- BNB struggles as $955 level threatens further price declines ahead.

- ETF exclusion weighs heavily on Binance Coin’s market momentum.

- Technical indicators suggest potential for BNB’s continued downward pressure.

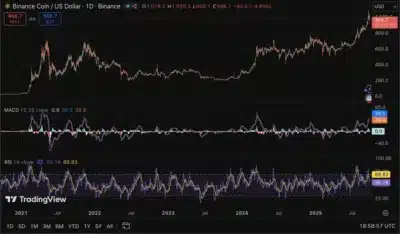

Binance Coin (BNB) has been under intense pressure, slipping toward the $955 level as the broader market experiences a pullback. Starting the day trading at around $1,017, BNB quickly encountered selling pressure. Despite initial support around the $1,000 and $980 levels, the price dropped to a low of approximately $945 before slightly rebounding. However, the coin ended the day at $967.29, marking a 4.79% decline.

Also Read: XRP Sparks Market Frenzy: Is a Bull Run or Major Decline on the Horizon?

Lack of ETF Inclusion Weighs on BNB’s Price Performance

One key factor behind BNB’s struggle is its absence from major crypto ETFs, unlike its peers such as Cardano (ADA), which have gained traction among institutional investors. According to James Seyffart, an analyst at Bloomberg Intelligence, ETF inclusion typically boosts a cryptocurrency’s legitimacy, attracting institutional flows.

To further emphasize the market’s skeptical mood, recent Bitget statistics indicate a large withdrawal of major digital assets. Spot Bitcoin funds in the U.S. suffered a loss amounting to approximately 3,211 BTC, worth approximately $360 million, and Ethereum ETFs lost 25,851 ETH, worth roughly 120 million. These withdrawals indicate a change in investors’ mood, which could be adding to BNB’s plight.

BNB’s Technical Strain: Can It Hold Above $945?

BNB’s technical indicators suggest a possible continuation of its downward trend. The MACD is becoming flattened, showing a slow increase in momentum, and the 14-day RSI has been approaching overbought at 69.83. Also, the trading volume increased to 4.31 billion per day, which is almost 17% higher than the day before, which confirms that selling pressure is now very high.

As the wider market is unsure about the market, investors are worried about investing in BNB as it fails to maintain its position at $1,000. The token’s fate hinges on whether it can reclaim this support level or if the $945 level will give way to further declines. Until the market stabilizes, BNB’s performance may continue to reflect the overall market unease.

Also Read: Bitwise Investment Advisers Files First ETF Tracking Hyperliquid’s HYPE Token