Chainlink (LINK) is gaining renewed attention in the crypto market as its fundamental role in decentralized data feeds strengthens across blockchain ecosystems. The network has established itself as a critical infrastructure layer, connecting smart contracts with real-world data securely and tamper-proof.

As of March 2025, LINK is trading at $14.18, backed by a market capitalization of approximately $9.3 billion. Recent technical upgrades and growing institutional integration have positioned Chainlink as one of the most watched assets in the decentralized finance and Web3 landscape.

One of the most significant developments is the rollout of Multistream, a major upgrade designed to improve data throughput across Chainlink’s decentralized Oracle network.

This enhancement is expected to increase data processing efficiency by up to 1000 times, reinforcing Chainlink’s position as the leading oracle provider across various blockchain networks.

Also Read: Pepe (PEPE) Price Prediction for the Year (2025-2028): Can PEPE Hit $ 0.000102?

Technical Indicators

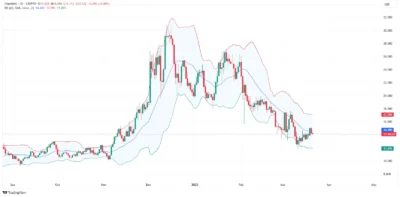

The price movement of Chainlink shows initial indicators of switching its momentum. Increased price volatility appears after a long period of stable movement because the daily Bollinger Bands have expanded.

LINK has reached the middle band position, challenging the 20-day simple moving average (SMA) at $14.49.

LINK will encounter resistance at $17.09 if it breaches the current $14.49 upper band. A decisive move above the resistance zone, which matches strong investor purchases, might initiate a price increase from $19-$20.

The Price of LINK will fall towards $12–$12.50 if it goes below $11.89, representing the lower Bollinger Band.

Source: Tradingview

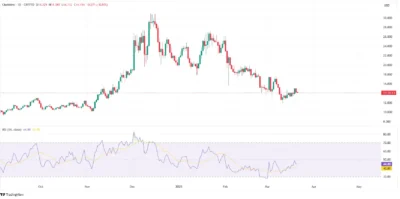

The moving average convergence divergence indicator displays initial bullish crossover dynamics. The MACD line approaches the signal line as its bars transition from red to green colors. Almost all selling activities seem to have subsided as buying power shows increasing signs across the market.

LINK should rise towards $16–$18 during short-term trading if it successfully crosses into positive momentum and the histogram moves progressively upward. A lack of crossing through these support levels would trigger another reassessment of prices between $12.50 and $13.00.

Source: Tradingview

The Relative Strength Index displays 44.88 values, which indicates that buying momentum has recovered yet remains weak. An increase above 50-55 would indicate new bullish participation, which might confirm upward price movement.

The future trading range for LINK will remain confined to consolidation levels until such a level is crossed.

Also Read: Story (IP) Price Prediction for the Year (2025-2028): Will Story (IP) Hit $7.5 Soon?

Source: Tradingview

Chainlink (LINK) Price Prediction Table (2025–2028)

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2025 | 14.25 | 22.37 | 30.89 |

| 2026 | 18.63 | 28.47 | 39.78 |

| 2027 | 22.94 | 36.82 | 50.52 |

| 2028 | 30.48 | 48.65 | 65.32 |

2025

Chainlink will trade between $14.25 and $30.89 during 2025 based on its ability to overcome technical resistance barriers. Market experts expect Chainlink to rise to $22.37 annually, but a break above $17.75 would start an upward trend toward $19.30 and beyond.

The LINK price will receive short-term boosts from three strategic enhancements: the Multistream update, enterprise system integration, and better staking capabilities. Market sentiments and Bitcoin’s movement will strongly influence how LINK performs in the market.

2026

For 2026, Chainlink will continue its price increase by trading between $18.63 and $39.78. LINK has the potential to become deeply integrated within secure data systems operating in insurance domains and supply chain operations while supporting AI-based automation.

Market analysts expect the 2026 average Price value for Chainlink to reach $28.47. The network will attract institutional investors toward a $40 trading level if LINK stays above its resistance point at $30.

2027

Chainlink could receive a positive impact in 2027 through the mainstream adoption of blockchain technology and real-world asset digitalization processes. LINK will trade between $22.94 and $50.52 throughout this period, as analysts expect an average price of $36.82.

Developing stronger staking and node reward metrics will likely facilitate long-term investor retention and upward price movement. Launching new data-focused Layer 2 solutions integrated with Chainlink services should significantly drive price gains.

2028

2028 will establish Chainlink as an essential technology base layer between smart contracts. For the upcoming year, analysts anticipate a trading span of $30.48 to $65.32, with an estimated average price of $48.65.

LINK demonstrates the potential to move toward top-tier status in the crypto market by achieving market capitalization dominance as AI, banking, and real-time insurance sectors expand their adoption. When LINK exceeds $60, it may gain additional investor interest.

Conclusion

Chainlink is at a critical point in its market trajectory, with technical indicators and on-chain developments pointing toward potential price growth. The token’s ability to provide essential data services across multiple blockchain platforms ensures it remains highly relevant in the coming years. If LINK clears resistance levels in 2025, it could trigger a broader rally extending well into 2028.

FAQs

What is Chainlink’s current trading price in 2025?

Chainlink is currently trading at $14.18 as of March 2025.

What technical signal supports a potential breakout for LINK?

The MACD shows signs of a bullish crossover, suggesting weakening bearish pressure.

What is the resistance level Chainlink needs to break to gain bullish momentum?

A breakout above $17.09 could confirm a bullish trend reversal.

What is the forecasted maximum Price for Chainlink in 2026?

LINK could reach a maximum price of $39.78 in 2026 if positive momentum continues.

How high could LINK trade by the end of 2028?

LINK is projected to reach $65.32 in 2028, depending on market adoption and use case growth.

Also Read: Uniswap (Uni) Price Prediction For The Year (2025–2028): Will Uniswap (Uni) Hit $30 Soon?