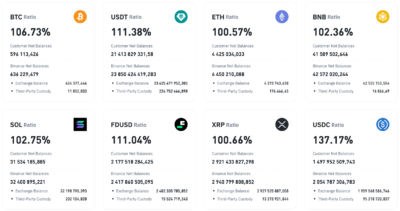

Binance, the world’s largest cryptocurrency exchange, has published its latest proof-of-reserves report. This report reveals the ratio between customer net balances and the exchange’s reserves. One key takeaway from the report is the notable surge in XRP reserves on the platform.

Over the past month, Binance customers have increased their cumulative net balance in XRP by 6%. This rise equals 165,386,790.313 XRP, bringing the total balance to 2.92 million XRP. To match the growing customer demand, Binance raised its net balance by adding over 330 million XRP, currently valued at around $175 million. Consequently, the coverage ratio for XRP on Binance now stands at 100.66%. Regarding net balances, XRP ranks as the seventh largest asset on the platform.

Source: Binance

Also Read: Ripple Burns Millions of RLUSD Stablecoins Amid Cautionary Alerts to Users

More XRP was reserved, showing that Binance customers continue to accumulate even more XRP. This trend is suitable for traders and investors as it shows a bullish signal in the market. Such behavior indicates that the managers are sure about XRP’s future cash flows and that the digital assets can deliver greater returns.

Decline in Stablecoin Reserves Highlights Market Dynamics

In contrast to the rise in XRP reserves, Binance has seen a decline in stablecoin reserves. Specifically, USDT, the most traded stablecoin, dropped from $22.11 million to $21.41 million during September. Additionally, two other stablecoins, FDUSD and USDC, experienced decreases of 2.15% and 1.32%, respectively.

Previous months were dominated by the increase of stablecoins as market participants looked for liquidity in ‘crypto-fiat.’ But these recent changes suggest a different picture. The shift from stablecoins to other assets may manifest the process in the making. It mirrors the sentiment of traders who look more assured in other cryptocurrencies, including XRP.

Despite these changes, it remains uncertain whether this shift in trading behavior represents a lasting trend. Traders may still revert to stablecoins if market conditions change. Overall, Binance’s report provides valuable insight into current market sentiment and trading activity. As investors adjust their strategies, the landscape of cryptocurrency trading continues to evolve. The ongoing developments on Binance will likely influence the broader cryptocurrency market and the observers will closely monitor how these trends unfold in the coming weeks.

Also Read: Binance to Delist Four Spot Trading Pairs Amid Low Liquidity