- Versan Aljarrah explained that as XRP’s price increases, it can handle larger cross-border transactions with fewer tokens.

- A $1 billion transfer would need 1 billion XRP at $1, but only 100,000 XRP at $10,000.

- The post revived focus on XRP’s real-world role in global liquidity and settlements, emphasizing utility over speculation.

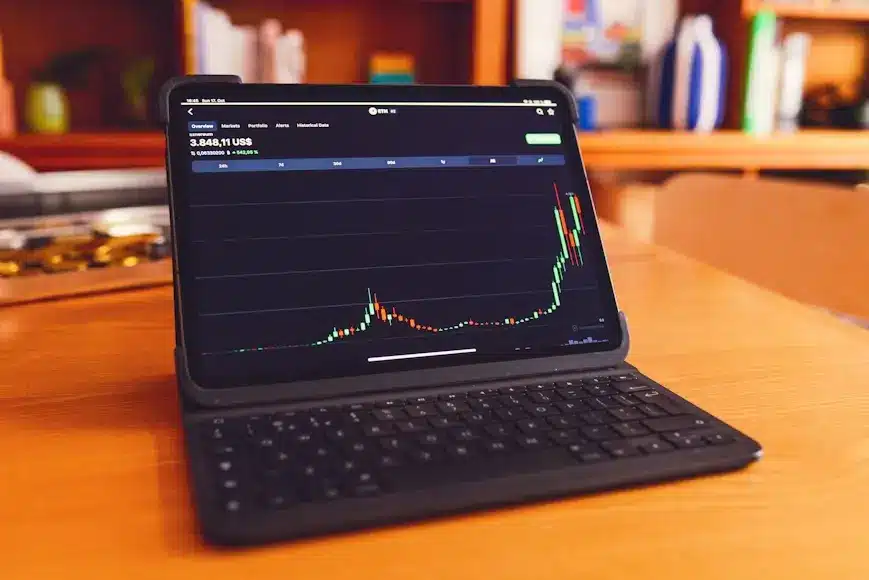

In a recent post on X, Versan Aljarrah, co-founder of Black Swan Capitalist, outlined how XRP’s price plays a critical role in its liquidity and transactional efficiency within global settlement systems.

According to Aljarrah, as the price of XRP rises, its ability to facilitate larger cross-border transactions with fewer tokens increases, a concept that underscores XRP’s unique design as a bridge asset for value transfer. “The higher the price of XRP, the greater its liquidity efficiency. Fewer tokens are needed to settle larger transactions,” Aljarrah explained.

Mathematical Breakdown: Fewer Tokens Needed as Price Increases

To illustrate his point, Aljarrah presented a simple example:

- A $1 billion transfer at $1 per XRP requires 1 billion tokens.

- The same transfer at $10,000 per XRP would only require 100,000 tokens.

Also Read: ETF Institute Founder: XRP Spot ETF Arriving Sooner, Here’s When

The higher the price of XRP,

the greater its liquidity efficiency.

Fewer tokens are needed to settle larger transactions. The more value XRP bridges, the higher its price needs to climb to maintain equilibrium.

$1B transfer at $1/XRP = 1B tokens

$10,000/#XRP = only 100K tokens pic.twitter.com/QDZQAs4iuO

— Black Swan Capitalist (@VersanAljarrah) November 2, 2025

This scaling relationship, he argues, shows that XRP’s value appreciation enhances network efficiency, allowing it to bridge larger amounts of value with less friction and reduced supply movement.

Liquidity Theory Aligned With XRP’s Original Design

Aljarrah’s comments echo the original intent behind XRP’s creation, to serve as a high-speed, low-cost intermediary currency for cross-border settlements. The higher its unit price, the more efficiently it can act as a universal liquidity provider across currencies and assets.

Many XRP advocates have long argued that price stability and scalability at higher valuations are essential for institutional adoption and the global utility of the XRP Ledger (XRPL).

Community Reaction: Renewed Focus on XRP’s Utility Narrative

Aljarrah’s post reignited discussion within the XRP community about price utility versus speculation, with several commentators noting that XRP’s long-term success depends on real-world transactional use, not market hype.

Supporters see his statement as a reminder that XRP’s true strength lies in its role as a liquidity bridge, not merely as a traded asset. As global adoption of on-chain settlement systems expands, Aljarrah’s argument suggests that a higher XRP price may not just be desirable, but necessary, for optimal performance.

Also Read: Ethereum’s Vitalik Buterin Highlights Blockchain’s Incorruptibility Amid ZKSync Developments