BlackRock, an American investment company has acknowledged the impact of artificial intelligence (AI) as a major economic shift. The company made this known in a mid-year outlook published on June 28.

The report which is subtitled “New Year, New Regime” talks extensively about AI as a force to be leveraged to drive returns both now and in the future. In the report, BlackRock said that it already has an overweight investment in AI, referring to the new technology as a “mega force,” claiming that its “tilt toward quality

already captures AI beneficiaries.”

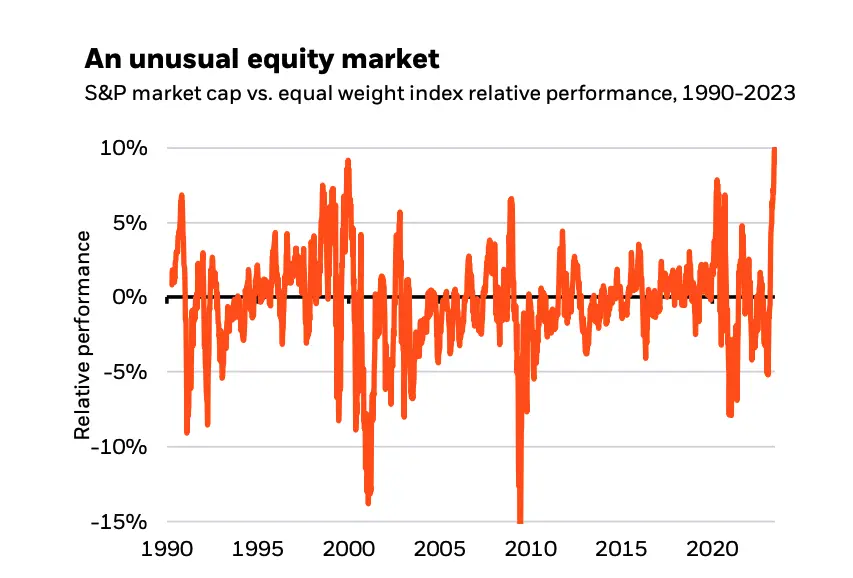

Furthermore, the report pointed out that the S&P 500 gains have become increasingly concentrated in a handful of tech stocks when compared to the 2000s tech boom. For context, S&P (Standard and Poor’s) 500, is a stock market index metric in the United States that tracks the stock performance of the top 500 publicly traded companies in the country.

Also Read: BlackRock Fund Withdraws $1.9 Million in PEPE, sparks reactions

The shift suggests that AI and other mega forces like the “fast-evolving financial system” can produce returns regardless of the few other opportunities provided by the economic environment.

Artificial Intelligence and Digital Disruption

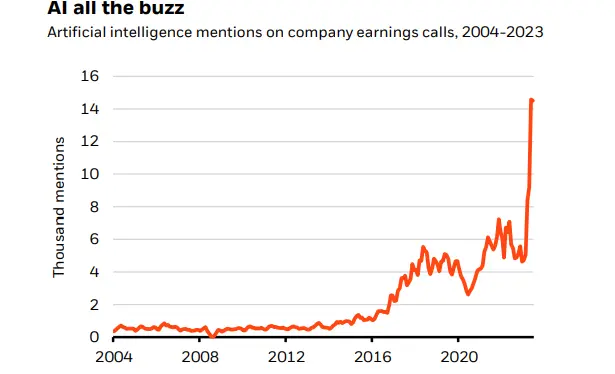

The report stated that AI has become “all the buzz,” noting that in 2023, the mention of artificial intelligence on company calls has grown exponentially to the tune of 14,000 (14 thousand). Also, companies’ and investors excitement has been filled with the growing popularity of ChatGPT and other language models.

“AI has become all the buzz. The mention of AI on company calls has skyrocketed in 2023. The popularity of ChatGPT and other large language models has stoked company and investor excitement over AI’s potential,” the report states.

Source: BlackRock mid-year outlook report

BlackRock further suggests in its report that the growing popularity of AI could trigger more investment growth. For instance, the investment in semiconductors could increase since it is the key component for AI tools and other models. In addition, the introduction of new AI tools could unlock the potential value of the data “gold mines” possessed by some companies.

BlackRock applies for Bitcoin ETF

Meanwhile, the investment giant has turned its focus to Bitcoin. On June 15, the company applied to the SEC seeking a spot for Bitcoin Exchange Traded Fund (ETF). If the application is approved, Blackrock’s fund will be the first of its kind to be approved by the Securities and Exchange Commission.