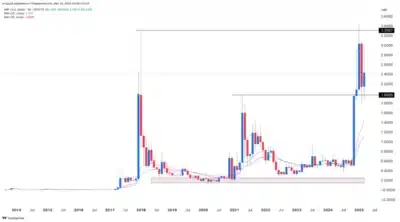

The XRP token maintained a $2.46 value while defying breakdown from the vital support levels at $1.90 as per Tradingview. Market analysts predict that the recent update could activate a fresh price increase despite XRP maintaining a position beneath its Annual high of $3.40.

Source: Tradingview

Also Read: Why Has The SEC Not Dismissed Ripple Lawsuit in Official Statement – Case Still Alive?

Financial analyst David Stryzewski, in an interview, told Fox Business that Ripple is the essential infrastructure emerging financial systems should utilize to operate. Ripple maintains its position as a central figure in financial advancement through its U.S.-regulated stablecoin and established banking partners.

🚨 BREAKING:Bank of America is utilizing $XRP for 100% of their internal transactions.

Like♥️ if your holding #XRP pic.twitter.com/GC0RDfnQ9Z

— CryptoSensei (@Crypt0Senseii) March 23, 2025

Analyst John Squire explained in his assessment how Ripple may serve as a potential replacement for the sustained SWIFT network control. According to X posts by Squire, SWIFT’s transaction system loses relevance daily because XRP enables instant settlements at much lower rates than SWIFT.

Ripple’s On-Demand Liquidity (ODL) system now supports over 300 financial institutions globally. With the conclusion of the SEC’s legal battle against Ripple, there is growing expectation that more banks will follow Bank of America’s lead in adopting XRP.

Ripple CEO Brad Garlinghouse recently confirmed that multiple central banks already use Ripple’s technology. According to Garlinghouse, while some of these partnerships have been disclosed, others remain confidential.

Ripple Positioned to Benefit From Institutional Momentum

XRP is increasingly viewed as the bridge between traditional finance and modern blockchain solutions. While Bitcoin is valued for its storage utility and Ethereum for smart contracts, Ripple offers both speed and functionality for real-world financial operations.

The XRP Ledger executes more than 50,000 transactions at minimal costs per second. The processing speed of Ethereum stands much slower than its costs, which remain higher than the XRP ledger.

The Ripple ecosystem grows through new platforms that include Ripple USD (RLUSD) and Coreum and Sologenic, which enhances the foundation’s wide-scale adoption. Ripple draws increasing interest from Ethereum users because it offers superior scalability and cost-effectiveness.

XRP maintains its position above long-term moving averages since it surpassed $1.97 last year. Research forecasts that XRP will attempt to break through the $3.40 resistance point due to its upward trend.

The successful breakout presents an opportunity for investors to move at $5, representing a psychological goal.

Conclusion

Bank of America’s complete internal adoption of XRP marks a pivotal moment for Ripple’s mainstream integration. With growing institutional support and regulatory clarity, XRP may enter a new growth phase as it strengthens its role in the global financial system.

Also Read: Ripple Issues New Proposal to SEC to Tackle Regulatory Uncertainty – Here is What’s Inside